Green revolution gets more expensive as copper price rallies

Look just beneath the surface of many of the technologies powering the energy transition and there’s a red metallic glint. Copper is a vital part of green infrastructure from grids to wind turbines, and a recent price surge threatens to make decarbonization more costly.

Copper has roughly doubled from the lows seen a year ago and was near a nine-year high at the start of the month. Amid predictions of a new commodity supercycle kicking off, many analysts say the top hasn’t yet been reached for a metal that’s core to the green energy drive. Even after a 3.2% drop Thursday, the price is still up more than 30% in the past six months.

Demand from renewable power generation, battery storage, electric vehicles, charging stations and related grid infrastructure accounts for about a fifth of copper consumption, according to Citigroup Global Markets Inc. With governments aiming for aggressive net zero emission targets in the coming decades, that means more clean electricity, a shift that’s likely to be copper-intensive given the $28.7 trillion grid build out required.

Part of that growth will come from the need to connect new renewable power plants with customers. That’s because it’s often cheapest to build such plants wherever the wind or sun resource is strongest, which could be in the middle of the sea or an isolated desert. But that then means a lot more cabling — using expensive copper — than a centralized grid needed in the past.

According to forecasts from BloombergNEF, the global power grid will grow by 48 million kilometers (30 million miles) by 2050. That’s enough to wrap around the circumference of the Earth nearly 1,200 times and equates to a doubling in copper demand to 3.6 million metric tons.

“Cities, electrification and copper go together,” said Sanjeet Sanghera, an analyst at BNEF in London. “Copper plays an important role.”

The metal is heavily used in underground cabling because of its conductivity, which is almost twice that of aluminum. That lowers the amount of energy needed to produce electricity.

A 240-kilometre electricity interconnector between Britain and France called IFA2 used 9,000 tons of copper, according to the U.K.’s National Grid Plc. A planned link to Denmark of 760 kilometres will require 26,000 tons.

In offshore wind projects, copper is still a relatively small component of costs, but that’s set to increase in the coming years, to about 3% by 2050 from 1% currently, according to BNEF.

Vestas Wind Systems A/S estimates that a 100-megawatt wind farm using 4.2 megawatt turbines would use around 89 tons of copper in the turbines.

If copper’s rally proves long-lasting and pushes up the cost of green investment, some wind farms may use cheaper aluminum where they can. Prices have risen less sharply compared with copper. Demand for aluminum in power grid infrastructure is estimated to reach 7.6 million metric tons by 2050, according to BNEF.

“We see copper remaining integral for interconnectors,” said Srinivas Siripurapu, chief innovation officer at cable manufacturer Prysmian SpA. “But for offshore wind farms, there’s a lot of indications that there will be a push more towards aluminum driven by overall costs.”

It’s not yet clear how much of an immediate impact copper’s price increase will have on the finances of green power operators. Turbine maker Siemens Gamesa Renewable Energy SA hedges raw materials prices a year ahead, protecting them for now.

The metal’s rally has been driven in large part by investors who see demand soaring as the green revolution gathers pace. But their early optimism may end up pushing up costs for governments as they start putting infrastructure spending packages to work.

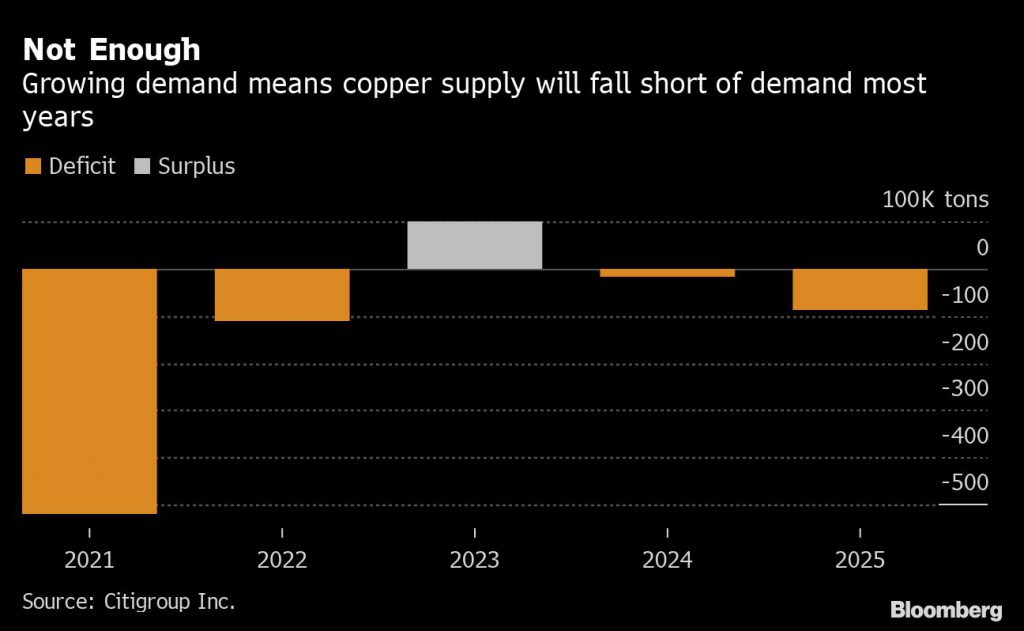

Higher copper consumption for decarbonization could drive annual demand growth of as much as 3%, said Max Layton, managing director for Commodities Research at Citigroup Global Markets Inc. That will add to periods where supplies fall short, with upside potential for prices.

While elevated prices mean companies have an incentive to ramp up investment in mining, which would help supplies, the downside is the length of time it takes to get projects up and running.

“If this price level holds, we should see announcements of new projects coming in the market,” Raul Jacob, chief financial officer of Southern Copper Corp., said in an interview Monday. But the lags from decision to production will make the price cycle “a little bit longer than in the past.”

(By Rachel Morison and William Mathis, with assistance from James Attwood and Mark Burton)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments