Lithium may get much-needed demand boost from battery storage

Lithium bulls are betting on energy storage systems as the next meaningful pillar of demand for the battery metal, nudging the global market back toward balance after years of oversupply.

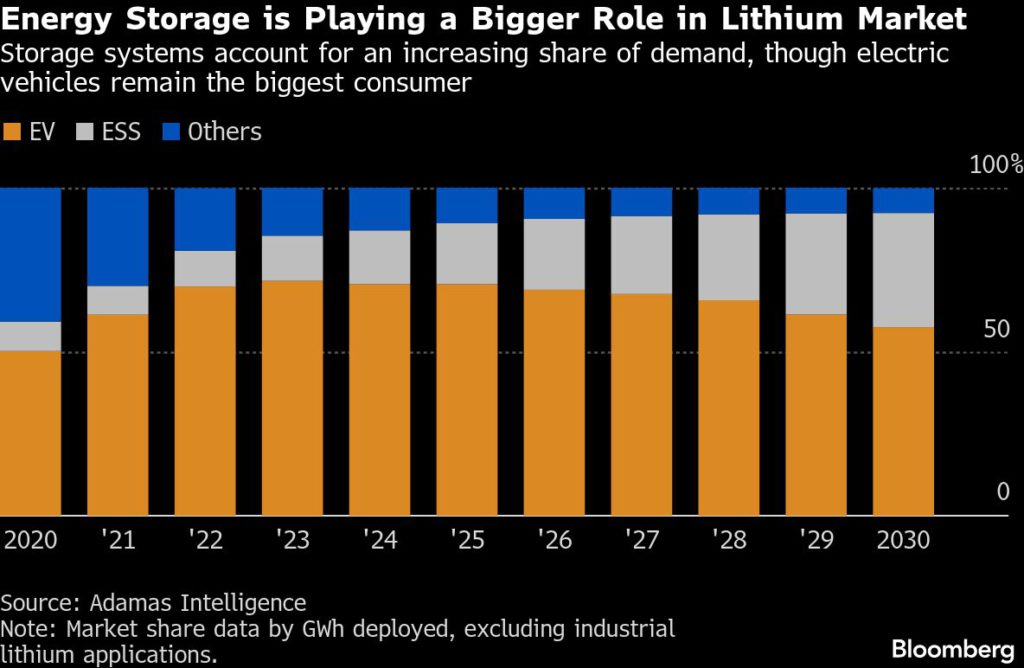

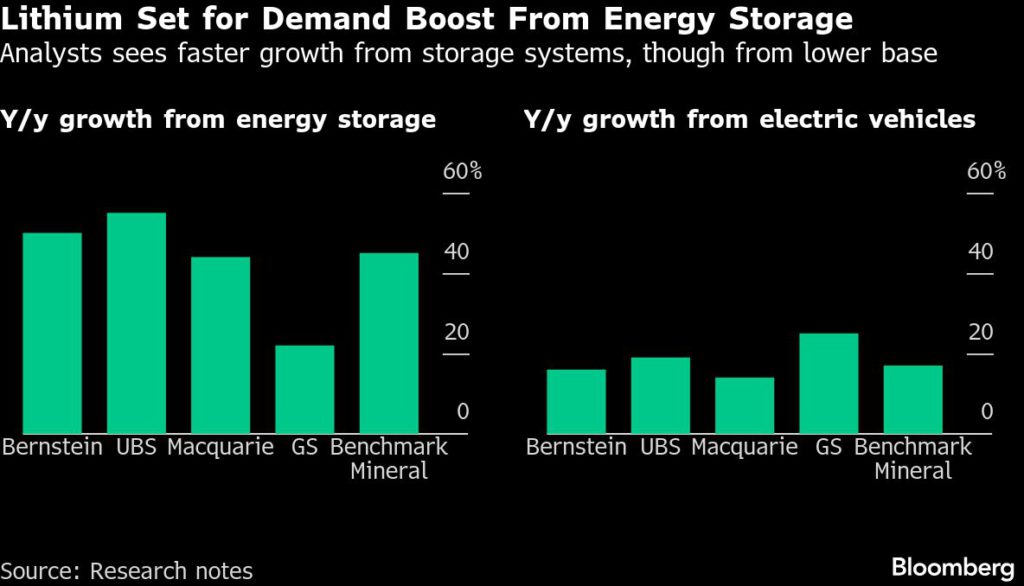

Giant utility-scale batteries, which absorb and store electricity for controlled release, are an increasingly important consumer of lithium. Though electric vehicles remain by far the biggest user of the metal, many analysts see demand from these storage systems rising at a faster clip than EV growth in 2026. Citigroup Inc., UBS Group Inc. and Bernstein even see that expansion helping to tip the global market into a deficit next year.

The relative maturity of EV adoption means growth in energy storage “remains the largest swing factor” for battery-cell production — and therefore lithium demand — in 2026, said Chris Williams, an analyst at industry consultancy Adamas Intelligence.

The global lithium market has suffered from a supply glut over the last three years, with EV demand growing at a slower rate than expected and lagging the addition of new mine capacity. Spot prices have swung wildly this year and – despite recovering some 50% from a four-year low in June – they’re still less than a sixth of where they were in late 2022.

The EV sector, while still expanding, has been challenged by a maturing Chinese market and uncertain sales prospects in the US, where President Donald Trump has moved to relax stringent fuel-efficiency standards as part of his plan to wind back incentives for EV production. Western automakers have also been rethinking their strategies.

Battery storage, meanwhile, is becoming a significant demand driver for lithium. For one, the cost of building utility-scale batteries has declined in recent years. These improving economics, as well as policy mandates to integrate more clean energy, are helping with the scale-up. The construction of massive new data centers is a tailwind too, given their need for stable and plentiful supplies of electricity to smooth out peaks in power demand.

China is on track to exceed its new target of 180 gigawatts of cumulative energy storage capacity by 2027, while in the US such storage systems are seen as “an attractive solution to address growing electricity supply-demand imbalances,” the UBS analysts said. Demand for lithium from the sector could rise 55% next year versus growth of just 19% from EVs, their data showed.

Other industry watchers are more circumspect. “We’re still predicting supply outpaces demand growth next year,” said Martin Jackson, head of battery materials markets at consultancy CRU Group, adding that some of the optimism was “dangerously inflated.” The number of cells being manufactured for storage systems is “immensely out of step” with the rate of installations, he said.

China announced last month it would accelerate its adoption of policies designed to curb excessive competition in the battery industry. Despite a rise in the amount of storage capacity installed, Beijing’s closer supervision of the industry and the overproduction of cells means demand growth for lithium “is likely to be choppier and probably softer in 2026–27 than the headlines suggest,” said Iola Hughes, head of research at Benchmark Mineral Intelligence Ltd.

In terms of supply, new mining capacity has been touted in China, Australia, Argentina and several African countries, while uncertainty persists over production at a mine in China’s Jiangxi province run by Contemporary Amperex Technology Co., the world’s biggest EV battery maker.

But executives from other Chinese producers have issued bullish comments in recent weeks. Jiang Anqi, chair of Tianqi Lithium Corp., said she sees a balanced market in 2026, citing energy storage as one reason for this. Ganfeng Lithium Group Co. vice president He Jiayan said the energy storage boom had exceeded expectations.

Supply curtailments, combined with robust demand, have helped shift the market toward a more balanced situation, the Bernstein analysts said. This year “represents the bottom,” they wrote in a note, “and we anticipate the lithium market tightening through 2026 and 2027.”

(By Annie Lee)

More News

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments