Nickel price spikes more than 10% as Chinese buying fuels metals surge

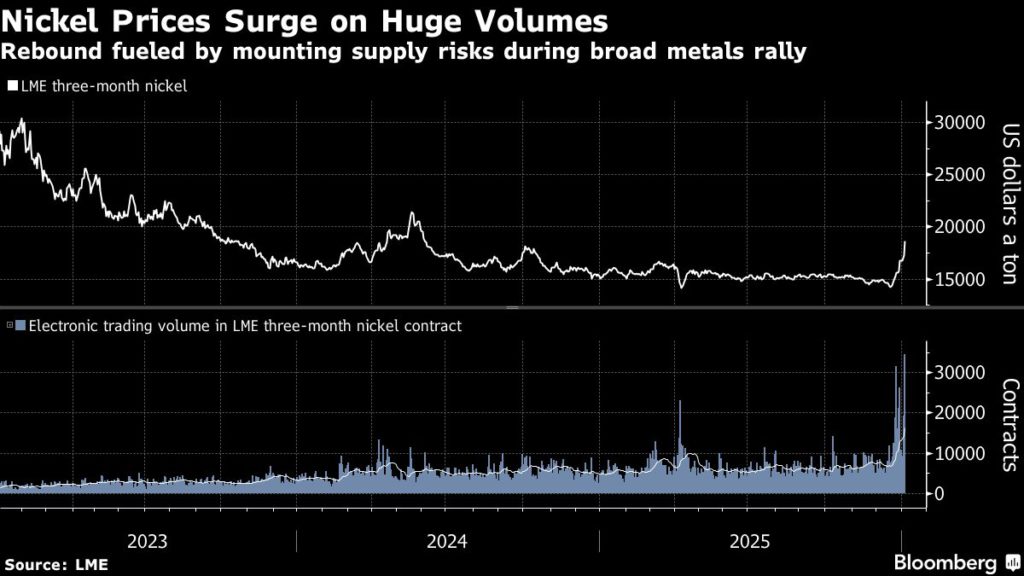

Nickel spiked by more than 10% in London, notching the biggest gain in more than three years as surging investor interest in China helps to turbocharge a broad rally in metals markets.

Prices for the metal used in batteries and stainless steel hit a high of $18,785 a ton on the London Metal Exchange, extending a scorching run that has lifted prices nearly 30% since mid-December. While the nickel market is heavily oversupplied, mounting risks to production in top supplier Indonesia have helped shore up sentiment, alongside a broad-based flood of investment in China’s domestic metals markets.

It’s a stark reversal of fortune for a metal that has been plagued by excess output from Indonesia and weaker-than-expected usage in electric-vehicle batteries. It also marks a revival for the LME’s nickel contract, after volumes collapsed in the wake of a historic short-squeeze in 2022.

Trading dynamics signal that Chinese investors have been influential in driving prices for metals including nickel, copper and tin sharply higher this week, with LME prices jumping in high-volume trading during Asian hours, and rallying again when the night-trading session got under way on the Shanghai Futures Exchange.

Base metals have seen a strong start in 2026, with the LMEX Index that tracks the six main metals surging to the highest level since March 2022, when the sector peaked. Copper has racked up a gain of more than 20% since late November, while aluminum has rallied to the highest level since April 2022.

Copper extended its rally this week after bursting past $13,000 a ton for the first time as investors bet on tighter supply and a risk-on mood took hold in broader financial markets. Three-month LME futures surged as much as 3.1% to a fresh record of $13,387.50 a ton on Tuesday, surpassing a peak set on Monday.

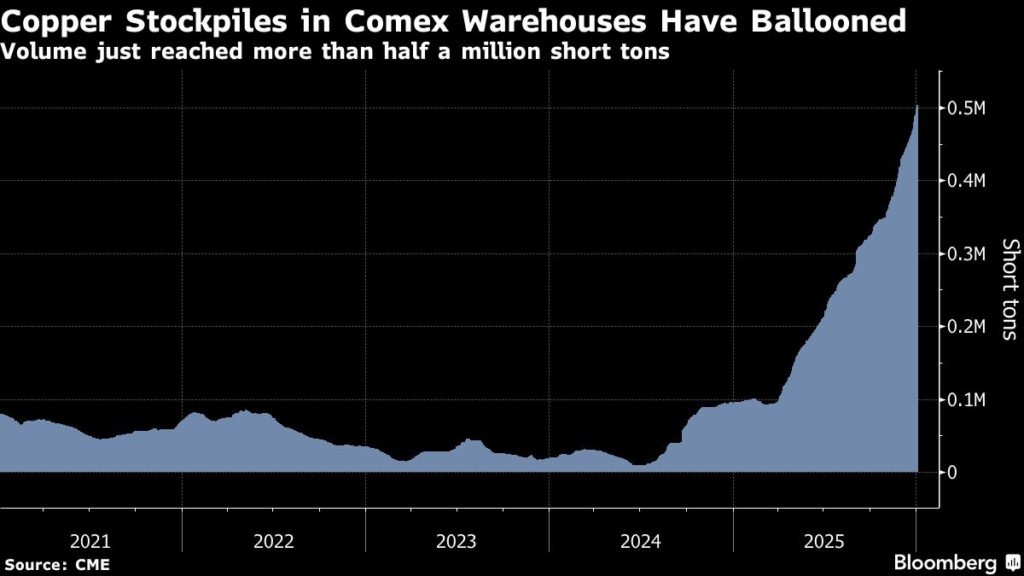

While demand has slowed in recent months — particularly in top consumer China — buyers there are being pulled into a bidding war to secure supplies as copper continues to gravitate toward the US. Expectations that the Trump administration may introduce a tariff on refined metal have drawn huge volumes of inventory into the US, potentially leaving the rest of the world short as miners struggle to boost output.

President Donald Trump fueled the rush to ship copper to the US in the first half of last year, before choosing to exempt refined metal from tariffs, prompting a pause. The trade then revived in recent months as a plan to revisit the question of levies caused local prices once again to trade at a premium. US copper imports in December jumped to the highest since July.

Copper volumes in Comex-tracked warehouses alone are now at more than half a million short tons after 44 straight days of net inflows. The tonnage in LME sheds has nearly halved over the past year, but is still higher than a recent low in June.

LME copper settled 1.9% higher at $13,238 a ton by 5:57 p.m. in London. Nickel rose 9% to close at $18,524 a ton, while tin settled 4.9% higher.

(By Mark Burton)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments