Column: LME’s new position rules reflect a changed metals landscape

The London Metal Exchange’s (LME) move to tighten the regulatory screws on long position holders comes at a time of turmoil in both aluminum and copper contracts.

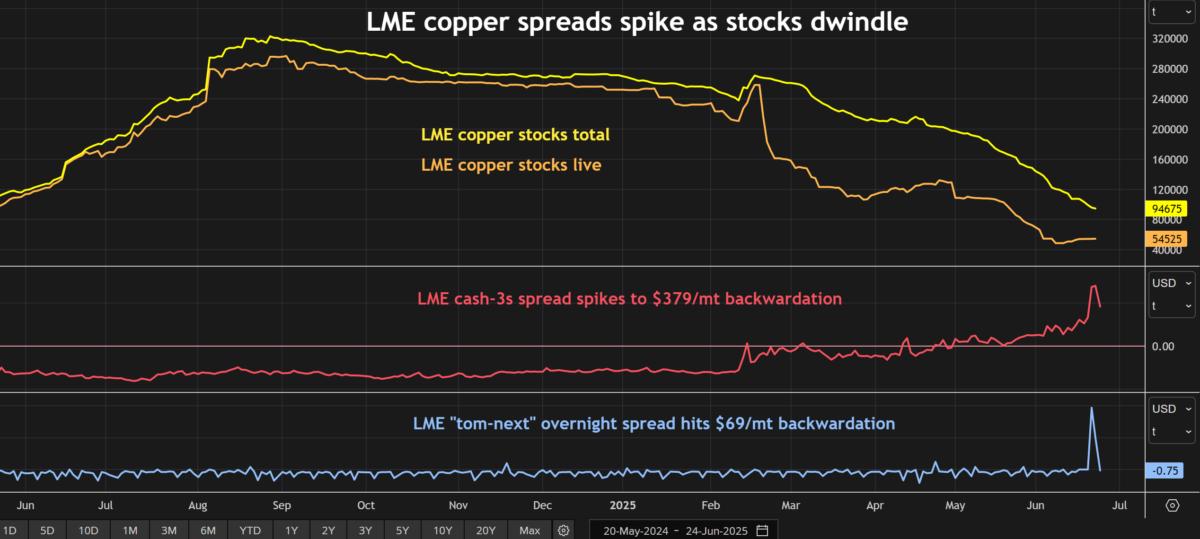

Traders have been scaling up bets even as LME warehouse inventory has been depleting, generating acute stress in the exchange’s unique date structure.

But it’s no coincidence that it’s these two contracts that have been most roiled. Both copper and aluminum physical markets have been massively distorted by tariffs and sanctions respectively.

Having just emerged from its 2022 nickel debacle, the LME is understandably keen to avoid a new crisis and since it can’t do much about either tariffs or sanctions, managing the consequences is its best bet.

The danger as ever with this 148-year old market is that tweaking such a complex ecosystem causes unforeseen consequences.

Cornering the future

This week’s upheaval in the copper market bears all the hallmarks of a mega clash of positions on the cash date.

The “tom-next” spread, which is an overnight position roll, flared out to a backwardation of $69 per metric ton on Monday. That helped inflate the backwardation across the cash-to-three-months period to $397 per ton, the widest since 2021.

One entity had bulked up on cash positions to the tune of 80-90% of available stocks coming into the week and whoever it is will be subject to the exchange’s automatic lending rules.

These are intended to prevent anyone cornering the market with positions so dominant they distort prices.

The new rules introduced on Friday by the LME’s special committee extend those lending caps beyond the cash date through the next monthly prompt. They are, for now at least, temporary.

This follows the recent squeeze in the aluminum market, which was focused not on the LME’s rolling cash date but on the June monthly prompt date.

But it’s clearly not the only mega long position that has given LME senior management cause for concern.

There have been “a number of occasions” of significant positions in nearby prompt dates and the special committee has “at times” directed holders to reduce them “relative to prevailing stock levels,” the LME said.

And there’s the rub. There’s not much stock of either copper or aluminum.

Tariff distortion

LME copper stocks have shrunk by 65% to 94,675 tons since the start of 2025 with the amount of available tonnage at a two-year low of 54,525 tons.

This is not due to diminished global availability but rather reflects a massive redistribution of global inventory.

Ever since US President Donald Trump launched a so-called Section 232 national security investigation into US copper imports in February, physical metal has been flowing to the United States to capitalize on the premium commanded by the CME’s US customs-cleared copper contract over the LME’s international product.

US imports of refined copper jumped to more than 200,000 tons in April, the highest monthly arrival rate this decade.

LME warehouses have been stripped to feed this physical tariff trade. CME stocks, on the other hand, have more than doubled this year to 184,464 tons, the highest they’ve been since August 2018.

Sanctions impact

While the prospect of US tariffs has upended global copper flows, those of aluminum have been fractured by sanctions on Russian metal.

When the United States and Britain announced sanctions on Russian producer Rusal in April 2024, the LME suspended all deliveries of Russian aluminum produced after that date.

Russian metal already in the LME system could continue trading but clearly wasn’t as desirable as other brands. There have been sporadic dog-fights over available non-Russian stocks ever since, each involving large positions and spread turbulence.

But the net result is that LME aluminum stocks are now at their lowest point since October 2022. Most of the stock awaiting physical load-out has departed and most of what remains is Russian metal.

There is no sign of any imminent replenishment. LME off-warrant stocks, which often rise when visible inventory falls as metal is re-directed to cheaper warehouse deals, are also down on the start of the year.

There have been no significant fresh deliveries onto LME warrant since March. The Russian liquidity tap has been dry since last year and holders of other brands are likely reluctant to lose them in the LME clearing.

In the case of both copper and aluminum, the efficiency of the LME’s global delivery function relies on the existence of a globally fluid physical supply chain that simply isn’t there right now.

Reduced incentive

The LME’s lending guidance has always faced criticism for favouring short position holders over longs.

Extending the lending restrictions on dominant long positions across the front month of the curve naturally skews the regulatory focus further.

It’s worth remembering that it was a dominant short not a dominant long that caused the 2022 nickel blow-out.

But given the growing mismatch between position size and available inventory, the LME is doubling down on precedence to try and avert another crisis.

The problem is that smoothing out what the LME deems distortions in the exchange’s price-setting function may reduce the financial incentive for metal to be delivered to what is supposed to be the market of last resort.

Assuming, of course, it’s neither Russian aluminum nor copper on its way to the United States.

(The opinions expressed here are those of the author, Andy Home, a columnist for Reuters.)

(Editing by David Evans)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments