Gold options traders boost long-shot bets even after correction

Some staunch gold bulls are shrugging off the precious metal’s historic correction and holding out for another surge to unheard-of levels.

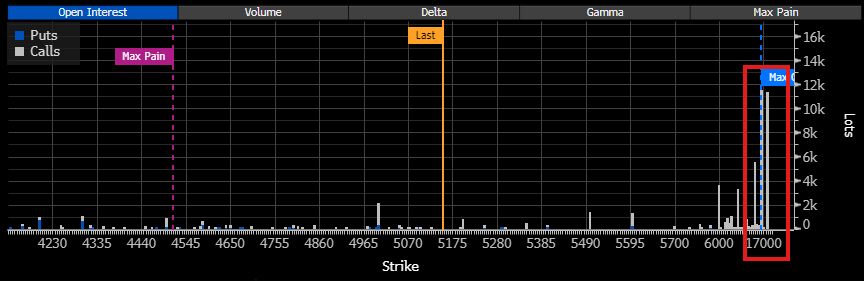

As bullion futures in New York hit a record high above $5,600 an ounce in late January, only to suffer an unprecedented plunge the next day, an investor or group of investors started buying December $15,000/$20,000 call spreads on the CME Group’s Comex exchange. Even after prices consolidated around $5,000, the position has continued to build, to around 11,000 contracts.

“It is surprising to see this much open interest on such deep out-of-the-money call spreads, particularly following the technical correction,” said Aakash Doshi, global head of gold and metals strategy at State Street Investment Management. “It is plausible some traders see this as a cheap lottery ticket.”

Gold’s latest leg up was stoked by a wave of speculative buying that sent prices to overbought territory. But many banks forecast that prices — which have doubled since early 2024 — will continue to be driven up by persisting geopolitical tensions, questions over the Federal Reserve’s independence and a shift away from currencies and sovereign bonds.

Still, it would take prices nearly tripling by late in the year for the options trade to expire in the money. The call spreads offer a less expensive way to profit from a renewed surge than buying outright bullish contracts, while capping potential gains. The traders can either close out the contracts at a higher price as December futures rally, or hold them until expiration if prices make it past $15,000 an ounce.

If the traders expect a “near-term violent move higher,” they could sell the spread without its value decaying much, since expiration in December is still a long way off, Doshi said.

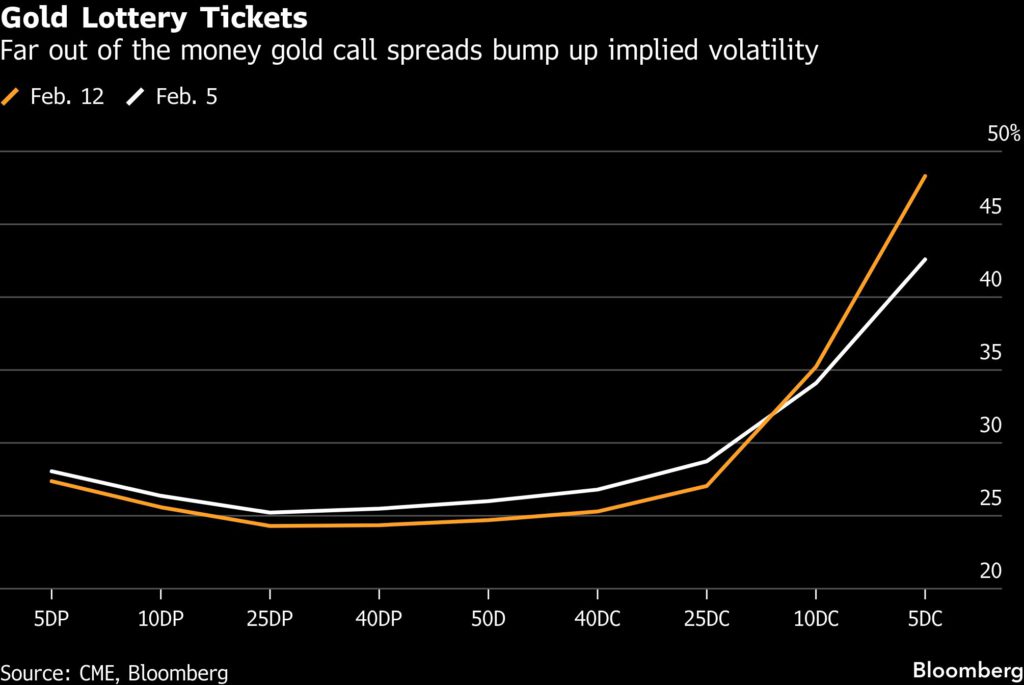

Though prices are still miles away from a level that would bring the contracts into play, the trades boosted implied volatility for far upside calls last week, even as most other options got relatively less expensive.

Gold’s call skew — or the premium for bets on a price gain versus a decline — is getting cheaper across different expiration months so far in February, but realized price volatility remains high, Doshi said, adding that the market still has the potential for large “gap” moves.

A 11% slump in Comex gold futures on Jan. 30 was the biggest one-day loss in decades. Prices also suffered a strong correction in October, sliding to $4,000 an ounce after nearing $4,500.

(By David Marino and Yvonne Yue Li)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments