Rare earth stocks surge in Sydney after Trump’s Australia pact

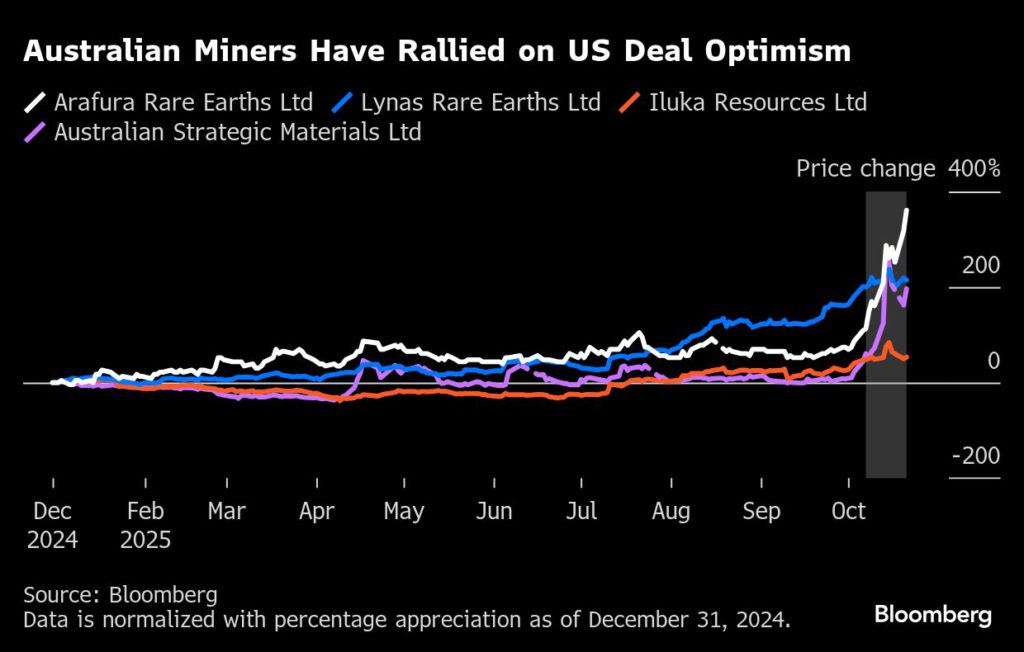

Rare earths shares jumped in Sydney after President Donald Trump signed an agreement with Australian Prime Minister Anthony Albanese that’s been described as a “shot in the arm” for the industry in Australia.

After the deal was inked in the White House on Monday, Arafura Rare Earths Ltd. announced the US Export-Import Bank was considering $300 million of financing support for its Nolans project in Australia, sending its shares soaring as much as 29%. The miner — backed by the richest Australian, Gina Rinehart — also received conditional approval for $100 million in funding from Albanese’s government.

The US Export-Import Bank also issued letters of interest to six other miners for more than $2.2 billion in financing. Recipients VHM Ltd. and Northern Minerals Ltd. climbed as much as 30% and 19%, respectively.

Producers of gallium, an ingredient used in the defense industry and semiconductor manufacturing, also rose after Trump and Albanese unveiled funding for related projects. Sydney-listed shares of Alcoa Corp. advanced as much as 9.6% after it was announced the Alcoa-Sojitz gallium project in Western Australia would get up to $200 million in equity financing.

Lynas Rare Earths Ltd., which is not a beneficiary of the funds at this time but is the only producer of so-called heavy rare earths outside China, saw its stock gain as much as 4.7% on Tuesday before it reversed gains. Mineral sands producer and rare earths aspirant Iluka Resources Ltd. rose 9.1%.

Finalized on Monday during Albanese’s trip to Washington, the pact signals a new way for miners to approach capital raising. It also underscores the heightened geopolitical strains between the US and China as Beijing imposes export controls of rare earths, which are key to advanced tech, batteries, chips and defense equipment.

The US and Australia will each spend $1 billion over the next six months on projects with additional outlays after that toward a $8.5 billion pipeline of critical minerals projects.

“It’s a golden opportunity for Australia and we intend to maximize it,” Treasurer Jim Chalmers said in a Bloomberg Television interview from Incheon, South Korea, on Tuesday. “Australia can be and will be world leader in the supply of rare earths and critical minerals,” he said, adding “the framework that was agreed with President Trump today is an important part of that effort.”

Australia is seen in the White House as an ideal partner to diversify away from reliance on Chinese rare earths, given its long-term geopolitical relationship with the US, endowment of critical minerals, deep history of mining, and export infrastructure.

The US and Australian governments could “spend the next few months identifying the next round of projects,” said Reg Spencer, a Sydney-based mining analyst at Canaccord Genuity Group Inc. “I don’t think we’ve seen the last of these sorts of announcements. We might see a continuation of investor interest in the sector for some time, as investors speculate on who potentially might be next or who may be a candidate for funding.”

Years away

Still, many of these projects are years away from operating. One of the most advanced projects is Northern Minerals’ A$600 million ($390 million) Browns Range rare earths mine in Western Australia — it will take at least two years to build. It’s also highly dependent on Iluka Resources constructing and commissioning a refinery to process material.

While some critical minerals stocks have seen a general uptick in their share prices over the past 12 months, many listed companies in Australia have struggled to raise capital in recent years following a plunge in commodity prices, which all but evaporated interest from traditional sources of finance. This has changed, with governments now entering the market, according to Northern Minerals chief executive officer Shane Hartwig.

“It’s a sort of shot in the arm, a confidence booster that governments are really committed to ensuring these supply chains stand up,” he said. “It gives confidence to the broader market, including private capital to follow government money. It will help bridge the gap and bring some of these critical projects into production in the next couple of years.”

(By Carmeli Argana and Paul-Alain Hunt)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments