Copper price climbs on tight supply outlook after best year since 2009

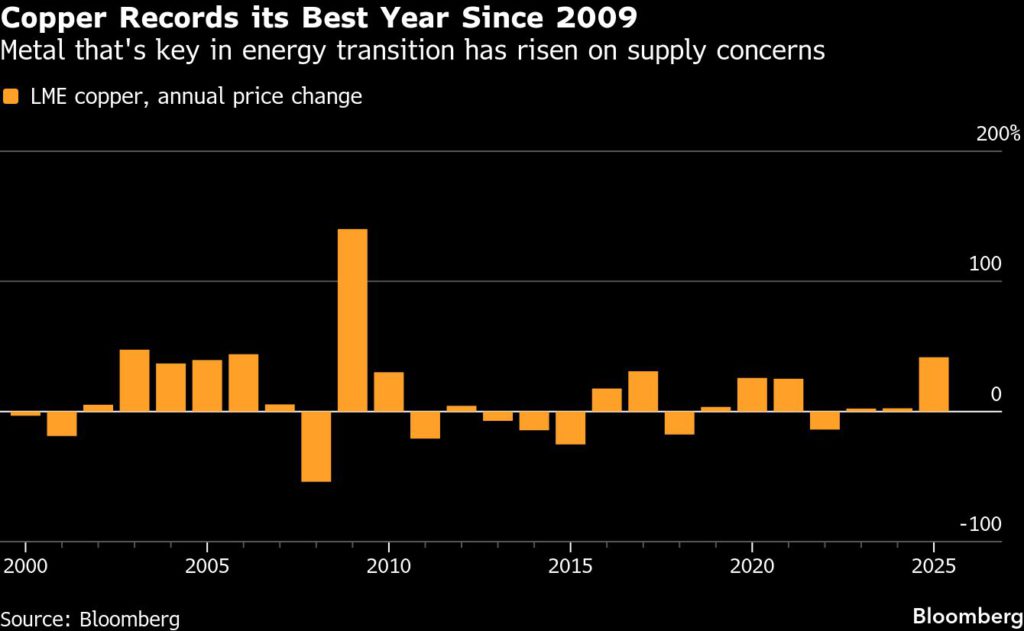

Copper rose on the first trading day of 2026, after capping the biggest annual gain since 2009 on prospects for a tighter market.

The red metal resumed its advance on Friday after losing 1.1% in the previous session. Copper rallied 42% on the London Metal Exchange in 2025, underpinned by mine disruptions and concerns around tariffs, which have led traders to ramp up shipments to the US, creating tightness elsewhere.

Copper notched a series of all-time highs during an end-of-year surge, making it the best performer of the six industrial metals on the LME. Beyond the tariff-driven flows, mines in Indonesia to Chile and the Democratic Republic of the Congo suffered accidents in 2025, crimping output.

The red metal was 1% higher at $12,543.00 a ton at 3:39 p.m. Singapore time, after hitting a record of $12,960 on Monday. Aluminum was little changed at $2,997.50.

Nickel climbed 1.1% to $16,840.00, with PT Vale Indonesia suspending operations at its mines after not receiving approval for an annual work plan from the authorities. Delays in mining-quota approvals are not unusual in the Southeast Asian nation, but traders are honing in on supply after Indonesia said it planned to cut output this year.

Iron ore futures in Singapore rose 0.2% to $105.55 a ton. Chinese markets are closed for public holiday.

(By Annie Lee)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments