Copper price spreads ease in sign squeeze will prove short-lived

Copper price spreads loosened rapidly in London after a huge spike seen on Tuesday, as analysts said new deliveries of metal may soon be made into exchange warehouses to ease supply constraints.

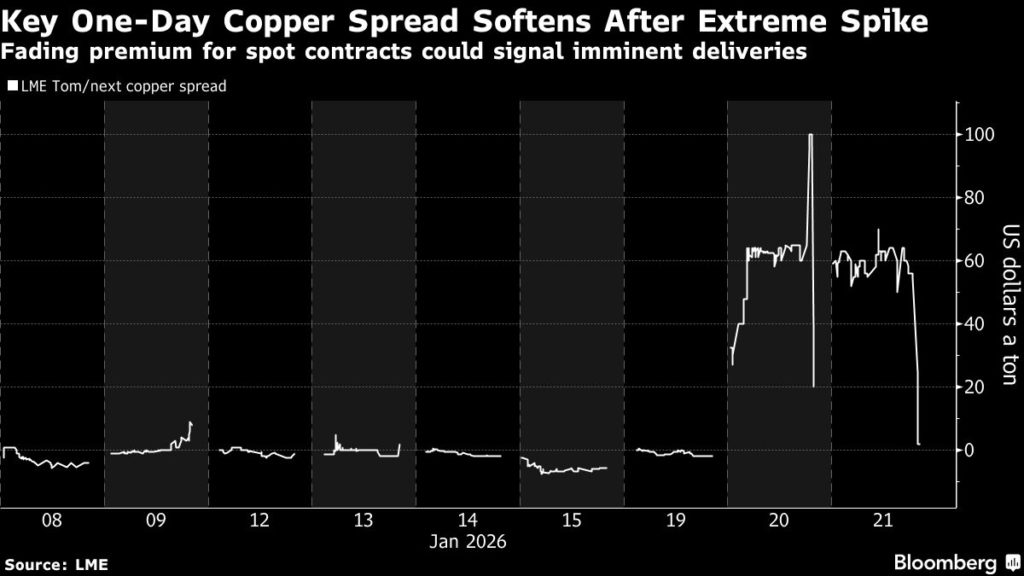

Contracts maturing tomorrow closed at a $2 premium to those expiring a day later, after the closely watched one-day spread briefly spiked to a huge premium of $100 a ton on Tuesday, and remained at elevated levels through most of the morning’s trade on Wednesday.

Premiums for spot contracts — known as backwardation — are a signal that demand for metal in the London Metal Exchange’s warehouse network is outpacing supply but the softening of the so-called Tom/next spread and the emergence of discounts in other longer-dated price spreads suggested the trend could prove short-lived.

Backwardation can inflict deep losses for those looking to roll forward short positions, and create incentives for them to deliver metal into the LME’s warehousing network instead. Data from the exchange indicates that there are large volumes of privately held stock that could be readily moved into its warehouses across Asia, the US and Europe.

Analysts said that the unraveling of the spreads indicate that such inflows could be imminent. Copper stockpiles tracked by the LME rose 3.8% to 112,575 tons on Wednesday, climbing for a sixth day.

“We’ve seen some deliveries already and the fact is that there is probably more stock to be delivered against the backwardation,” Al Munro, a senior base metals strategist at Marex, said by phone. “People think that moving stock between exchanges is a simple process, but it can be laborious and sometimes shorts can face delays in delivering against their positions.”

The ructions in LME spreads have had little impact on outright prices for the metal, with the LME’s benchmark three-month contract rallying as much as 1.6% toward $13,000 a ton on Wednesday. The move came as global stock markets steadied after a selloff on Tuesday, and Goldman Sachs Group Inc. said it expects continued flows of the metal into the US, a key driver behind its powerful price rally.

The industrial commodity has notched a series of record highs since late last year as mines have faltered and a surge in shipments to the US ahead of potential tariffs has tightened supplies elsewhere. Meanwhile, investors see demand spiking to power the burgeoning artificial-intelligence industry.

Flows to US

The once-in-a-lifetime trading opportunity to ship record volumes to the US was fueled by a rally in copper prices there. While the recent spike in prices on the London Metal Exchange has left US front-month futures trading at a discount, Goldman Sachs expects the flows to continue, as the arbitrage opportunity is still open in later-dated contracts.

“Our current view is that you have a continuation of a build even with the spread where it is today between COMEX and LME,” Eoin Dinsmore, an analyst with the bank, said at a briefing Wednesday.

Goldman Sachs forecast a 600,000-ton inventory build in the US this year, which splits between 200,000 tons in the first quarter, easing in the second and third quarters and picking up again at the end of the year.

Other industrial metals also rallied alongside gold, which rose to a record high as the crisis over Greenland and a meltdown in Japanese government debt supported haven demand. Frenzied investment across multiple metals has stoked gains in recent weeks, and the debasement trade — where investors retreat from traditional financial assets — is also helping.

Copper rose 1.3% to $12,920 a ton on the LME as of 1:57 p.m. local time. Aluminum gained 0.6% to $3,126 a ton, while tin surged as much as 6.9% to $52,810.

Read More: Copper price won’t stay above $11,000 for long, says Goldman

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments