Lithium swings from glut to scarcity on Asia demand, Traxys says

One of the world’s biggest lithium traders is seeing a turnaround in the battery metal market as accelerating demand ends a glut that dragged down prices.

“We see a very healthy Asian demand and an under-supplied market at this point in time,” said Martim Facada, managing director for lithium trading at Luxembourg-based Traxys. “We think the market has legs to keep going up.”

Lithium is emerging from a period of oversupply after record-high prices spurred supply growth at a time of disappointing demand. The ensuing price slump prompted some projects to be idled — and they’ll take time to restart, even as prices recover on strong electric vehicle and energy storage demand.

“A lot of money was lost across different parts of the supply chain,” Facada said in an interview. “We’re turning the corner now.”

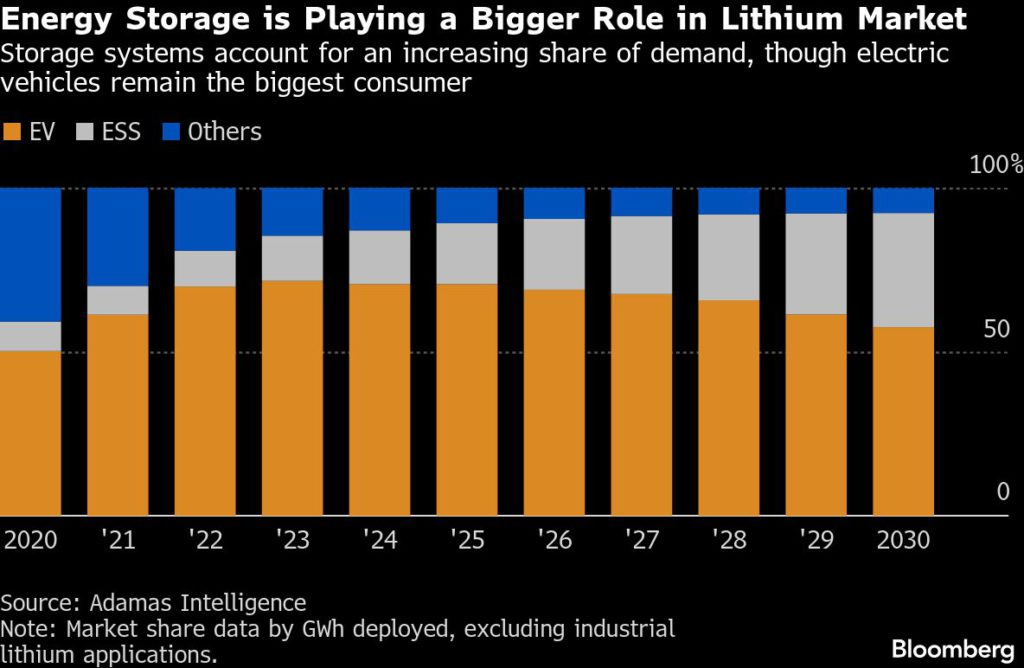

He expects EV penetration in China to climb to 60% to 70% this year, calling that a “huge” boost for demand. That compares with slightly more than 50% currently. While EVs remain the dominant consumer of lithium, energy storage that balance grids are becoming an increasingly important source of growth.

Chinese lithium prices have more than doubled from last year’s lows, though they remain more than 70% below a late-2022 peak.

Traxys recently signed an agreement to buy lithium from Lilac Solutions Inc.’s Great Salt Lake project in Utah, where production is slated to begin in early 2028. Besides offtake, the trading house may also contribute part of the roughly $300 million Lilac is seeking to raise.

Lithium carbonate from the project is earmarked for sale domestically, according to Facada and Lilac chief executive officer Raef Sully, who spoke in the same interview.

“Even though US EV subsidies have rolled off and we’re not seeing the same pace of fully electric vehicle growth domestically, the global outlook for lithium and batteries remains very strong,” Sully said.

(By James Attwood and Yvonne Yue Li)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments