Gold to overtake LNG, met coal as Australia’s second most valuable export

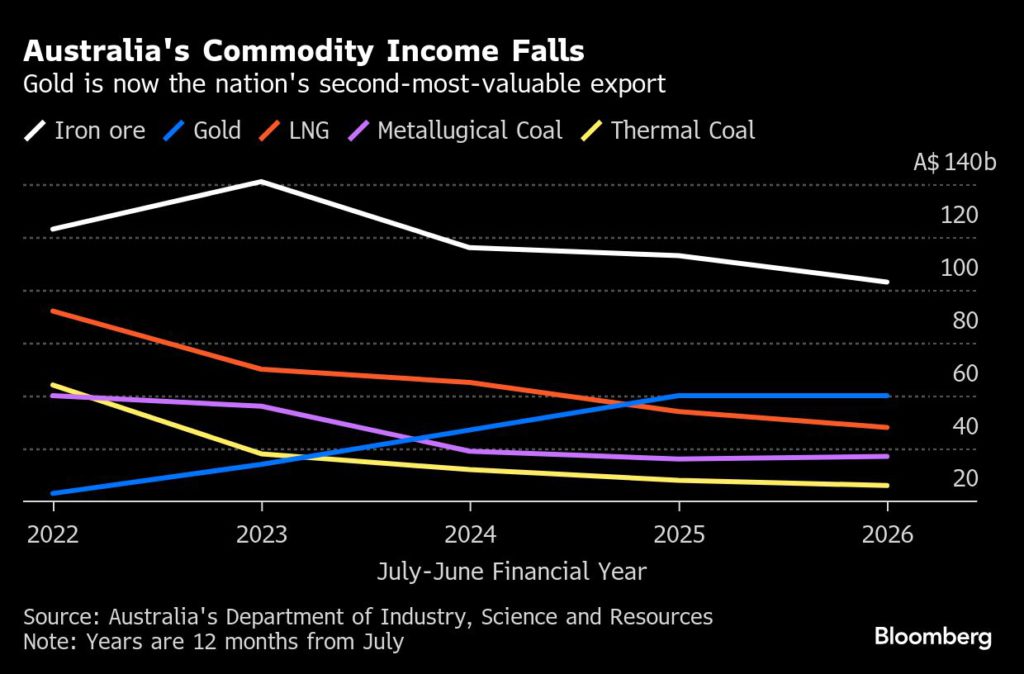

Gold will become Australia’s second-most-valuable commodity export, overtaking liquefied natural gas, after the precious metal’s “extraordinary surge” to record prices, the government said.

Revenues from bullion will jump to A$60 billion ($39.6 billion) in 2025-26 — the 12 month period to next June — up from A$47 billion in the prior year, and almost double the total two years ago, the Department of Industry, Science and Resources said in a report. The surge will partially offset expected revenue declines in other commodities, including iron ore.

Gold has punched to successive highs over the last 12 months — making it one of the top performing commodities — as central banks boost holdings, the Federal Reserve cuts US interest rates, and geopolitical instability lifts demand for havens. LNG, meanwhile, has softened, in part as crude oil has weakened, while metallurgical coal, another major export, has also dropped.

“The main driver of upward revisions to export values in 2025–26 has been the extraordinary surge in US dollar gold prices,” the department said in its quarterly snapshot. “The renewed strength in gold prices comes as US interest rates cuts occur — which lowers the opportunity cost of holding gold — and worries rise over the US fiscal outlook and the rate of US inflation.”

Australia is one of the leading gold producers, with output projected to rise from 340 tons in 2025-26, to 369 tons in the following period. Spot bullion hit a record above $3,977 an ounce on Tuesday, with prices up by more than half this year.

Total resource and energy export earnings, which includes iron ore, oil and gas, as well as metals such as lithium and copper, will total A$369 billion over the 12 months through to next June, about 4% lower on-year, it said. They are forecast to fall further to A$354 billion in 2026-27.

“Global economic uncertainty continues to weigh on other commodity prices and earnings,” the department said. Rising trade barriers — and uncertainty over the level at which such barriers will settle – are disrupting flows between the US and other nations and slowing investment in some sectors, it added.

Iron ore will remain the biggest earner, accounting for about a quarter of commodities revenue, worth A$113 billion in 2025-26. While volumes are projected to increase, prices are in decline as new mines come on line amid a glut of steel in the largest producer, China. Iron ore is seen averaging about $87 a ton, before easing slightly in the next financial year.

That outlook comes as major miner Rio Tinto Group prepares to ship its first cargo of iron ore from the SimFer mine at Simandou in Guinea, Africa. At full production, Simandou will deliver 120 million tons a year, though it will take years before the project hits that capacity.

(By Paul-Alain Hunt)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments