Record gold floods into Shanghai warehouses on arbitrage play

Bullion held in warehouses linked to the Shanghai Futures Exchange has jumped to an all-time high, another sign of resilient demand for gold investments in China.

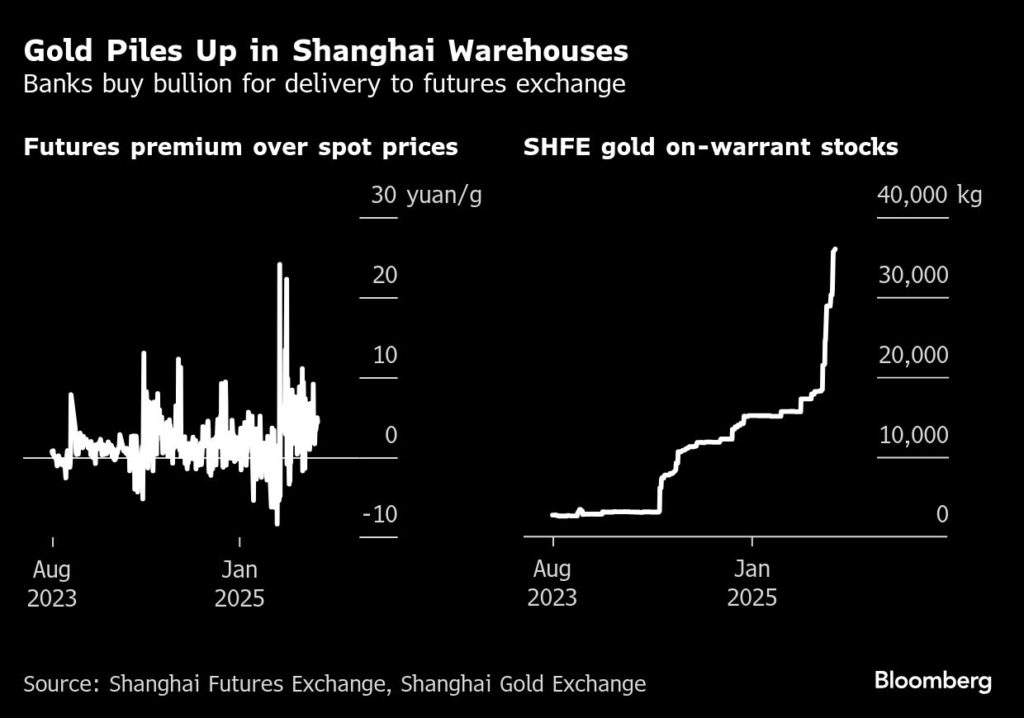

More than 36 tons of gold bars have been registered for delivery against futures contracts, a quantity that has almost doubled over the past month. The build-up in stockpiles reflects a surge in arbitrage activity triggered by heavy demand for futures, which are trading at a large premium to the physical metal.

Traders and banks have moved to take advantage of the price gap, buying cheaper gold on the spot market and delivering it to the exchange’s warehouse. From there, it can be used to offset sales of futures, allowing them to close positions at a profit.

“This shows how strong gold trading demand is in China right now,” said John Reade, senior market strategist at the World Gold Council. “So many people were piling into futures that prices shot up above physical gold. That created an opportunity for others to step in and deliver gold into the system.”

The precious metal continues to broadly benefit from economic uncertainty and geopolitical ructions. But a disconnect between futures and spot markets has arisen as lower interest rates in China help fuel speculative activity among traders, just as near-record prices sap physical demand from retail consumers.

While purchases of gold jewelry in mainland China shrank 45% from the previous quarter, demand for investment bars and coins remained resilient, according to the WGC’s second-quarter report. Gold-backed exchange-traded funds have also seen outflows, driven in large part by a rotation into stocks from the retail crowd.

Volatile conditions have also caused unusual dislocations on other gold markets. Earlier in the year, metal flooded into Comex warehouses in New York on the expectation of US tariffs, only for the trade to come to an abrupt halt when the Trump administration exempted precious metals.

(By Yihui Xie)

More News

Contract worker dies at Rio Tinto mine in Guinea

Last August, a contract worker died in an incident at the same mine.

February 15, 2026 | 09:20 am

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments