Nickel price extends drop amid lack of detail on Indonesia output cuts

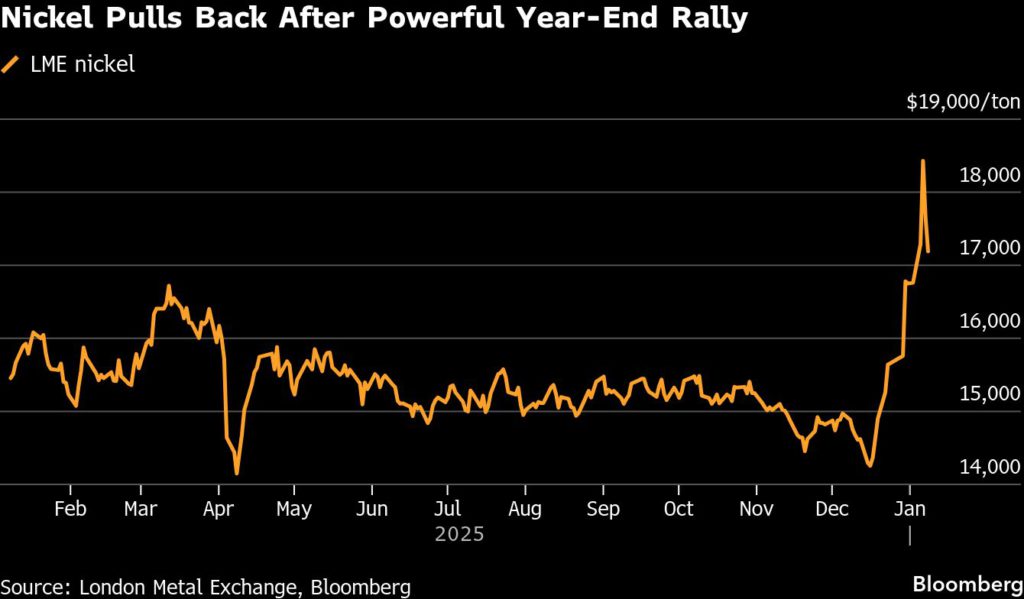

Nickel fell further from a 19-month high after Indonesia didn’t provide details on its pledge for output cuts, which had earlier fueled a sharp rally.

Three-month futures declined as much as 5.9% on the London Metal Exchange. Prices had surged as high as $18,800 a ton on Wednesday — the highest since June 2024 — as investors bet on risks to output in top supplier Indonesia, but the metal ended the day 3.4% lower.

Indonesia has flagged plans to reduce production this year to improve the balance between supply and demand. The Energy and Mineral Resources Ministry didn’t provide any details on this year’s nickel mining quota at a Thursday press briefing, with Minister Bahlil Lahadalia saying the figures are still being finalized.

Nickel — used in batteries and stainless steel — has surged about 20% since mid-December, joining a rally in copper and aluminum. The metals have been buoyed by a wave of buying from Chinese traders, as well as heightened geopolitical concerns.

The sustainability of nickel prices “remains uncertain, unless quota reductions are implemented in a meaningful and consistent manner,” Benyamin Mikael, an analyst with UOB-Kay Hian Holdings Ltd., said in a note. The impact of the planned quota cuts is likely to be limited in the near term as “most committed investments are largely exempt for the next one to two years.”

Nickel settled 4.1% lower at $17,155 a ton on the LME as of 5:52 p.m. London time. Most other metals also settled lower, with copper falling 1.4% to close at $12,720.50 a ton.

Read More: China’s metals in grip of frenzy as investors bet on rally

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments