Mercuria pares vast aluminum bet that’s roiled market for months

Mercuria Energy Group has pulled back from a giant aluminum trade that drew scrutiny from the London Metal Exchange, according to people familiar with the matter.

The energy trader had built up a huge position in aluminum on the LME earlier this year, in part as a bet that a peace deal to end the war in Ukraine could lead to a relaxation of sanctions against Russian metals.

But in recent weeks Mercuria has relinquished the majority of its dominant position in aluminum inventories on the LME, according to the people, who asked not to be identified because of the commercial sensitivity of the matter.

The aluminum market has been rocked by the arrival of Mercuria and other large energy traders this year, with their efforts to scoop up inventories threatening to crimp availability for other buyers. Spot prices have softened relative to futures as Mercuria has trimmed its position in recent days, in a sign that supply conditions on the LME are improving.

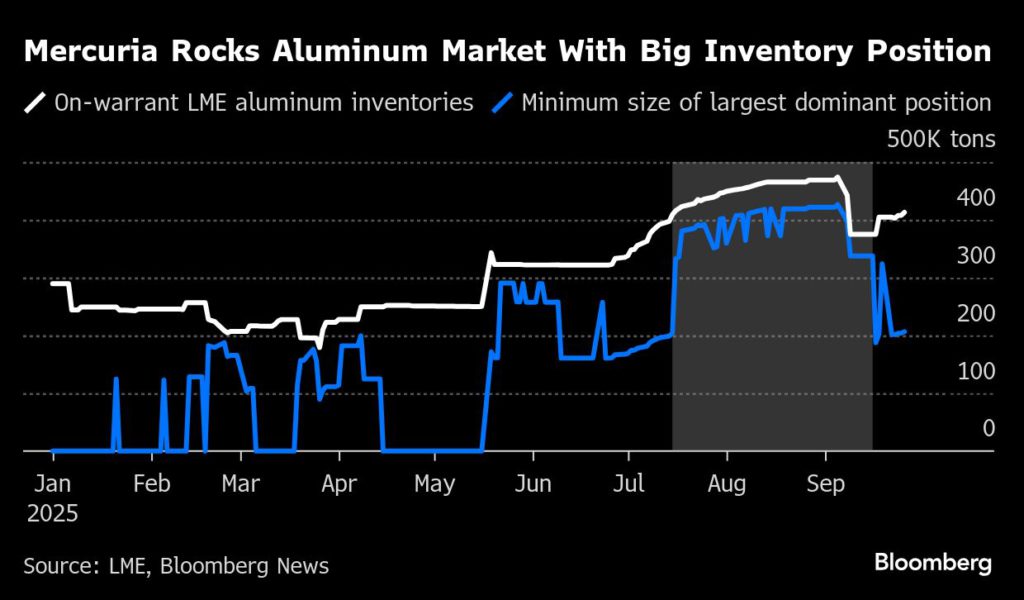

Data from the LME show that one trader consistently held over 80% of the available stocks of aluminum from mid-July until mid-September; that trader was Mercuria, the people said.

However, since mid-September, the position has shifted, with Mercuria releasing much of the Russian inventory it was holding, and maintaining a position principally in non-Russian aluminum, the people said. According to exchange data, 228,000 tons of the aluminum on the LME was of Russian origin as of the end of August, with almost all of the remaining 241,000 tons being Indian.

The move means that Mercuria is no longer a dominant holder of aluminium inventories, with its position now below levels that would require disclosure to the LME. Last week, exchange data briefly showed two large positions in inventories and nearby contracts, and since then one trader has held a position equivalent to 50-80% of LME stocks. The remaining dominant position is held by rival trader Trafigura Group, not Mercuria, the people said.

Representatives for Mercuria, Trafigura and the LME declined to comment.

Mercuria built up its position earlier this year, arguing publicly that any easing of sanctions against Moscow could drive up the value of Russian metal, which in turn would cause exchange inventories to be drawn down. Russian aluminum makes up a large share of LME inventories, but it has been shunned by many consumers during the war.

However, hopes of a peace deal have foundered recently, with US President Donald Trump this week suggesting that Ukraine could retake the parts of its territory lost to Russia.

Mercuria’s trade has dominated discussions in the aluminum market, and prompted intervention from the exchange. At the same time as it took a dominant position in LME inventories, it also built up an unusually large long position in the LME’s monthly contracts. Amid fears of a possible market squeeze, the LME formalized a new rule forcing traders to reduce outsized positions in the nearby month’s contract.

The key cash-3 month aluminum spread fell into contango this week for the first time in over a month, a sign of easing competition for inventories. LME data show no positions larger than 20% of open interest in aluminum for the next two months, although in December one trader has a long position equivalent to 20-30% of open interest, while another trader has a short position equivalent to 30-40% of open interest.

Many traders continue to believe the long-term trend is towards a tighter aluminum market, as Chinese production approaches a capacity cap set several years ago by Beijing. Mercuria was behind cancellations of about 100,000 tons of largely Indian metal in Port Klang in September, the people said, as it draws on exchange inventories to meet demand from physical consumers of the metal.

(By Jack Farchy and Mark Burton)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments