Key LME copper spread spikes to highest level since 2021 squeeze

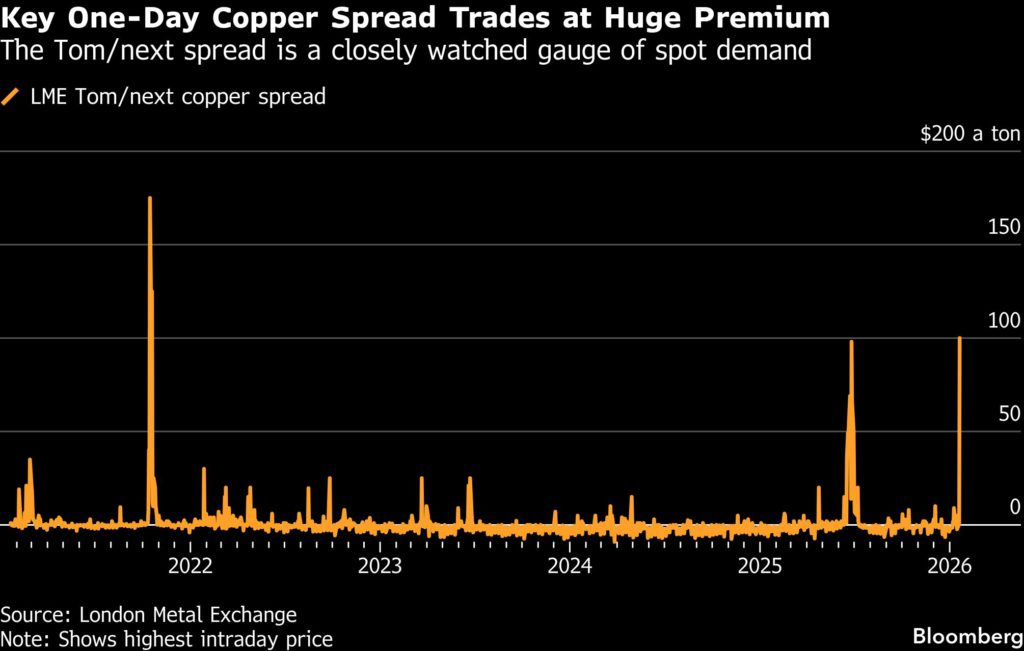

Spot copper prices surged to trade at a huge premium over later-dated futures on the London Metal Exchange, with a closely watched one-day spread reaching levels not seen since an historic supply squeeze in 2021.

Copper contracts expiring Wednesday briefly traded at a $100 premium to those expiring a day later, in a structure known as backwardation that typically signals rising spot demand. The so-called Tom/next spread was at a narrow discount on Monday, and the spike was among the largest ever seen in pricing records starting in 1998.

The surge creates a fresh bout of turmoil in the LME copper market, after a breakneck rally that lifted prices to record highs above $13,400 a ton earlier this month. Traders have been piling into the market as mines have faltered and a surge in shipments to the US has drained copper supplies elsewhere, while many investors are betting on a jump in demand to power the burgeoning artificial-intelligence industry.

The Tom/next spread is closely watched as a gauge of demand for metal in the LME’s warehousing networking, which underpins trading in its benchmark futures contracts. The advance came ahead of the expiry of the LME’s main January contracts on Wednesday, with the Tom/next spread providing a final opportunity to trade those positions.

Data from the LME showed that there were three separate entities with long positions equal to at least 30% cumulatively of the outstanding January contracts as of Friday, and if held to expiry the positions would entitle them to more than 130,000 tons of copper — more than the amount that’s readily available in the LME’s warehousing network.

Holders of short positions, meanwhile, would need to deliver copper to settle any contracts held until expiry, and the spike in the Tom/next spread exposes them to hefty losses if they look to roll them forward instead. The move to $100 a ton took the spread to the highest level since a major supply squeeze in 2021, which prompted the LME to roll out emergency rule changes to maintain an orderly market.

Structural constraints

The Tom/next spread often flares into backwardation in the run-up to the expiry of monthly contracts, but such extremes are a rarity — partly because the LME has rules in place that force large individual holders of long positions to lend them back to the market at a capped rate.

The spread had earlier been trading at a premium of $65 a ton, which equates to 0.5% of the prior day’s official cash price. That’s the maximum level participants can lend at if they hold positions in inventories and spot contracts that are equal to between 50% and 80% of readily available stocks. The spread later fell in the final minutes of trading, and closed at $20 a ton at 12:30 p.m. London time.

While the Tom/next spread is highly volatile, copper’s broader price curve is also signaling more structural supply constraints in the broader copper industry, with backwardation seen in most monthly spreads through to the end of 2028. Many analysts and traders expect the market to be in a deep deficit by then, in a trend that could drain global inventories and push prices sharply higher.

Global inventories are at sufficient levels for now, but much of the stock is held in warehouses in the US, after traders shipped record volumes there in anticipation of tariffs. The once-in-a-lifetime trading opportunity was fueled by a surge in copper prices on New York’s Comex exchange, but the recent spike in spot prices on the LME has left US futures trading at a discount.

This week, there have been small deliveries of copper into previously empty LME warehouses in New Orleans, and the surge in the Tom/next spread could incentivize further deliveries into US depots. Data from the LME shows that there were about 20,000 tons of privately held copper that could be readily delivered into New Orleans and Baltimore as of Thursday, while more than 50,000 tons were also held off-exchange across Asia and Europe.

LME copper inventories rose by 8,875 tons to 156,300 tons on Tuesday, driven by deliveries into warehouses in Asia and a small inflow in New Orleans. The turmoil in price spreads had little impact on the LME’s benchmark three-month contract, with prices falling 1.6% to settle at $12,753.50 a ton as US President Donald Trump’s push to take control of Greenland sparked a broad selloff in stock markets.

(By Mark Burton)

More News

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments