Fidelity fund that sold gold before crash is ready to buy again

Fidelity International money manager George Efstathopoulos sold a chunk of his gold holdings days before the precious metal’s biggest slide in four decades. Now he’s getting ready to buy again.

“If we see another 5%, 7% correction, I’m buying up,” Efstathopoulos said in an interview Tuesday. “A lot of the froth has been taken out, and the structural sort of medium-term themes are very much in place” for gold to continue rallying.

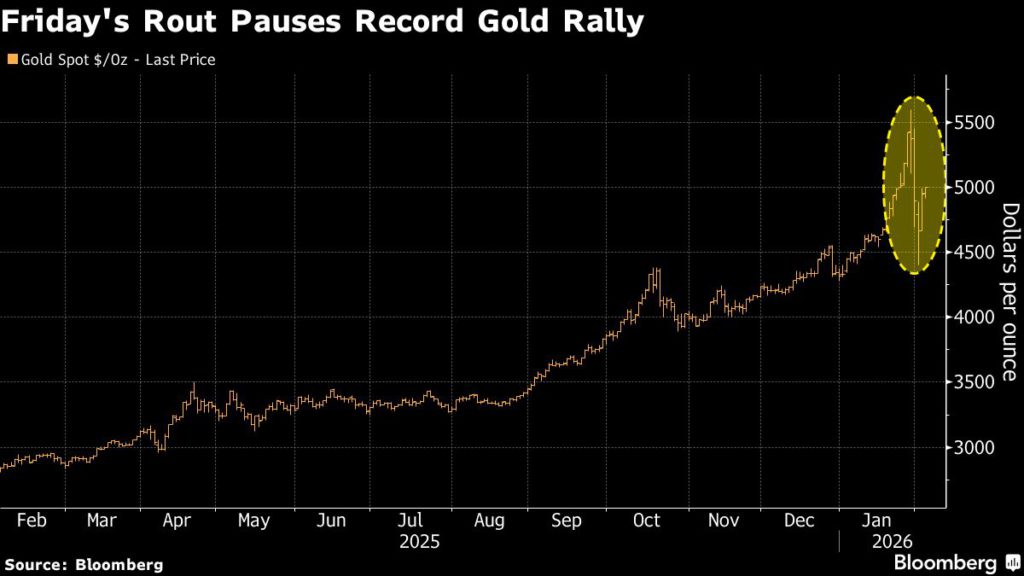

Efstathopoulos cut his gold exposure to about 3% from around 5% early last week, booking profits before bullion plunged Friday on concerns Kevin Warsh — seen by some as a policy hawk — would be nominated as Federal Reserve Chairman.

The money manager sold even as the metal rose to a record on haven demand triggered by concerns about currency debasement, the Fed’s independence and geopolitical tensions. Chinese speculators’ buying had also added froth to the rally.

Efstathopoulos is one of the first prominent global fund managers to express optimism about gold’s outlook after the recent rout, a view shared by some banks including Deutsche Bank AG, which is standing by its forecast for bullion to rally to $6,000 an ounce. The precious metal has rebounded for two consecutive days, thanks to dip buyers that have emerged after the historic price collapse.

Bullion climbed as much as 2.8% to above $5,080 an ounce on Wednesday, after jumping more than 6% in the previous session. It hit an all-time high of $5,595.47 an ounce on Jan. 29.

Efstathopoulos, who helps oversee about $3 billion in income and growth strategies at Fidelity, said the factors that have driven gold to record highs remain intact.

“Inflation continues to be sticky,” he said, adding that dollar weakness is an additional driver.

Meanwhile, massive buying from central banks and investors’ diversification away from US assets are also favorable trends.

A survey published by the Official Monetary and Financial Institutions Forum, a think tank, found more than 50% of central banks intend to build reserves to bolster resilience, with gold demand rising as a hedge.

Efstathopoulos, whose fund posted a 20% gain last year, gets his gold exposure from exchange traded funds, exchange traded commodities, and at times, gold miner stocks.

“Gold makes sense because it just creates a more robust portfolio” from a diversification perspective, said the money manager, who plans to boost bullion’s share up to around 5% of his fund again. “We want to be buying the dip.”

“Gold and silver face a two-paced trajectory: a clear short-term prognosis that may see them clawing their way back to previous highs and possibly even higher; and a longer-term outlook that is sobering.” – Ven Ram, Bloomberg strategist

(By Ruth Carson, Bernadette Toh and Yihui Xie)

More News

Analysts ramp up gold price forecasts as global uncertainties mount

February 04, 2026 | 08:46 am

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments