LME WEEK: US aluminum price rise spurs deliveries from Canada

Canadian aluminum producers have increased deliveries to the United States in recent weeks as US prices on the physical market have risen to reflect the 50% import tariffs imposed by President Donald Trump earlier this year, analysts said.

The tariffs levied in June aimed to boost domestic aluminum production and encourage investment in capacity for the metal used in the power, construction and packaging industries.

Initially, Canadian producers diverted their aluminum to Europe. But that flow is reversing as the aluminum inventories, which had provided a buffer for US consumers, have shrunk.

Not ‘full pace’ yet

“There is some revival in aluminum deliveries to the US but we have not reached full pace yet,” Jean Simard, CEO of the Aluminum Association of Canada, told Reuters.

Simard was referring to the trade flows in September and October that have yet to appear in public customs data.

Imports of aluminum from Canada at 2.7 million metric tons last year amounted to 70% of total shipments to the United States, according to information provider Trade Data Monitor.

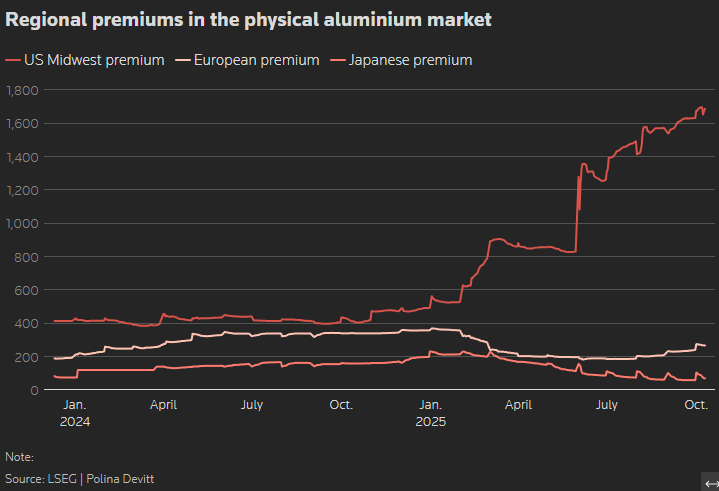

Aluminum consumers buying on the physical market pay the London Metal Exchange price, around $2,750 a ton, plus the Midwest premium to cover taxes, freight and handling costs.

The premium hit a record $0.77 per lb. or $1,697 a ton, on October 6, a rise of 250% since January.

“The US Midwest premium is effectively fully pricing in that 50% tariff,” BNP Paribas analyst David Wilson said.

Reduced pressure from Canadian aluminum has in turn led to a rise in the European duty-paid aluminum premium, which at $266 a ton has jumped 46% since June.

Canada’s exports of unwrought aluminum to the US fell by 22%, or by 410,600 tons, year-on-year to 1.4 million tons in January-to-August, according to the Trade Data Monitor.

Its data showed that in August, 123,474 tons were delivered to the US from Canada, down 51% from March.

Meanwhile, Canada’s aluminum deliveries to Europe jumped 94% to 189,320 tons in the first eight months of 2025. In the US, aluminum stocks in Comex warehouses at 7,661 tons are down 73% since January.

“Without new trade agreements, there’s room for further increases in the Midwest premium,” said Edgardo Gelsomino, head of aluminum research at Wood Mackenzie.

(By Polina Devitt and Ashitha Shivaprasad; Editing by Pratima Desai and Barbara Lewis)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments