Chinese demand for copper vanishes after prices hit record

A significant chunk of Chinese copper demand has all but evaporated after the metal’s stunning surge to record levels.

Copper on the London Metal Exchange burst through $13,000 a ton for the first time this week, extending its rally to nearly 50% over the past year. A cocktail of bullish factors could drive prices even higher over the short term. While real-world buyers typically take time to adjust to such sharp increases, what’s notable in this case is the extent to which industrial users in the biggest market are scaling back purchases.

“It is surprising how much price rejection is taking place. The Chinese are just not buying copper, it’s true,” Kostas Bintas, head of metals at trading giant Mercuria Energy Group Ltd., said in an interview. “But it’s finite — at some point you need to buy.”

Sluggish physical demand contrasts with the speculative frenzy lifting futures markets, where deep-pocketed funds are responding to tighter global supply, favorable interest rates and an impulse to hedge geopolitical turmoil by stockpiling commodities. The copper contract in Shanghai, which accounts for import costs, topped 100,000 yuan a ton ($14,300) for the first time at the end of December.

Chinese industry, though, accounts for half of global copper demand. The fabricators that shape the metal — into wires, sheets and pipes for power cables, circuit boards and plumbing systems — are struggling to pass on their higher costs to factories. As inventories build, the smelters that refine copper in the first instance are trying to export their surplus.

Record copper prices “had a significant impact in December,” said Hai Jianxun, a sales executive at Henan Yuxing Copper Co. in central China, which makes pipes for items like air-conditioners. “The overall market was very quiet — much quieter than in previous years.”

A Mysteel Global survey covering most suppliers showed that about 60% of the firms making copper rod for electricity transmission, a category that accounts for around half of China’s copper goods, cut or shut production over the month because of mounting costs.

Fees to process refined copper into rod fell to zero this week, Mysteel said, the lowest-ever level for the time of the year.

The subdued activity isn’t an anomaly. Even during the autumn, when demand typically peaks, operating rates across fabricators were at multiyear lows for the season. Ultimately, the market is paying the price of the economy’s lackluster recovery from the pandemic and structurally weaker growth.

Upstream of manufacturing, the refined copper stockpiles tracked by the Shanghai Futures Exchange rose above 180,000 tons on Friday, doubling that of a month ago. Although inventories usually build ahead of Chinese New Year, they are at a 10-year high for the time of year.

Imports weaken

Suppliers of copper to China are also meeting resistance. Chilean producer Codelco, which sets the benchmark, has offered metal at a premium of $350 a ton over LME prices for 2026 annual contracts, a steep hike driven by a rush of shipments to the US that has stoked concerns about shortages elsewhere. Barely any Chinese importers have been willing to sign up, though, with some only prepared to buy when premiums are closer to $100 a ton, according to traders in Asia.

By contrast, some smelters in eastern China are willing to accept premiums of about $30 a ton to export copper, and are offering even lower rates for larger volumes, said the traders, who cited sluggish downstream demand for the pricing discrepancy.

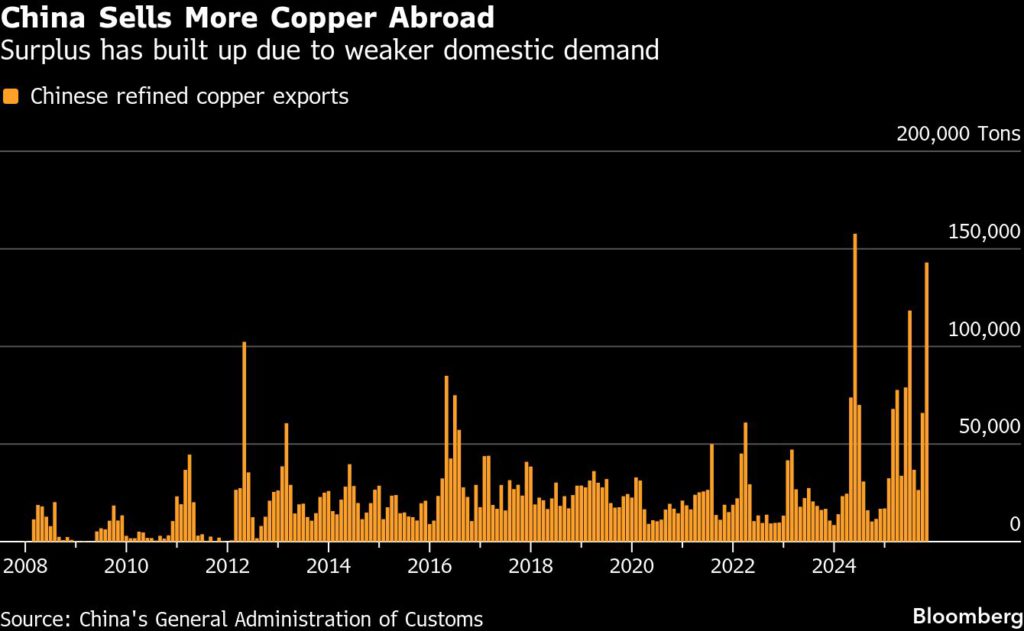

China’s smelters are selling cheaply to escape tough domestic conditions. Overseas sales in November climbed to about 143,000 tons, not far from record levels. They’re expected to stay above 90,000 tons over December and January, according to Mysteel.

Still, there’s optimism that conditions may improve later in the year. Copper usage in the new energy and artificial intelligence sectors is slowly clawing back demand lost to China’s property crash. Chinese factories continue to export to the world, while the government has extended its subsidy programs to support domestic consumption, which could benefit copper-intensive home appliances.

“After January, sentiment may start to shift,” said Henan Yuxing’s Hai. “Customers are gradually adapting to copper prices above 90,000 yuan, and sales are slowly recovering. January feels a bit better.”

Read More: AI to boost copper demand 50% by 2040 — S&P

More News

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments

kunj gaur

Excellent article on copper.