Critical minerals firm weighs plan to build US rare earth plant

Atlantic Strategic Minerals, a small US mining company, is considering building a rare earths plant in a bid to join America’s push for domestic production of key materials.

The facility would be at the company’s operations in Stoney Creek, Virginia, about 150 miles from Washington, DC, where it already produces some critical minerals and rare earth elements as a byproduct, according to Michael Scherb, chief executive officer of Appian Capital Advisory, which owns Atlantic Strategic Minerals.

“We’re debating now what we should do with the byproduct,” Scherb said Tuesday in an interview. “You can separate it and you can produce rare earths, but you need a refining facility.”

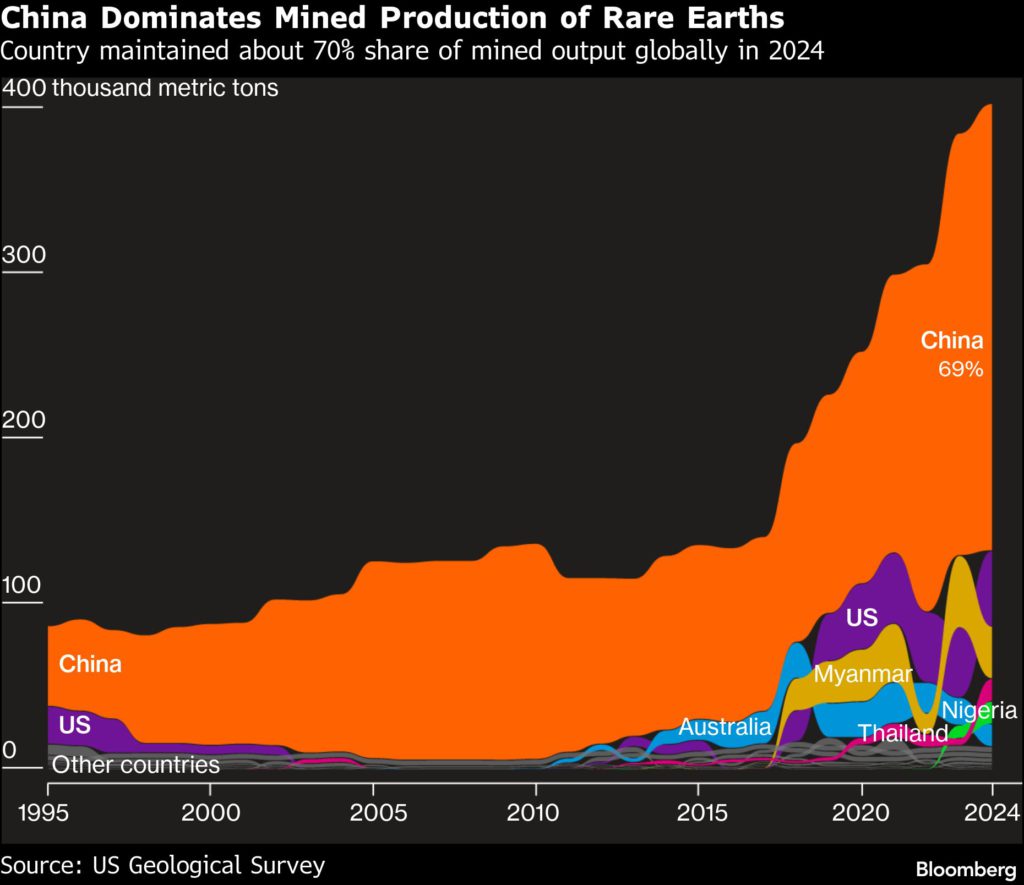

The decision follows the Trump administration’s push to loosen China’s grip on rare earth minerals, which are essential for products ranging from smartphones and electric vehicles to fighter jets. China controls the vast majority of the world’s rare earth mining and processing capacity, leaving US industries exposed to potential supply shocks.

Appian, which has about $5 billion of assets under management, is one of a few investment firms dedicated to the mining sector, alongside the likes of Orion Resource Partners and Resource Capital Funds. Atlantic Strategic Minerals started commercial operations in June, where it now produces niche minerals like ilmenite — a primary material used in titanium — and zircon, a source for the metal zirconium, which is used in nuclear reactors.

Scherb said Appian has held conversations with the White House seeking government support for the plant, which he estimated would cost under $100 million to build. The firm also is looking at processing domestic and international materials from third—party companies beyond its own operations, including Appian-owned Gippsland Critical Minerals, which has a rare earths project in Australia.

Companies have announced a flurry of investment plans for critical mineral projects in the US in light of President Donald Trump’s efforts to secure domestic supplies. Korea Zinc Co. — one of the world’s largest zinc processors — is planning a $7.4 billion smelter in Tennessee, while MP Materials Corp. is building a rare earths separation plan in California.

Atlantic Strategic Minerals’ facility would be considerably smaller but easier to achieve, said Scherb.

“These grand, huge mega-projects — you don’t need to pursue those,” he said. “You can actually look at more cost-effective, strategic ways to get supply out, whether it be through recycling or better use of the byproduct that comes out of operations like these.”

(By Jacob Lorinc)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments

Noah

Essentially it would be a good idea to have a backup, in the most important minerals, moreover, you never know what could happen with our supply line, though since the US is funding the Philippines to extract the minerals, it’s still a good idea to have a backup: keep the Chinese out of the market, essentially we are trying to freeze out China, because they are using the minerals over our heads, and the US doesn’t like that in any; confusion to our enemies, yours Noah Hastings, Ph.D.