Lithium trading hits record on CME as funds seize budding market

Trading of CME Group Inc.’s nearly three-year-old lithium hydroxide futures contract is soaring, with more funds crowding into the budding market as prices of the battery metal falter.

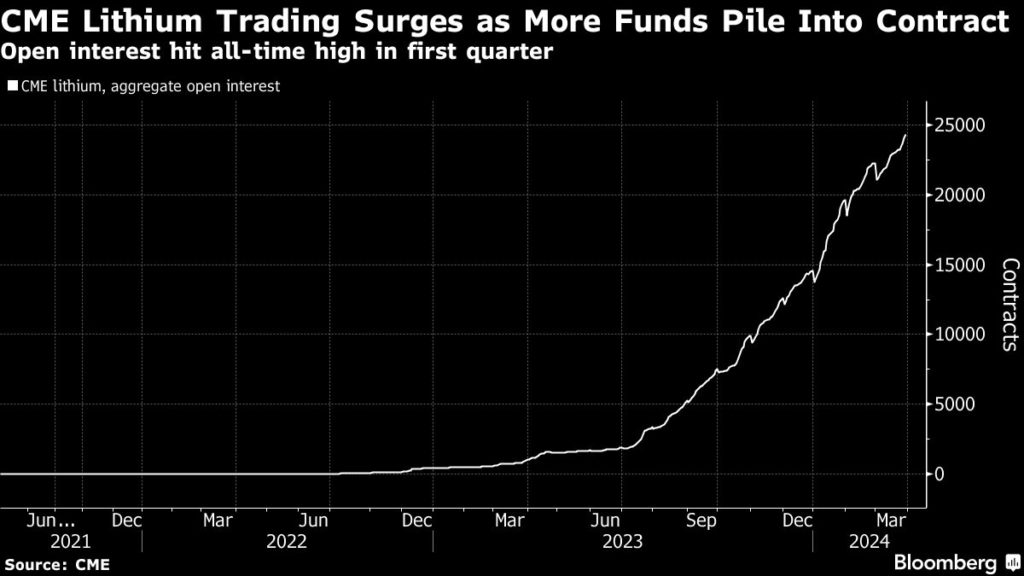

The number of outstanding contracts hit a record high of 24,328 in the first quarter, and open interest extends to September 2025 — an indication of more liquidity for the nascent contract, according to the US bourse. The number of futures changing hands in the quarter was close to the trading volume for all of last year. CME, one of the world’s largest commodity exchanges, introduced its contract for lithium hydroxide — a chemical form of the battery metal — in May 2021.

This year’s growth in open interest builds on the robust liquidity of 2023, which was driven by the arbitrage trade between China and the US. The Asian nation launched a lithium carbonate contract on the Guangzhou Futures Exchange last July.

The surge in open interest is a positive sign that the market is gradually maturing for the lithium industry, which is still evolving compared to other metals such as copper and aluminum. A well-developed derivatives market is crucial for commodities since it lets producers, merchants and end-users hedge against volatility in the spot market. At the same time, hedge funds and other financial players can also trade on volatility and price spreads to make profit.

“We expect to see more end-users and physical market participants enter into these markets” as open interest continues to grow, said Jin Hennig, global head of metals for the Chicago-based exchange.

The increasing liquidity of CME’s lithium hydroxide contract is a bright spot in an industry that has been facing headwinds. Prices of the white, silvery metal are down more than 80% from the record high in November 2022 as the market whiplashed from shortage fears to a mountain of surplus inventories. The price collapse has created havoc among producers, with stalled projects, scrapped deals and output cuts.

The drop in lithium prices has flipped the market into a contango — when futures prices are higher than spot. This change has created opportunities for funds.

The rise in open interest gives “assurance” to funds and financial participants that they can trade the contract fairly easily, moving in and out of positions if price direction moves against them, said Leon Hoffmann, a broker at SCB Environmental Markets in Switzerland, adding that more Asia-based funds are trading the CME contract this year. “We also see funds that are active in metals now adding lithium to their suite of trade.”

CME’s lithium contract is already on pace to shatter last year’s record trading volume. The number of contracts changing hands reached 20,101 in the first three months of this year, according to the exchange, just shy of the 20,307 traded in all of 2023.

(By Yvonne Yue Li)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments