Japan seeks support as fears rise over China’s rare earth grip

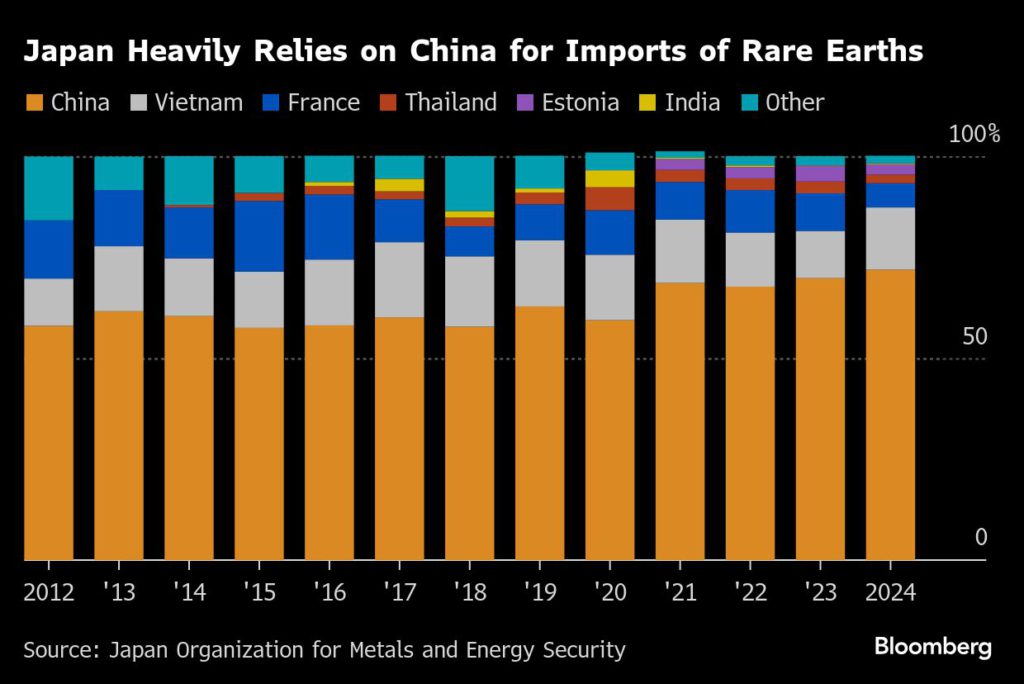

Japan is ramping up efforts to reach out to its Group of Seven peers and beyond amid mounting concerns over China’s grip on rare earths as the dispute with Beijing escalates.

Japanese Finance Minister Satsuki Katayama said she will meet with counterparts of other industrialized democracies to discuss critical minerals during a trip to the US starting Sunday, while Defense Minister Shinjiro Koizumi is also set to hold talks with his US counterpart on Thursday. At home, Prime Minister Sanae Takaichi will be holding a summit with South Korea’s Lee Jae Myung next week to reaffirm the alliance between the two key US allies.

“The fundamental consensus among the G-7 nations is that it is unacceptable for countries to secure monopolies through non-market means,” Katayama told reporters on Friday, referring to China’s past actions regarding critical minerals. “This poses a crisis for the global economy and is extremely problematic for economic security.”

Tensions have continued to rise between Asia’s two biggest economies, dragging out a dispute that began in early November, when Takaichi made comments that suggested Japan could deploy its military if China uses force to try and seize Taiwan. Following this week’s actions from China, from new export restrictions that may impact rare earths to an anti-dumping probe into a key chip-making material, Japan appears to be trying to reach out to its allies in a bid to strengthen its footing.

Earlier Friday, Japanese Chief Cabinet Secretary Minoru Kihara called for smooth shipments of rare earths and food, following reports that Beijing is hindering trade on those goods. Kihara declined to comment on individual transactions by private companies, but he said Japan is monitoring developments closely and will act appropriately as needed.

“I believe international trade in rare earths should proceed smoothly, and I consider this to be extremely important,” Kihara said at a press conference. “China’s export control measures on rare earths and other materials have been ongoing for some time and are having a serious impact on the global supply chain.”

China has begun choking off exports of rare earths and rare earth magnets to Japan, the Wall Street Journal reported earlier, citing two exporters in China. A Japanese company that imports rare earths from China hasn’t been informed of any halt in export application procedures at least from Thursday to noon on Friday, according to a person familiar with the situation.

The impact of China’s latest move is still unclear, but existing export controls have already lengthened the time required to procure rare earth magnets, said Hiroshi Yamada, president of Tokyo-based Sanshin Kinzoku Kogyo Co., which manufactures and sells magnetic equipment. Neodymium magnets in particular have been affected, with procurement lead times growing to three to four months, instead of the usual one to two, he said.

While customs approvals have not halted for Chinese rare earths, processing times have gradually lengthened since the end of last year, according to a person familiar with the sourcing operations at a Japanese electronics components maker. The manufacturer has secured roughly six months’ worth of inventory in anticipation of the delays, the person said, asking that the company not be named.

Applications for export approvals of rare earths remain in play as of Friday morning, according to a representative of another company that sources rare earths from China.

Katayama said she will confirm with Japan’s customs about transactions with China.

This week, China announced new export controls on dual-use items that could enhance Japan’s military capabilities, and launched an anti-dumping investigation into Japan’s production of dichlorosilane, a key chip-making material. Japan has also protested China’s deployment of a mobile drilling vessel in the East China Sea.

It’s hard to assess the impact of the fresh curbs on dual-use items whose content remains largely unclear, according to Japan’s Trade Minister Ryosei Akazawa. He added that China’s curbs on rare earths, which are used in various products such as cars and electronics, have been in place since April last year and affected Japan’s various industries causing some to adjust production.

“We are currently scrutinizing the impact on Japan’s economy,” Akazawa said Friday. “We intend to take necessary measures in a resolute and calm manner, after comprehensively considering the situation from various perspectives.”

Meanwhile, Takaichi is set to meet South Korea’s Lee on Tuesday and Wednesday in the premier’s home prefecture, followed by Italian Prime Minister Giorgia Meloni’s visit to Japan between Jan. 15-17.

“The importance of Japan-South Korea relations and Japan-South Korea-US cooperation has increased significantly,” Kihara said. “Both governments have agreed to engage in close communication, including shuttle diplomacy, to ensure the stable and forward-looking development of Japan-South Korea relations. We expect this visit to Japan to be an important opportunity for that.”

(By Yoshiaki Nohara and Erica Yokoyama)

More News

Contract worker dies at Rio Tinto mine in Guinea

Last August, a contract worker died in an incident at the same mine.

February 15, 2026 | 09:20 am

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments