Energy Fuels to buy Australian Strategic Materials in $300M deal

US uranium producer Energy Fuels has agreed to pay a large premium for Australian Strategic Materials (ASM), as the United States bolsters efforts to secure Western supply chains for rare earth elements.

Energy Fuels will acquire the rare earths firm in a deal valuing the Australian firm’s equity at A$447 million ($300.9 million), the two parties said in separate statements on Wednesday.

The deal, which represents a 121% premium on ASM’s close from January 20, sent shares of the Australian producer soaring as much as 126% to A$1.63.

The buyout is significant for the US, which is looking to lock in Western supply for the metals used in applications such as wind farms, mobile phones and missiles. Australia and the US signed a framework agreement for cooperation around critical minerals including rare earths last year, each pledging to invest $1 billion.

That investment, which will cut the risk for other stakeholders, is part of a suite of government policies that are expected to spur more sector consolidation, said law firm White and Case in a report this week.

“We are already seeing it (consolidation), and we’re going to continue to see it, because everyone recognizes that…rapid establishment of the supply chain you are going to need multiple parties who are working together,” ASM CEO Rowena Smith told Reuters in an interview.

Under the deal, shareholders of ASM would receive 0.053 Energy Fuels shares for each ASM share held, along with a special dividend of up to A$0.13 per ASM share, representing a total implied value of A$1.60 per ASM share.

ASM’s board has unanimously recommended that ASM shareholders vote in favour of the transaction in the absence of a superior proposal, it said.

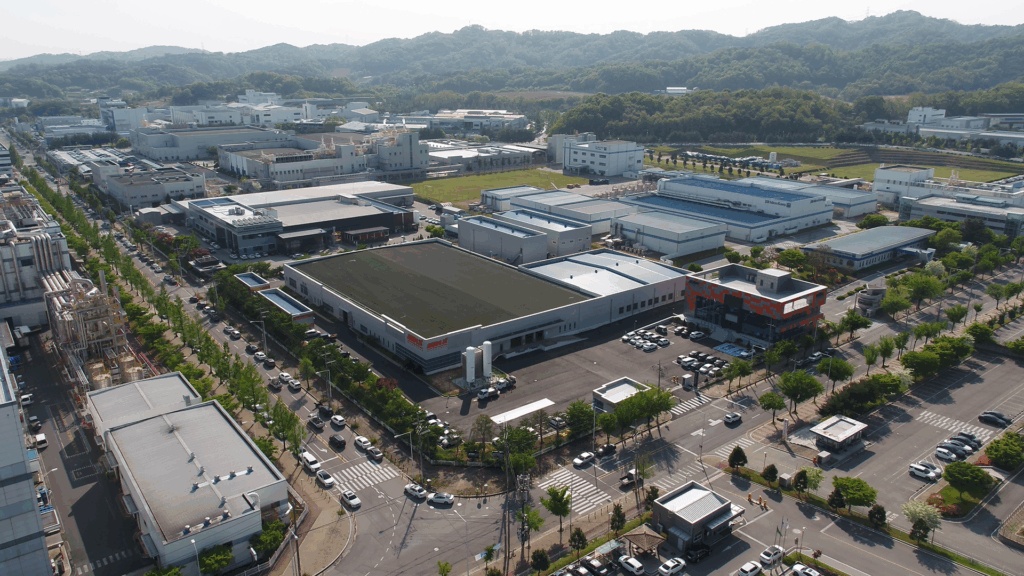

Upon completion, the transaction will combine ASM’s operating Korean metalization plant and its planned American metals plant with Energy Fuels’ existing rare earth oxide production at its White Mesa Mill in Utah.

It will also have a number of development projects. In Australia that will include ASM’s Dubbo rare earths project in New South Wales, the Donald project in Victoria, as well as the Vara Mada project in Madagascar and the Bahia project in Brazil.

They are all intended to supply feed materials for the planned expansion of the company’s White Mesa Mill to produce 6,000 tonnes per annum (tpa) neodymium-praseodymium (NdPr), 240 tpa dysprosium, and 66 tpa terbium oxides.

Prices of rare earths have been rising as Western countries scramble to reduce dependence on China. In response, Australia has been considering setting a price floor and new international partnerships to support rare earths projects and build alternative supplies.

Australia’s Lynas Rare Earths is the world’s largest rare earths producer outside China. It produced 10,462 tons of rare earth oxides in the 2025 financial year.

($1 = 1.4857 Australian dollars)

(By Himanshi Akhand and Melanie Burton; Editing by Alan Barona, Chris Reese and Jacqueline Wong)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments