CMOC boosts cobalt production despite Congo export ban

Chinese miner CMOC Group Ltd. produced more cobalt at its two projects in the Democratic Republic of Congo in the first half, despite the African nation’s ban on exports.

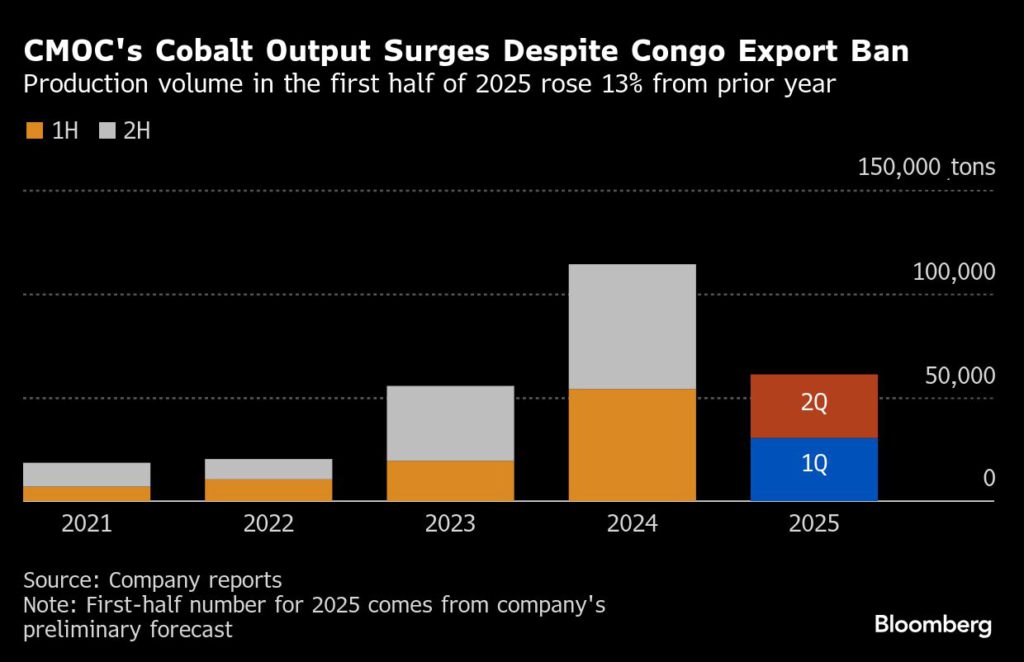

The world’s largest cobalt miner forecast a 13% year-on-year rise in production of the material, used in batteries and alloys, to 61,073 tons in the six months through June, according to a preliminary earnings statement released Monday.

The increase comes just as the DRC – which accounts for about 70% of global cobalt output – extended an export ban first announced in February for another three months to September. The country cited “a continued high level of stock on the market,” as it attempts to rein in a global cobalt glut that was deepened by CMOC’s breakneck expansion in recent years.

That signals the Chinese company still mined slightly more cobalt in the second quarter, when the DRC ban was in force for the entire period. Output in the April-June period totaled 30,659 tons, against 30,414 tons in the previous quarter.

CMOC said its production of copper also rose 13% in the first half to 353,570 tons. Output of products including cobalt, molybdenum and tungsten, exceeded initial expectations, the company said in a separate statement on its website.

The Chinese miner predicted first-half net income would be between 8.2 billion yuan ($1.1 billion) and 9.1 billion yuan, a jump of as much as 68% from a year earlier, citing stronger output and sales for copper, as well as higher selling prices for cobalt and copper. That would be a record half-year result.

Spot prices of cobalt hydroxide have more than doubled since the DRC suspended shipments. CMOC’s trading unit IXM has recently declared force majeure on such deliveries. That could weigh on the company’s second-half earnings after a “solid” first-half, according to analysts at Bloomberg Intelligence,

CMOC shares climbed as much as 1.9% in Hong Kong early on Tuesday, before reversing gains to trade down 0.4% at HK$7.95 as of 10:26 a.m. local time.

(By Annie Lee)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments