China’s precious metals frenzy sparks protest as risks grow

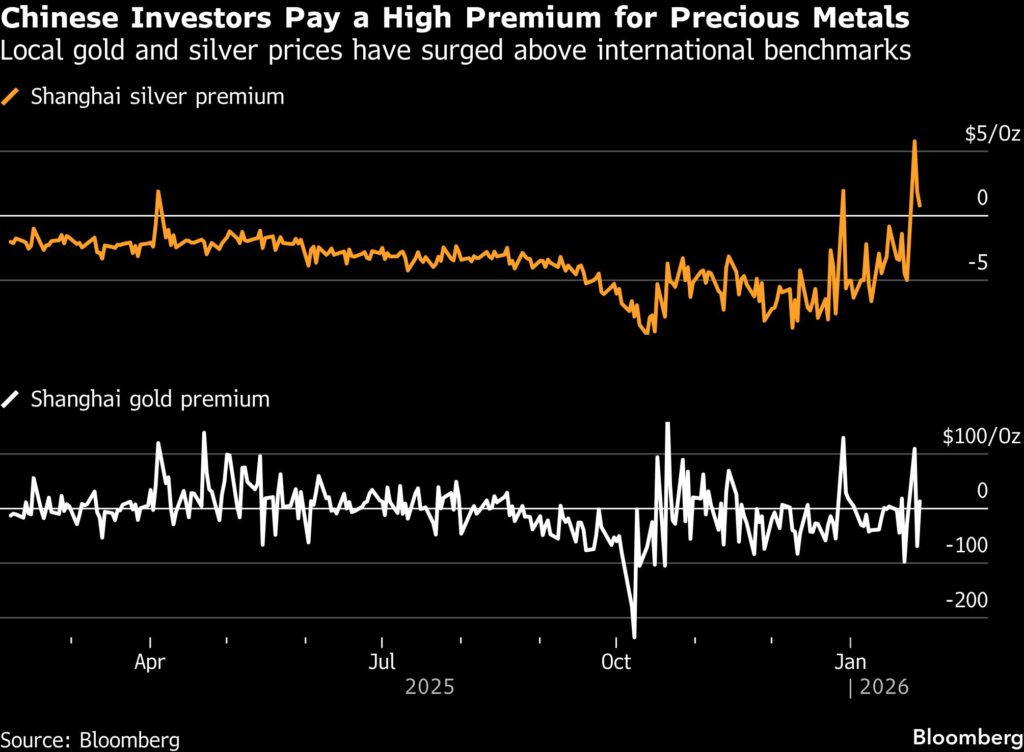

Chinese investors piling into a record-breaking rally in precious metals are becoming increasingly exposed to risk, as speculative demand pushes local prices well above international benchmarks.

Authorities in the southern city of Shenzhen set up a special task force to oversee the operations of a gold-trading platform, according to a statement from the Luohu district government, after investors faced difficulties withdrawing funds from their accounts. China’s only pure-play silver fund, meanwhile, halted trading briefly and turned away new investors.

The backdrop to the drama is a breakneck rally in global prices. Gold surged to a record above $5,300 an ounce on Wednesday and has gained more than a fifth this year, fueled by US dollar weakness and investor flight from sovereign currencies and bonds. Silver’s rise has been even more dramatic – around 60% in just four weeks – and its daily moves more chaotic.

Local prices in China are even higher — even after accounting for the 13% value-added tax borne by local importers — with investors’ appetite for precious metals seemingly insatiable over the past few months. The latest events are a stark example of the frenzied nature of investing in bullion – and a sign of how tricky it might yet become.

Around 100 users of the Shenzhen Jiewo Rui gold-trading platform crowded the company’s premises on Tuesday, with a video posted on Hong Kong-based news outlet HK01 showing a handful scuffling with police. Bloomberg News was unable to verify the authenticity of the video. Other social media platforms showed similar clips.

Jiewo Rui allows users to lock in gold prices for future delivery by posting margin equal to as little as one-fortieth of the spot price, effectively offering 40-times leverage, according to Chinese media group Yicai. The platform operator was not available for comment.

Such leverage would place a high requirement on the operating company to hedge against price swings and maintain fund flows, as well as sufficient inventory for delivery. With gold prices hitting successive highs, this becomes especially challenging.

The platform is just one example of the many small to medium-sized gold traders who operate platforms in Shenzhen, home to the biggest physical bullion marketplace in China. The local industry association issued a sector-wide warning as early as last October, citing a crackdown on three companies. Similarly, a major silver seller in the city’s Shuibei market also defaulted on delivery in January, with more than 350 people waiting to be compensated, according to the National Business Daily.

Anticipating risks to investors, a number of funds have halted subscriptions after overwhelming demand drove premiums well above the value of their underlying assets. The UBS SDIC Silver Futures Fund LOF took such a step from Wednesday, having issued near-daily risk warnings – and frequently halting trading – since early December. Its premium over Shanghai Futures Exchange silver contracts remains elevated at 36%, according to data compiled by Bloomberg.

This premium is “unsustainable” and investors could face “significant” losses if the market suddenly turns, UBS SDIC Fund Management Co. said in its latest notice. Trading was halted briefly on Wednesday morning. Meanwhile, the E Fund Gold Theme Fund has also stepped in to quell heated sentiment, with its manager halting new subscriptions from Wednesday.

(By Yihui Xie)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments