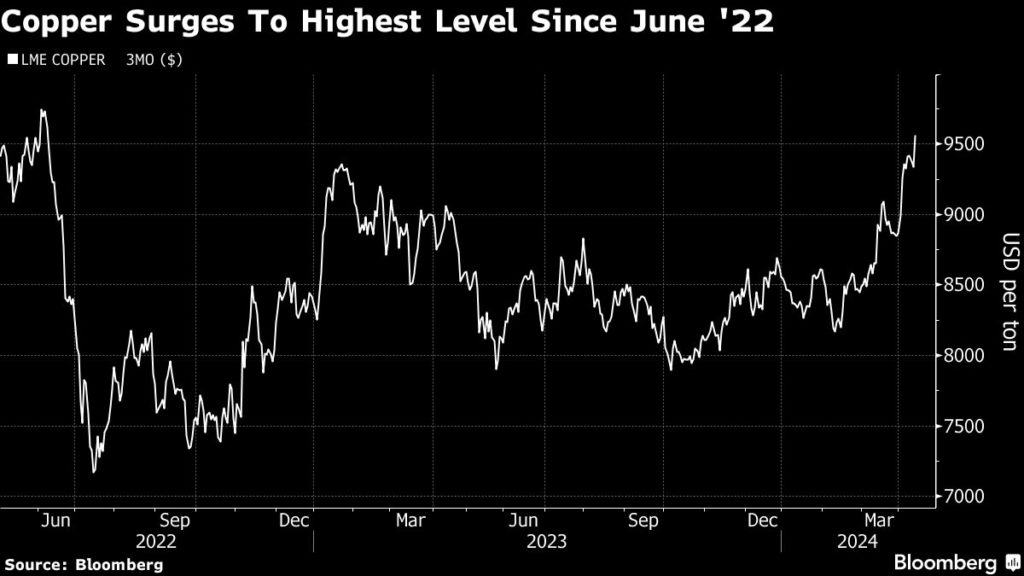

Copper price rally continues with surge to highest in 22 months

Copper continued its upwards charge, hitting the highest level since June 2022 as investors bet that curtailed ore supply will struggle to keep up with rising global demand.

Copper has found itself strongly positioned after a mine-supply shock late last year that is now combining with better-than-expected consumption, as global manufacturing usage picks up. Prices have also benefited as investors start to pivot into commodities as a hedge against renewed inflation fears.

Futures on the London Metal Exchange have risen more than 11% this year. Copper jumped as much as 2.7% to $9,590.50 a ton on Friday, after fresh data showing strong Chinese imports during March.

“The underlying narrative remains very positive, both from a challenged supply perspective and with regards to cyclical improvements in global growth,” said Marcus Garvey, the head of commodities strategy at Macquarie. “However, the near-term move looks to be driven by financial flows, both discretionary and systematic moment driven, and is arguably getting ahead of itself now.”

On the LME, hedge funds have increased their net long positions in copper to the highest since February 2021, according to data for the week through April 5. Investors have been focusing on signs of a recovering industrial sector in China, while disruptions at major mines have pressured margins at the Chinese processing plants that account for more than half the world’s supply, raising the prospect they will reduce output of refined metal.

Chinese trade data published Friday show imports of refined copper in the first quarter are up 6.9% from a year earlier, even though the country has been expanding its domestic smelting capacity. An index of China’s manufacturing industry jumped at the end of March to indicate sector growth for the first time since last September.

“Investors now betting that China is recovering, demand is coming back, and also elsewhere, manufacturing activity is improving,” said ING Bank commodities strategist Ewa Manthey. “Plus, all the micro drivers are supportive like tightening supply of copper concentrates.”

Copper smelters have come under increasing pressure this year, as a supply squeeze on copper concentrates — a partially processed form of ore that is used to produce refined metal — has driven processing fees to the lowest levels in recent memory.

The concentrates market has tightened dramatically as smelters have been expanding capacity while mine supply has been disrupted by the sudden shutdown of First Quantum Minerals Ltd.’s Cobre Panama mine, removing roughly 400,000 tons of the metal from the world’s annual supply. The outlook for mined copper tightened further after Anglo American Plc announced it was scaling back output by about 200,000 tons.

Those lost tons, while painful for First Quantum, Anglo and the Chinese smelters, has been a boon for rival producers. Antofagasta Plc, which mines the metal in Chile, has jumped 37% this year to trade at a record high.

The pressure on smelters is expected to eventually lead to cuts in refined copper production, although no major reductions have yet been announced. Still, data published this week showed that about 8.5% of China’s smelting capacity was inactive in the first quarter, compared with 4.1% a year earlier.

One potential headwind for prices is a buildup in refined copper stocks in China, while spot prices are also trading at a large discount to futures, a market structure which typically signals ample supply.

Copper’s price surge has coincided with a wider commodities bull run. Gold is currently trading at a record high, while analysts and trading houses are becoming bullish on oil hitting $100 a barrel.

“Copper has, just like several other commodities especially metals, increasingly become a buy on dip market with hedge funds adding exposure,” said Ole Hansen, Saxo Bank’s head of commodity strategy.

(By Thomas Biesheuvel, Archie Hunter and Jack Ryan)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments