Northern Star sees gold prices supported next year

Gold is expected to hold onto gains into 2026 following a rally to a record earlier this year, Australia’s biggest listed miner of the metal said after reporting that full-year profit more than doubled.

“I’m encouraged with where the price levels are, I still see it maintaining,” Northern Star Resources Ltd. chief executive officer Stuart Tonkin told Bloomberg TV. “This is a pretty strong, healthy environment right now.”

Bullion has been one of the strongest performing commodities this year, peaking above $3,500 an ounce in April as concerns over US President Donald Trump’s aggressive stance on trade and geopolitics fueled demand. Although gains have been muted in recent months, without a fresh catalyst to spur more advances, several Wall Street banks expect fresh records in 2026.

Net income in the twelve months to June more than doubled to A$1.34 billion ($862 million), while underlying free cashflow hit a record A$536 million, the Perth-based miner said in a statement on Thursday. Its shares rose as much as 3.7% in Sydney to a seven-week high.

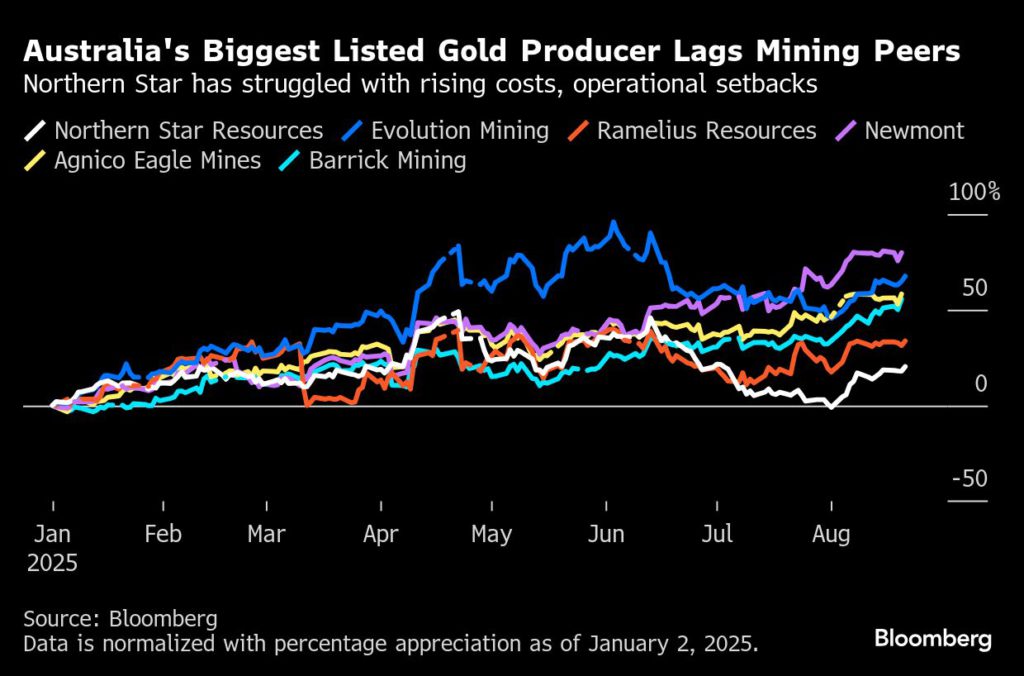

Still, compared with Australian and North American peers, Northern Star has struggled to take full advantage of the rally amid operational setbacks and rising expenses. In July, the miner cut its 2026 sales guidance due to planned shutdowns at its three key assets, including the flagship “Super Pit” mine in Western Australia. The company has also flagged higher-than-expected costs from sector-wide inflation and increased capital requirements.

Bullion’s record-setting rally has also renewed deal-making across the industry following a period of subdued merger-and-acquisition activity. Earlier this year, Northern Star completed the A$5 billion acquisition of De Grey Mining Ltd., whose undeveloped Hemi project in Western Australia is set to become one of the country’s top five gold mines. Output is expected to average 530,000 ounces a year over the first decade, according to a company statement last year.

“The lower end of the ASX potentially have some synergies to liberate through combinations in the business,” Tonkin said, referring to smaller companies on the Australian Stock Exchange. “You’ll still see more of that.”

While Northern Star remains focused on organic growth, Australian assets more broadly look attractive due to foreign-exchange arbitrage opportunities, he said. “There’s potentially the flow of capital back into Australia, when historically it was moving from Australia offshore.”

(By Sybilla Gross)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments