Investors place bets on Trump team’s next investment target

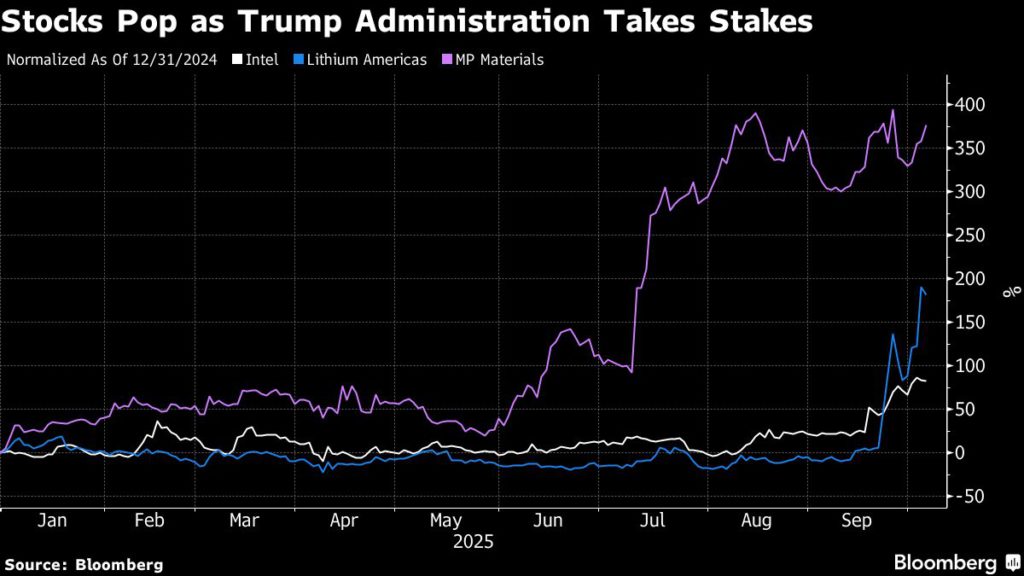

First it was a $400 million stake in MP Materials Corp., a little-known miner of rare earth materials. Next, a $10 billion investment in embattled chipmaker Intel Corp. Then another slug of shares in Lithium Americas Corp., which has aspirations of producing lithium in the US.

Each investment by the Trump administration sent the target company’s shares soaring by double digits. And now, investors are wondering, who’s next?

The moves by the federal government to bolster some American businesses have sparked a cottage industry, where investors scour lists of companies in industries deemed critical by President Donald Trump, from minerals miners to chip makers to drug firms. Really, any publicly traded company that gets government grants is under scrutiny.

Some bets have already been placed. Critical Metals Corp. shares soared Monday after a report the lithium company was in talks with the US government over a potential stake. USA Rare Earth Inc. shares jumped Friday after a similar rumor.

“All of a sudden, you’re going to have investors front-running the potential for the government to come in and basically either take a stake or provide loans to companies or grants,” said Brooke Thackray, a research analyst with Global X Investments.

With good cause. Lithium Americas shares have nearly tripled since the Defense Department plowed $2.3 billion into a loan for it. Intel Corp.’s stock was resuscitated – now up 82% this year – after Trump forced it to turn a $10 billion federal grant into a 10% equity stake. And when the federal government agreed to buy $400 million in shares of MP Materials, the stock soared 376% for the year.

The Trump administration says the capital injections are needed to ensure America has domestic producers of materials and products used to make modern weaponry, artificial intelligence products and infrastructure, and power generation equipment. Trump has talked openly about establishing a sovereign wealth fund that would champion certain American manufacturers, tech providers and heavy industry companies.

With potentially billions at its disposal and hundreds of billions more in the form of government contracts and grants, a US federal government operating so forcefully in the market can make fortunes for investors able to suss out its next target.

“Investors have to ask ‘who’s next?’ because the stocks are moving fantastically on this news no matter what the actual details are of these announcements,” said David Deckelbaum, analyst with TD Cowen, who covers a handful of the stocks that have seen these big moves, including Lithium Americas and MP Materials.

Guessing obviously comes with its own perils. A spokesperson for the White House said Monday that the US is not considering an equity stake in Critical Metals. The stock pared gains by more than half to 45% — still a good trading session, but short of the 109% gain it enjoyed earlier.

Late Monday, shares in Vancouver-based Trilolgy Metals Inc. more than doubled after the White House said the US government will take a 10% stake in the company, which had a $343 million market value as of Monday’s close.

To Decklebaum, the speculative nature of these share moves recalls the meme stock frenzy that gripped the market during the Covid-19 pandemic. Then, most of the gains quickly evaporated, which he worries could occur for miners if either the US government’s investments don’t come to pass or fail to help the companies build out.

“This is more speculation than anything else at this point,” he said in a phone call. “The retail crowd, especially, is going to follow flows and momentum. And once the momentum stalls, you know, you can obviously see an opposite reaction,” Deckelbaum said.

There are more names being tossed around on Wall Street.

But Trump’s push to have US access to critical materials isn’t limited to American companies. Rumors abound on Toronto’s Bay Street, the financial hub where shares of Canadian miners and energy producers change hands. Meetings have also taken place between several Australian mining firms with officials from various US agencies, according to people familiar with the talks.

Ramaco Resources Inc., a metallurgical coal producer that has some critical minerals resources, and Energy Fuels Inc., owner of US-based uranium mines, are among the companies that have been named as likely candidates by analysts. Toronto-listed Nouveau Monde Graphite Inc. is also on watchlists, since graphite is considered a critical mineral and much of the world’s supply is based in China. Further afield, Australia’s Iluka Resources Ltd. and Lynas Rare Earths Ltd. have also seen shares rise on speculation the US government is kicking the tires.

Purveyors of exchange traded funds have benefited from the newfound interest in minerals miners. The Sprott Critical Minerals ETF, for example, saw a record month of inflows in August, followed by its second-best month in September. The fund, which has now seen 20-straight months of positive net inflows, has risen 77% this year.

“All of these events have been catalysts for moves higher, even if it’s for a short period of time,” said Steve Schoffstall, director of ETF product management at Sprott Asset Management.

Schoffstall said the US government taking direct stakes in companies represents a “step past the rhetoric” of needing to build out a specific industry in the country, or speeding up permitting, to something that tries to catalyze the sector’s growth.

(By Geoffrey Morgan)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments