Gold Reserve aims to retake Venezuela assets after Maduro’s fall

Gold Reserve Ltd. has spent years fighting with Nicolas Maduro’s government over two gold deposits seized by Venezuela. Now, after the US captured the country’s leader on Saturday, the tiny mining company sees a path to regain those prized assets.

The company operated two gold and copper deposits — Brisas and Siembra Minera — before they were seized by Venezuela’s government in the 2000s and 2010s. The Brisas deposit, which was confiscated under the Hugo Chavez regime, holds about 10 million bullion ounces — worth about $44.4 billion based on Monday’s gold price.

Paul Rivett, the company’s vice-chair, says he fielded numerous calls from mining companies over the weekend expressing interest in the deposits. Already, Rivett said he’s exploring deals that could help develop them under a new Venezuelan government.

“We will be doing some form of a transaction, whether it involves an investment into us or a partnership,” he said in a Monday interview. “Thankfully we’ve been able to hold on to all the mining professionals and geologists who found this deposit and proved it out years ago, but they’re all in their late 60s and 70s. What we need now is operational expertise.”

The company’s early moves show how miners and resource investors are already probing Venezuela’s rich mineral frontier after a dramatic shift in the country’s political landscape over the weekend.

Venezuela sits atop some of the Western Hemisphere’s largest gold deposits, but the Maduro administration struggled to develop them. Most of the country’s operating mines are dominated by criminal cartels and Chinese firms. Gold Reserve’s two former projects are presently run by the Cartel de los Soles — a US-designated narco-terrorist organization — using Chinese technology, according to the company.

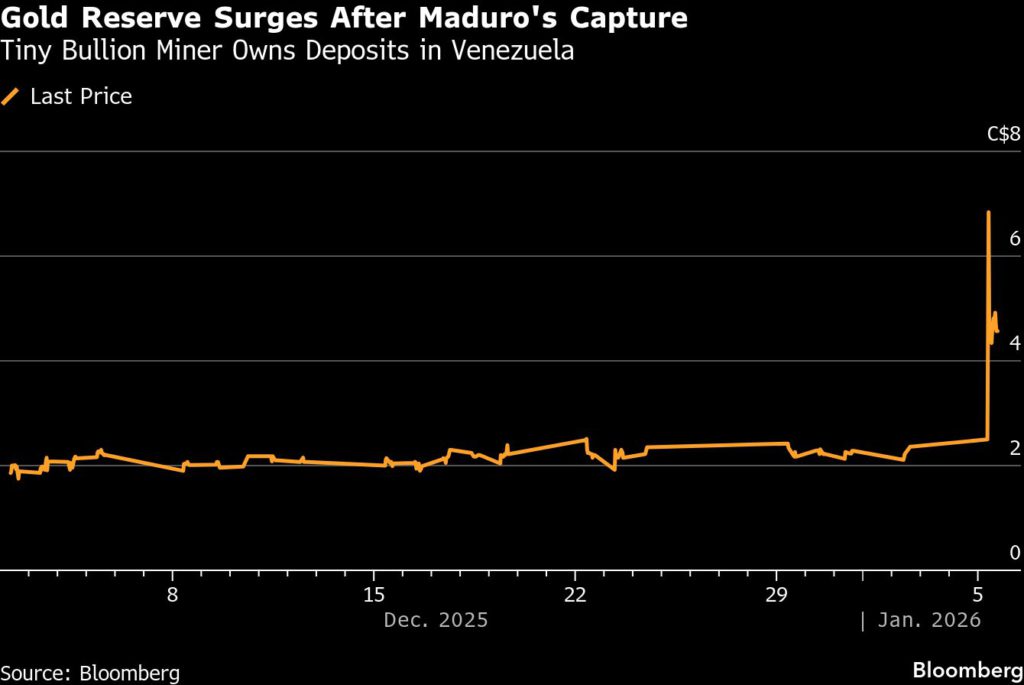

Shares of the company surged 103% in Toronto on Monday.

The company is one of two North American miners that filed arbitration suits against Venezuela after their assets were seized. The other firm, Rusoro Mining, said Monday that its chances of collecting more than $2 billion in compensation from the Venezuelan government have improved, following the US removal of Maduro.

Beyond Venezuela’s crumbling oil infrastructure — which the Trump administration has pledged to rebuild — the White House has touted the country’s access to minerals.

“They have a great mining history that’s gone rusty,” Commerce Secretary Howard Lutnick told reporters Sunday. “It was once upon a time one of the great economies and cultures of the world, and it was destroyed, and now President Trump is going to fix it and bring it back.”

The regime change has also renewed Gold Reserve’s hopes that it can secure the release of its legal counsel, José Ignacio Moreno Suarez, who was imprisoned in 2023 amid the arbitration dispute.

“We’ve got a colleague who’s still stuck in jail, who sleeps on concrete, who has broken fingers, bruises up and down his body,” Rivett said. “This is real. These are really bad people.”

(By Jacob Lorinc)

More News

Contract worker dies at Rio Tinto mine in Guinea

Last August, a contract worker died in an incident at the same mine.

February 15, 2026 | 09:20 am

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

3 Comments

Steven Solomon

Saying that 10 million ounces of reserves in the ground is ‘worth $44.4 billion’ is pretty misleading. Unless those ounces are able to jump out of the ground in the form of smelted gold coins at zero cost, then they are worth considerably less than that.

JAMES HAZELTON

I was Purchasing Manager in Venezuela at the time Chavez Withdrew Gold Reserves license. Much more has to happen than just the removal of Maduro before this can once again be a viable project. Currently the property is overrun by illegal miners, controlled the ELN & FARC.

Gerald lohuis

I have high hopes Gold Reserve will be able to get access to their joint venture back.That