Pan Pacific Copper secures rollover on smelting fees for 2026

Pan Pacific Copper and Lundin Mining Corp. have agreed to keep processing fees to turn copper ores into metal broadly unchanged next year, with the miner choosing not to pursue reductions that would further squeeze the Japanese smelter’s margins.

PPC and Lundin last month agreed to broadly roll over commercial terms set for this year in a supply deal for 2026, with smelting fees known as treatment and refining charges effectively remaining flat, according to people familiar with the matter, who asked not to be identified because the negotiations are private. The agreement was provisional and final commercial terms are still being discussed.

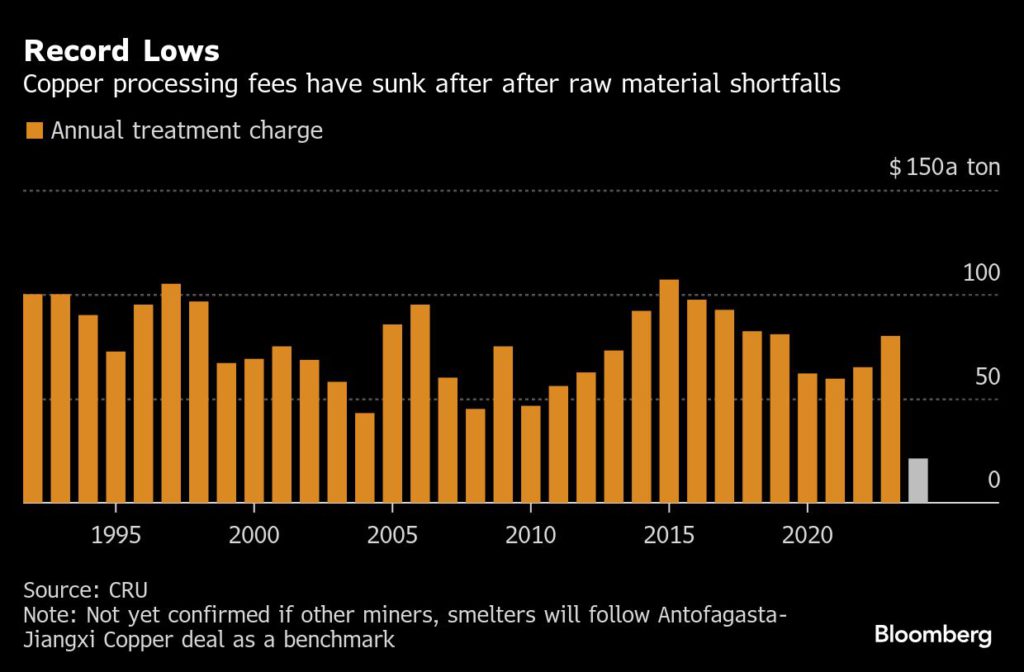

TC/RCs have already fallen to record lows in annual deals for this year, with a slew of mine outages and an over-expansion of global refining capacity causing smelting margins to collapse. There are widespread expectations that they’ll fall even further in supply deals for 2026, but with plants including PPC dialing back output and others shutting down entirely, smelters and governments have warned miners that the industry is already near breaking point.

For decades, the global copper industry has typically settled annual contracts with reference to the first large supply deal reached between a major miner and a smelter, with Chinese plants taking over from their Japanese rivals in setting the benchmark in the 2010s. But that pricing system is coming under strain as TC/RCs collapse, with discussions for next year in deadlock as Chinese smelters seek to limit the extent of further declines.

As negotiations kicked into gear in October, top miner Freeport McMoRan Inc. announced that it plans to break away from the benchmark system to protect smelters’ profitability. The deal between Lundin and PPC suggests the trend is broadening out, with miners making sizable commercial concessions to key long-term customers as the global smelting industry plunges deeper into crisis.

A spokesperson from Lundin declined to comment. A representative for PPC said it could not provide answers regarding individual contracts.

TC/RCs — which are deducted from the value of the metal contained in semi-processed ores known as concentrates — are crucial in keeping smelters running, as they typically account for about one-third of revenues. But this year’s mismatch between mine supply and smelting capacity has been so severe that many expect the Chinese benchmark to turn negative, with smelting fees effectively being added to the cost of concentrates, rather than deducted from them.

That’s an outcome that Chinese smelters have said they can’t accept, leaving them at an impasse in annual discussions with Chilean miner Antofagasta. This year’s global benchmark TC/RC was set at a record low of $21.25 a ton and 2.125 cents a pound, in a deal between Antofagasta and China’s Jiangxi Copper Co.

However, Antofagasta later struck smaller contracts with some Japanese buyers carrying higher TC/RCs of about $25/2.5 cents, Bloomberg has reported. That has already caused a rift between other miners and smelters following the benchmark system, and negotiations with Japanese smelters have become particularly complex, as PPC and others have large equity stakes in operations run by miners including Antofagasta and Lundin.

JX Advanced Metals Corp., which owns PPC, has a 30% stake in Lundin’s Caserones project, having initially invested in the project in 2011. It was Japan’s first overseas push into copper mining, and it marked the start of a wave of investments to shore up supplies through the 2010s. Last month, PPC announced that it would seek to bolster Japanese smelters’ buying power further by merging its purchasing and sales with Mitsubishi Materials Corp., which also has stakes in several large mines.

While this year’s benchmark is at a record low, it’s still significantly higher than smelters are receiving on copper cargoes in the spot market. Pricing agency Fastmarkets’ copper treatment charge index stood at -$66.80 per ton of concentrate as of Dec. 5.

(By Julian Luk)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments