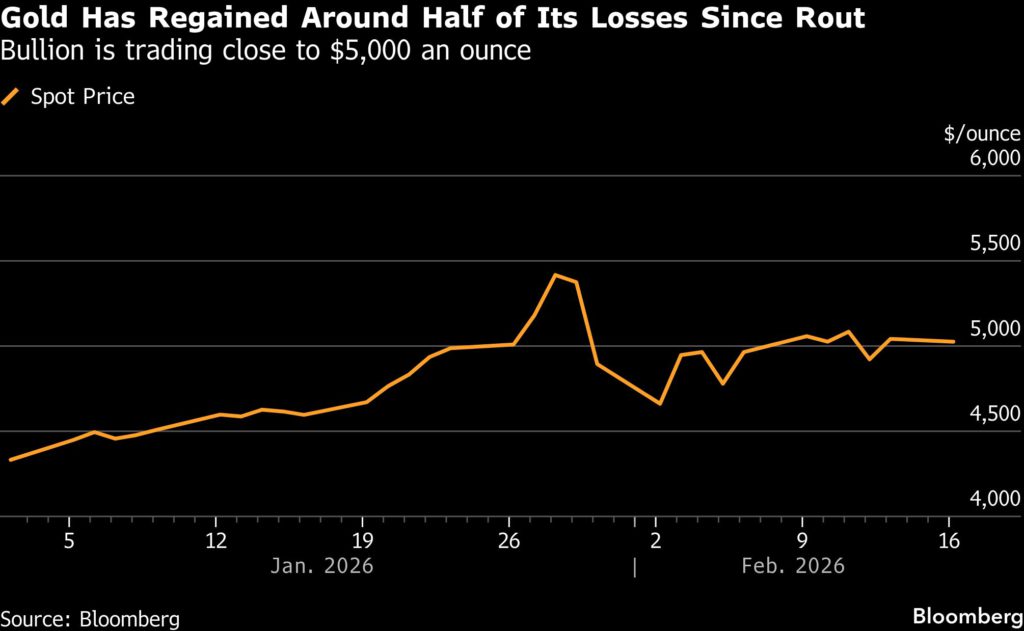

Gold price hovers near $5,000 with US and China closed

Precious metals drifted lower in thin trading, with many Asian traders offline for the Lunar New Year break, and the US also closed.

Gold fell 0.9%, holding near $5,000 an ounce. Bullion gained 2.4% Friday after a modest rise in the US consumer price index for January allayed concerns about a bigger jump. That boosted the case for the Federal Reserve to trim interest rates — a tailwind for precious metals, which don’t pay interest.

“The market remains in a phase of rebalancing between bulls and bears, lacking clear catalysts to break the range,” Dilin Wu, a strategist at Pepperstone Group Ltd., said in a note. “At $5,100, multiple attempts to push higher failed, as profit-taking at the top generated selling pressure,” she said.

With markets in China closed this week for the Lunar New Year holiday, liquidity is thinner than usual during Asian trading hours.

Retail demand for precious metals in the country has been frenetic in recent months, prompting authorities in the retail hub of Shenzhen to issue a stark warning against “illegal gold-trading activities,” ranging from apps offering leverage to retail investors to online live streams promoting bullion sales.

The silver market in China meanwhile, continues to be exceptionally tight, although it has begun to show some signs of easing in recent days. Inventories on the Shanghai Gold Exchange and the Shanghai Futures Exchange are at historic lows, while prices for silver futures close to delivery are well above contracts for later in the year, an unusual reversal of a normally upward sloping futures curve.

There are “tentative indications that speculative intensity is moderating” on the Shanghai Futures Exchange, Marc Loeffert, a trader at Heraeus Precious Metals, wrote in a note Monday. Tweaks to exchange rules that will limit the pace of inventory outflows should ease domestic tightness, he added.

The rapid rally in silver has cut into the use of the metal in solar panels, which has been “one of the main sources of industrial demand growth over the last 10 years,” Loeffert wrote, as manufacturers look to replace or reduce the expensive input. That means prices will “be even more exposed to investor sentiment and investment flows,” over the medium term, he said.

Spot gold fell 0.9% to $4,996.55 an ounce as of 12:18 p.m. in London. Silver dropped 0.9% to $76.73 an ounce. Platinum fell, and palladium edged higher. The Bloomberg Dollar Spot Index, a gauge of the US currency, rose 0.1%.

(By Robin Paxton and Jack Ryan)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments