Goldman warns base metals rally at risk on weak Chinese demand

The rally in base metals this year could soon run into headwinds as soaring prices and bullish sentiment clash with the reality of softer demand from manufacturers, especially in China, according to Goldman Sachs Group Inc.

“The real producers on the ground, they start to respond negatively,” Trina Chen, co-head of equity research, said in a Bloomberg Television interview. “We’re seeing some pullback in demand.”

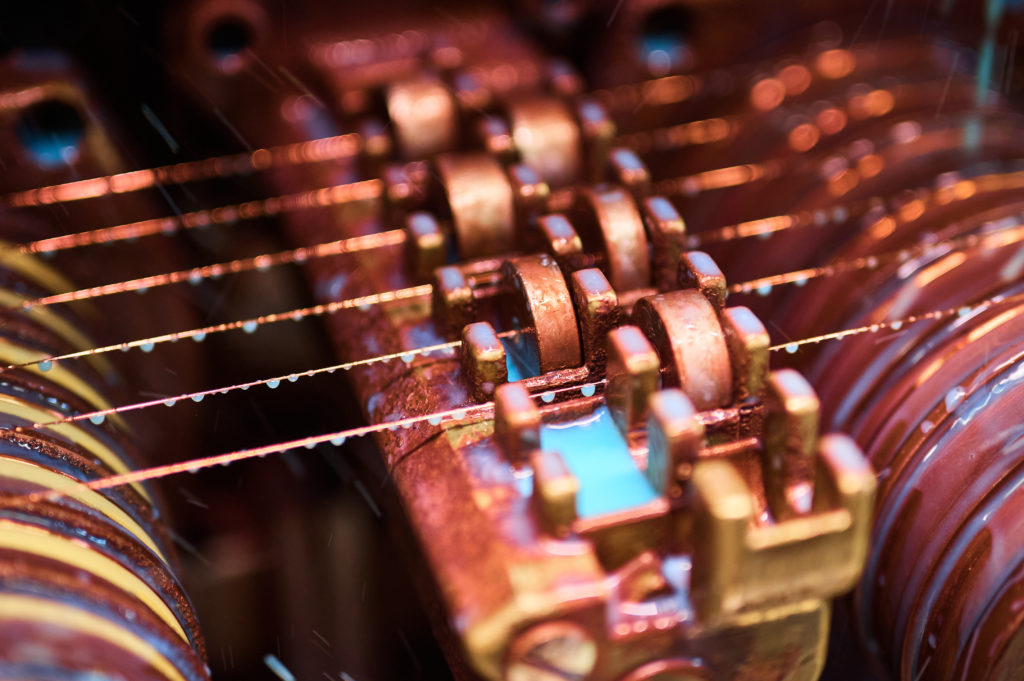

Metals from copper to aluminum have powered higher in the opening weeks of 2026, as global investors pile into industrial commodities in bets on tighter supply, a weaker US dollar, and Federal Reserve interest-rate cuts. Still, more cautious analysts have flagged weaker activity in China.

Goldman’s most recent survey of the copper market showed order books at fabricators had fallen by 10% to 30% as users in industries from consumer electronics to hardware pulled back, Chen said.

“Even grid orders are slowing,” she said, referring to electricity networks that are a mainstay of copper consumption in China, Asia’s largest economy.

The LMEX Index — a catch-all measure of the main six materials traded on the London Metal Exchange — has climbed by about 7% this year. That’s left the guage within touching distance of the record set in 2022.

Benchmark copper rose 0.6% to settle at $13,086.50 a ton on the LME, not far from the record set earlier this month. Aluminum notched a three-year high in London, other metals except lead advanced.

Read More: Chinese demand for copper vanishes after prices hit record

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments