Gold heading for record-breaking inflows this year

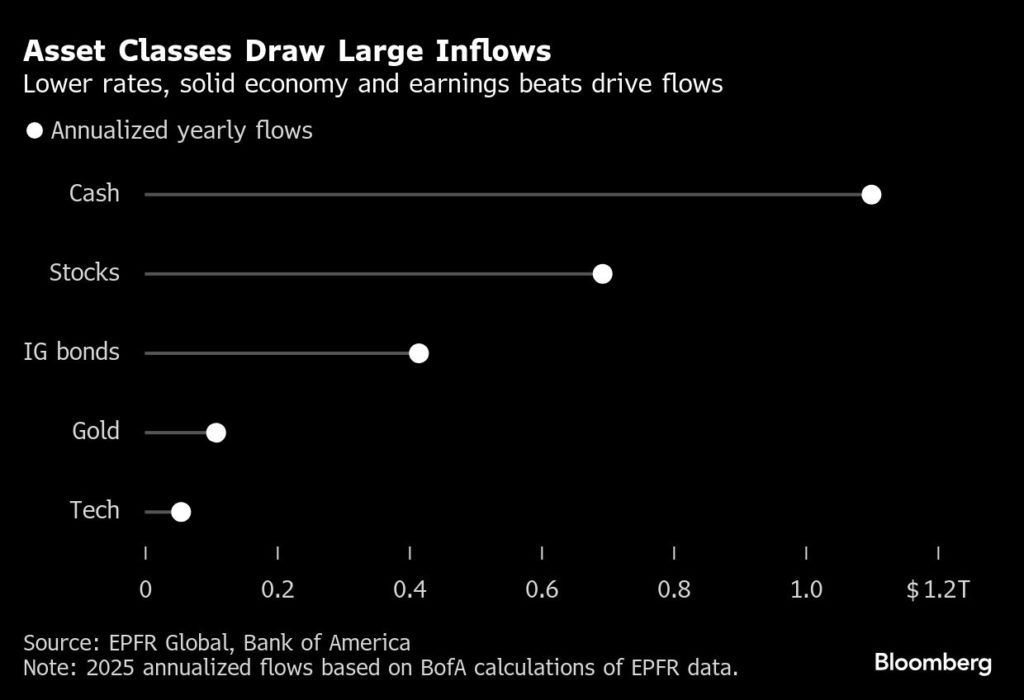

Stocks, cash, gold and bonds are set for some of the largest yearly inflows on record in a market that’s seeing a breakdown in traditional correlations between asset classes.

Equity funds are heading toward $693 billion of inflows in 2025 based on annualized year-to-date figures, according to Bank of America Corp. calculations using EPFR Global data. That would be the third highest tally ever, strategists at the bank wrote in a note.

Cash funds are on course to attract $1.1 trillion, their second-largest inflow. Investors are set to pour record amounts into gold and investment-grade bonds at $108 billion and $415 billion, respectively.

Unpredictable US trade policies have been at the heart of a turbulent year in markets that has tested investors’ ability to choose between asset classes. The debate over the path for Federal Reserve interest rates and a US government shutdown that’s created an economic data vacuum have further complicated the picture.

Still, stocks have rallied to records as the massive surge in artificial intelligence spending rages on, while earnings and the economy remain solid. Bond yields have pulled back as global borrowing costs drop, while gold has soared to all-time highs on its attraction as a haven in uncertain times.

Goldman Sachs Group Inc. macro trader Bobby Molavi earlier this week observed that historical correlations between bonds, equities and gold have been “thrown out the window,” and that this “remains a post-modern market in many ways.”

(By Farah Elbahrawy)

Read More: Gold ETFs reached highest level since 2022 as market rout struck

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments