Rio Tinto and BHP to lead Australia earnings rebound

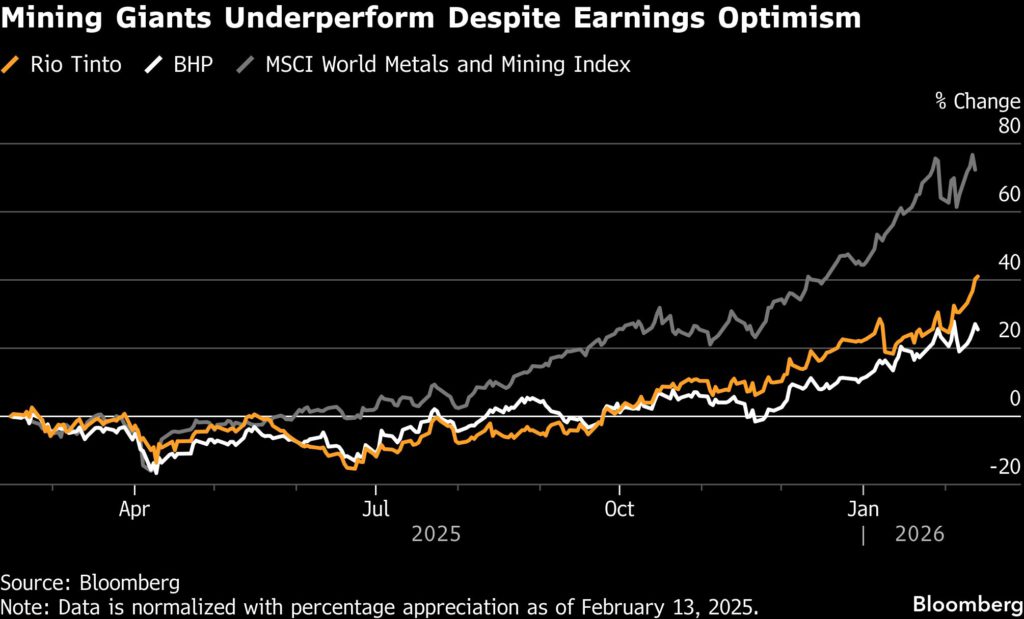

Australia’s reporting season moves into high gear this week with Rio Tinto Ltd. and BHP Group Ltd. seen crucial for the country’s earnings rebound.

Both miners enter 2026 set for earnings outperformance, buoyed by commodity prices that help valuations catch up with broader equity markets, Bloomberg Intelligence analysts Alon Olsha and Grant Sporre wrote in a note.

Wilsons Advisory says investors should also pay attention to growth outside iron ore, Rio’s main source of revenue, especially in copper, which is BHP’s biggest seller.

The results come less than two weeks after Rio Tinto walked away from talks to acquire Glencore Plc, scuttling a mega merger that would have created the world’s largest mining company.

In Australia’s consumer sector, winemaker Treasury Wine Estates Ltd. swung to a first-half net loss and missed revenue estimates amid supply chain difficulties in the US and adverse consumer trends in China.

Retailer Wesfarmers Ltd. will be the next major consumer firm to report after the country’s household spending unexpectedly declined in the final month of 2025. The RBA’s rate hike earlier this month is likely to further restrain demand.

(By Rachel Yeo and Harshita Swaminathan)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments