Codelco weighs fate of marginal copper assets in strategy shift

Codelco is scrutinizing operational and investment options for the coming years as some officials at the Chilean state copper behemoth push for a shift toward prioritizing profit over production.

Annual planning sessions this year include a review of options for marginal assets, such as its lowest quality mine, Gabriela Mistral, and century-old smelter Potrerillos, said people with knowledge of the matter. No decisions have been been made and the company may opt to proceed with existing plans for the assets, especially with copper prices at record highs.

While asset reviews are standard practice in the industry, the scrutiny of low-return investments reflects a shift in approach at Codelco, where the focus has been churning out as much as possible to maximize inflows to state coffers and avoiding politically sensitive closures. A collapse at its most profitable mine has further dimmed the financial outlook and undermined its chances of returning to pre-pandemic production levels.

A Codelco spokesperson declined to comment.

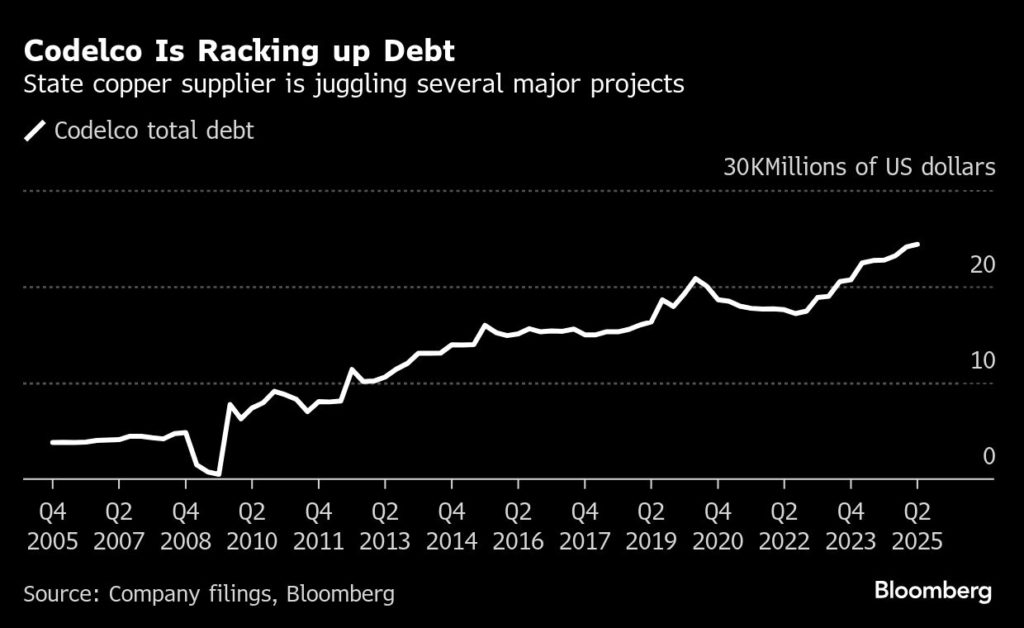

The talks come as Codelco is saddled with an enormous debt load that’s hurt prospects even as the copper market rallies. Analysts have criticized project strategies and execution at the company.

For the copper market, a shift by Codelco toward value over volume would be felt just as supply is set to tighten due to new demand from the energy transition and data-center boom.

Management is exploring ways to reduce the cost of an $800 million-plus project to extend the Gabriela Mistral mine, dubbed Gaby, said the people, asking not to be identified discussing non-public talks. Some within the company are leaning toward Gaby being mothballed once its life ends in 2028 — which would further complicate the task of returning annual production to 1.7 million tons by 2030 from about 1.4 million now. There’s also debate over the future of Potrerillos amid global smelting overcapacity.

Options for Gaby and Potrerillos are being discussed as part of business and development planning, the results of which will be presented to the board next month for further debate.

Also being debated are options for the giant El Teniente underground mine, which suffered a deadly collapse on July 31. That includes which of the remaining inactive areas should be restarted and whether gains can be squeezed out of unaffected areas to offset the impact, the people said.

Codelco has been spending unprecedented sums in recent years to overhaul aging mines and reverse a protracted output slump. Projects have come in late and over budget, pushing debt levels above $24 billion.

A potential cautionary tale for Codelco is the Salvador mine. Rather than closing its smallest operation as ore quality depleted, the company opted to sink more than $1 billion into an problematic overhaul that has yet to bear much fruit.

The Gaby open-pit project came online in 2008 and last year produced 103,000 metric tons, or about 0.5% of the world’s mined copper production. Among Codelco’s fully owned mines, Gaby has the lowest grades, resources and reserves, according to the latest annual report.

In December, the company filed a request with Chile’s environmental agency to extend Gaby’s operations until 2055, with an investment that was estimated at the time at about $800 million. Approval is pending for a project that includes a new water source and a new kind of leaching for sulfide ores. If the company decided not to proceed with the extension, it would be the first time a Codelco mine has been deactivated.

Gaby’s concession area spans a whopping 73,000 hectares (180,000 acres) in northern Chile. With a full-time staff of about 500, it was the first Codelco mine to operate with all autonomous trucks. It uses a type of processing that depends heavily on fluctuating sulfuric acid prices.

Another marginal asset coming under scrutiny is the Potrerillos smelter and refinery complex, which has been offline since mid-June due to a chimney collapse and maintenance work.

The mishap stoked debate over the pros and cons of shutting it down as a global smelting glut puts pressure on older, higher-cost plants. One possibility is to continue smelting operations there but halt refining and instead use spare capacity at another plant.

Much will depend on whether copper prices remain elevated, as well as the outcome of Chilean elections. The country’s new president will appoint three directors to the board after taking office in March, with the leading presidential candidates at opposite ends of the political spectrum.

(By James Attwood)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments