Panama will insist on resource ownership in Cobre copper mine talks

Panama will require that any agreement to restart the $10 billion Cobre Panama copper mine clearly stipulates that the country is the owner of the land and the resources, the country’s finance chief said in an interview.

Ordered shut in late 2023 after a Supreme Court ruling and an eruption of environmental protests and political turmoil, the new government under President Jose Raul Mulino has been laying the groundwork necessary to begin negotiations with mine owner First Quantum Minerals Ltd.

“For us, it’s important to have an agreement that states very clearly that resources belong to the Republic of Panama,” Economy and Finance Minister Felipe Chapman told Bloomberg in an interview on the sidelines of the International Monetary Fund and World Bank annual meetings in Washington on Friday.

Mulino in June had said “the table is clear to start conversations” with First Quantum after Franco-Nevada Corp., which has a supply agreement for metals from the mine, agreed to halt its arbitration case against Panama.

That development came three months after First Quantum Minerals Ltd. told its lawyers to suspend its arbitration cases against Panama over the mine that once accounted for 1% of global mined copper.

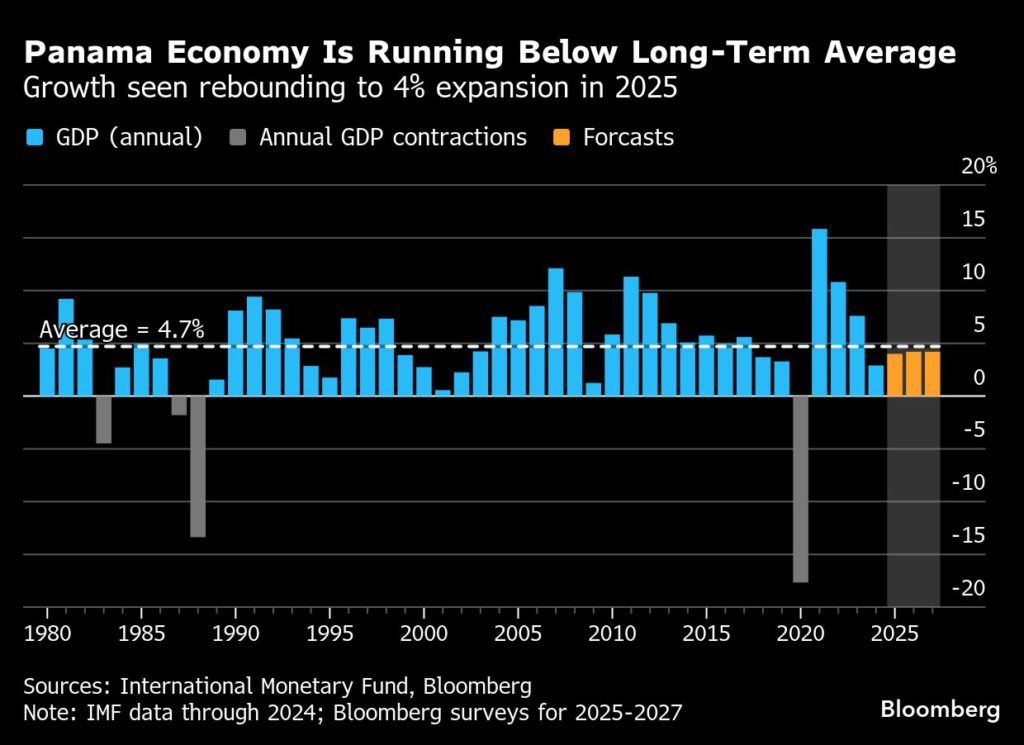

For Panama, a reopening of the mine, which represented roughly 5% of gross domestic product, offers the potential for creating thousands of jobs and a boost to the economy.

Chapman said that public sentiment toward the mine has improved, with the latest polls showing 50% of those surveyed holding a negative opinion compared to over 80% more than a year ago.

There is also an “agnostic” block of people who could be persuaded to support reopening of the mine under favorable conditions, he said.

As to government finances, Chapman said he’s committed to fiscal consolidation, saying the fiscal deficit targets of 4% this year and 3.5% in 2026 are “non-negotiable.” He’s also waiting for interest rates to decline further before tapping the global bond market.

(By Zijia Song and Martha Beck)

More News

Contract worker dies at Rio Tinto mine in Guinea

Last August, a contract worker died in an incident at the same mine.

February 15, 2026 | 09:20 am

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments