Gold, silver volatility to persist after price plunge, BofA says

Volatility in the gold and silver markets will remain elevated after the precious metals crashed from all-time highs, according to Bank of America Corp.

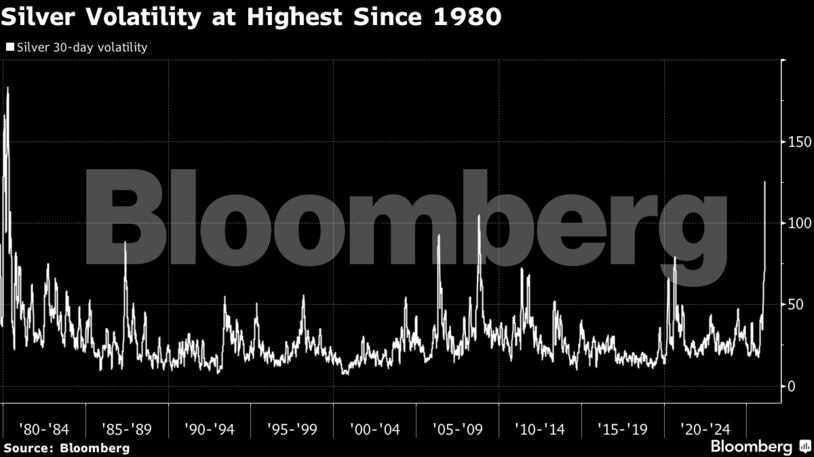

By one measure of volatility, gold prices are more unstable than at any time since the height of the 2008 financial crisis. Silver, meanwhile, hasn’t experienced this much market turmoil since 1980.

The metals soared last month, extending a blistering rally underpinned by speculators, geopolitical fears and angst over the Federal Reserve’s independence. That all came to an abrupt halt late last week, with gold suffering its biggest drop in more than a decade and silver clocking its worst day on record.

“We will maintain higher volatility environments than we had historically, but not what we’ve had over the last few days unless we run up another spec bubble,” said Niklas Westermark, head of EMEA commodities trading at BofA. “We’ve had a washout now over the last two sessions that I think has cleaned up the market to a good extent.”

Bullion and its cheaper sibling rebounded Tuesday as dip-buyers rushed in. Gold has a stronger, longer-term investment thesis, Westermark said. Inflated prices and turmoil may affect position sizing but not overall investor interest, he noted

(By Yvonne Yue Li)

More News

USA Rare Earth eyes $3 billion-plus funding to accelerate plans

February 03, 2026 | 02:34 pm

Gold, silver volatility to persist after price plunge, BofA says

February 03, 2026 | 12:53 pm

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments