Codelco returns to global debt market as copper prices rally

Codelco sold $1.4 billion of dollar bonds, tapping global markets for the second time this year as investors look past a fatal accident at its largest mine.

The state-owned copper miner issued notes due 2035 and 2055 to yield 125 basis points and 152 points above US Treasuries, respectively, tighter than initial price talk of 150 basis points and 180. The company had first sold $1.5 billion of the bonds in January at a spread of 165 basis points and 185, respectively.

“We believe the retap will enhance the company’s liquidity,” S&P Global Ratings analysts Amalia Bulacios and Flavia Bedran wrote in a report Monday. “We also see the issuance as a sign that Coldelco maintains favorable conditions to access capital markets despite the recent noise stemming from the incident at its El Teniente mine.”

Codelco’s 2035 bonds traded at just 117 basis points above US Treasuries last week, the lowest spread since mid 2023, as the El Teniente mine gradually reopened and investors focused on rising copper prices and lower interest rates. Copper registered its biggest weekly gain in three months last week, after a global supply crunch intensified due to a spate of production setbacks.

Copper rallied as traders monitor the impact of a deadly accident at Freeport-McMoRan Inc.’s huge Grasberg mine in Indonesia, which saw the company declare force majeure on contracted supplies, and the shut down of a Hudbay Minerals Inc. mill in Peru this week.

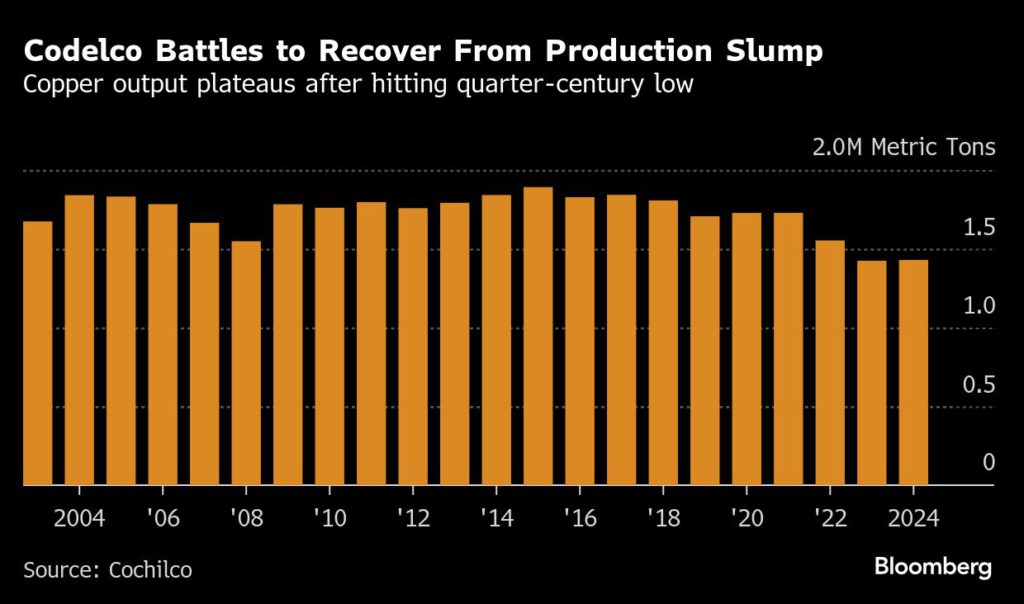

Codelco is selling debt to finance a multi-billion-dollar investment program to overhaul aging mines — projects that are crucial for future production. While it recently lowered its 2025 capital expenditure budget to $4.3 billion-$5 billion from $4.6 billion-$5.6 billion, production and therefore earnings will also be lower than thought due to the collapse at a new section of the El Teniente mine.

The company has debt payments of about $104.9 million and $1.4 billion this year and next, respectively, according to data compiled by Bloomberg.

(By Carolina Gonzalez)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments