Peru leftist copies Chile’s proposal for tax on copper boom

A proposal to tax Chilean copper sales at rates of as high as 75% is reverberating all the way to Peru, where the leading presidential candidate wants to impose a similar measure.

Pedro Castillo, who has vowed to nationalize a major gas field and capture more mineral profits to fund social spending, just added a tax on copper sales to his platform in a document he shared on Twitter late Sunday.

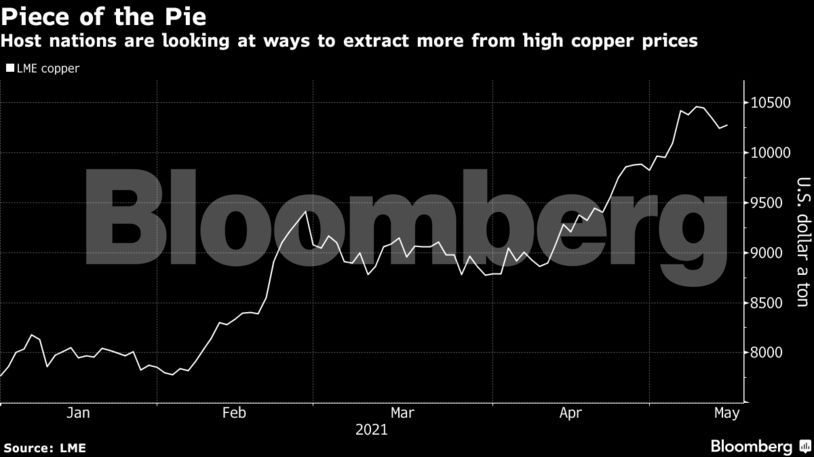

The left-wing candidate, who retains a slim lead over his rival ahead of a runoff election, joins a list of politicians from copper-mining nations looking to gain a bigger share of record-high prices to fight poverty. In top producer Chile, the lower house of congress earlier this month passed a system of progressive taxes on copper sales in what could become one of the heaviest levies in global mining.

Pedro Castillo joins a list of politicians from copper-mining nations looking to gain a bigger share of record-high prices to fight poverty

“Let us note that the Chilean Chamber of Deputies has already approved a new royalty whose rate reaches 75% if it exceeds $4 a pound, as is the case today,” Castillo’s Free Peru party said in the document.

Among proposed measures are a new tax on profits, royalties based on sales “as do neighboring countries such as Chile and Colombia” and the renegotiation of tax stability contracts with large companies, according to the document.

Just like Chile did last year, Castillo is proposing a referendum to determine if Peruvians want a new constitution. He’s also proposing a national gas pipeline network, reducing food imports and setting aside land for small farms. On the Covid front, the candidate said his government would vaccinate all Peruvians older than 18 and ensure the country has access to 60 million shots.

Investment risk

In Chile, the mining industry and the government say the copper sales royalty — which would come on top of corporate taxes and a separate tax on mining earnings — would erode Chile’s competitiveness and stall investments.

Peru, host to companies including Freeport-McMoRan Inc. and BHP Group, is the largest producer of copper after Chile and a major zinc, silver and gold supplier.

While mining companies in Peru won’t be cheering additional taxes, that prospect would be preferable to the government expropriating assets, which was the initial fear when Castillo defied polls to win the first round vote. In addition, he’s likely to face stiff opposition from a divided legislature.

The tax proposals are “rather less radical than his first-round rhetoric,” said Eileen Gavin, global markets and Americas principal analyst at Verisk Maplecroft. “Our view is that the local private sector in Peru, including the mining industry, should not panic. But should he be elected, big mining should be prepared to come to the table.”

(By James Attwood and Daniela Sirtori-Cortina, with assistance from Maria Cervantes)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments