Citi sees silver price surging to $150 as China buying still has legs

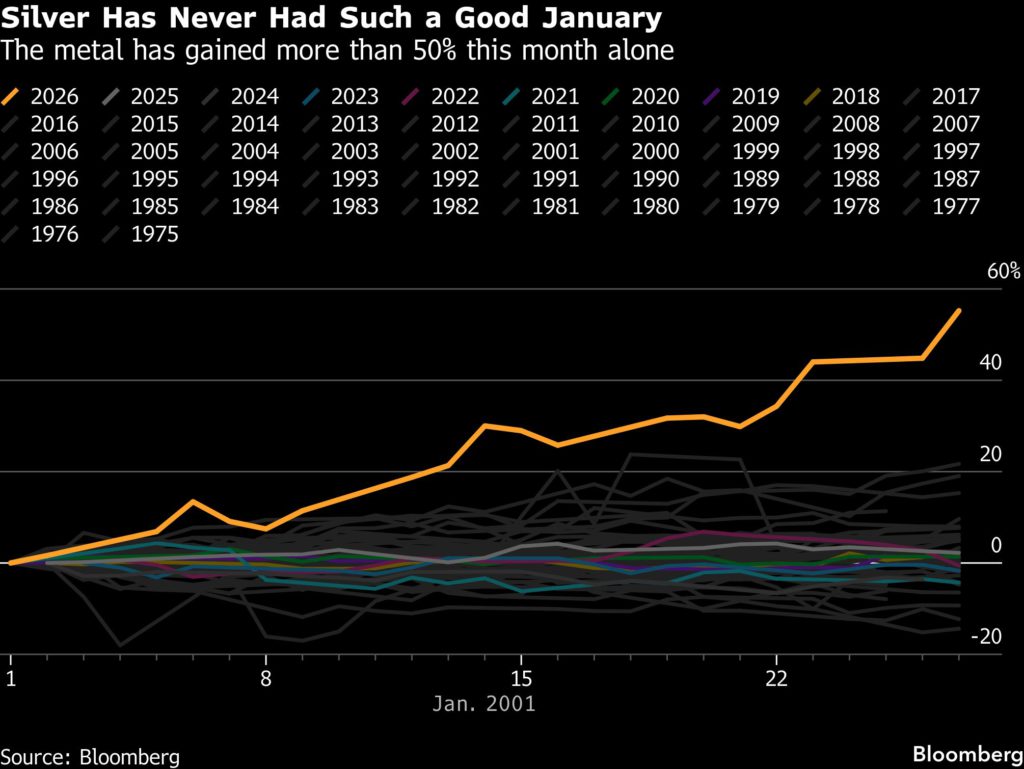

Citigroup Inc. expects spot silver prices to hit a record $150 an ounce within three months, extending a historic rally that has seen the metal surge nearly 50% in January.

The bank’s analysts, including Max Layton, see strong buying momentum continuing in China, and said higher prices will be needed to encourage existing holders to sell.

“Silver is behaving like ‘gold squared’ or ‘gold on steroids’,” the analysts wrote in a note Tuesday. “And we think this likely continues until silver looks expensive by historical standards, relative to gold.”

Silver reached a fresh record of $117.71 on Monday after jumping as much as 14%, its biggest intra-day rise since the 2008 global financial crisis. The rally has been supported by strong physical demand and speculative interest in a relatively illiquid market, with signs that buyers in China are leading the move.

If the ratio of gold prices to silver return to a 2011 low of 32 to 1, that would point to silver trading as high as $170 an ounce, the Citi analyst said.

The price gains have come in the face of a number of bearish factors, Citi added, including outflows from silver-backed exchange traded funds, selling by speculators in futures markets, and declining inventories in US warehouses, bolstering availability elsewhere.

Still, the exceptional speed and volatility of silver’s rally since December has many traders and analysts ringing the alarm bell.

“History suggests that this rally is much nearer to its end than its beginning,” Marc Loeffert, trader at Heraeus Precious Metals wrote in a note. “The gold/silver ratio has been lower than today several times in the past but has rarely seen such a large swing in such a short time.”

(By Jack Ryan)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

2 Comments

Keith Mcmaugh

Ratios, tech analysis, charts, Fibonnaci, Bollinger bands, etc are irrelevant. The West, especially USA, is in a war with China in the A I race, and race to the moon and for financial domination. Every western politician vows to spend endless. And silver must be used for A I, chips, and military.

K Mcmaugh

When the West confiscated Russia assets and Treasuries, the rest of the world, especially Global South revolted by reducing purchasing Treasuries and instead, starting to hoard tons of gold. And gold always drags silver along. The US requires many buyers of Treasuries to fund the running of their economy, or everything grinds down. A lawless govt is able to control their own country but not the entire world.