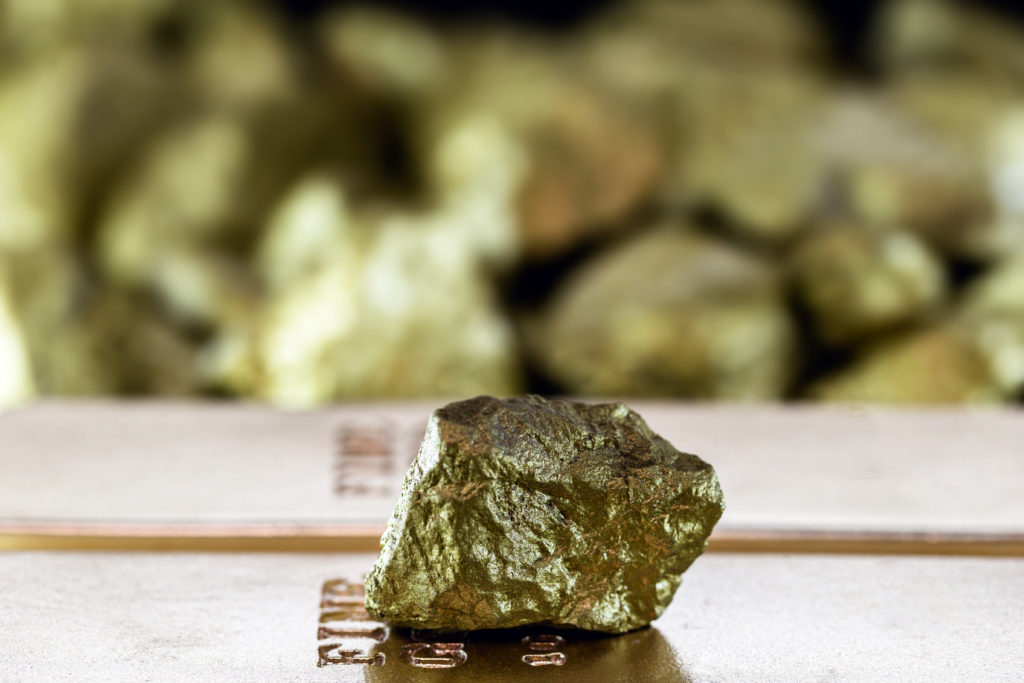

Russia gains $216 billion in gold rally, replacing lost assets

Russia has reaped a windfall from a surge in gold prices since the start of its war in Ukraine, generating gains on a scale comparable to the sovereign reserves frozen in Europe over President Vladimir Putin’s invasion.

The value of the Bank of Russia’s gold holdings has increased by more than $216 billion since February 2022, according to Bloomberg calculations. At the same time, the central bank has largely refrained from both major purchases of the metal and using its gold reserves during that period, despite the loss of access to foreign securities and currencies blocked under sanctions.

In December, European Union countries approved extending a freeze on around €210 billion ($244 billion) of Russian sovereign assets held in the bloc.

The increase in the value of bullion restores most of Russia’s lost financial capacity, even if it doesn’t return the blocked reserves. While securities and cash immobilized in Europe cannot be sold or pledged, gold can still be monetized if needed.

Russia, the world’s second-largest gold producer, mines more than 300 tons of the metal a year. Since 2022, however, Russian bullion has been shut out of Western markets and is no longer accepted by the London Bullion Market Association, effectively barring it from the world’s biggest over-the-counter gold-trading hub. That complicates any potential large-scale sales by the central bank to Asian buyers, where it would also face competition from newly mined gold produced by sanctioned Russian producers that cannot currently be sold elsewhere.

Gold prices have rallied sharply over the past four years, supported by strong demand from central banks, persistent inflation concerns, heightened geopolitical risks and investors seeking safe havens from uncertainty caused by trade wars.

In 2025, gold gained around 65%, its strongest annual performance since 1979. This has significantly lifted the valuation of official holdings worldwide even without additional purchases.

Russia’s international reserves reached $755 billion at the end of last year, including $326.5 billion held in gold, according to central bank data published on Friday. Gold prices have risen by more than 8% since then, surpassing $4,700 per ounce.

The Finance Ministry expects gold prices to keep climbing over the long term to $5,000 an ounce and higher. The current rally reflects a loss of confidence in global reserve currencies, while attempts to expropriate Russian assets are only increasing demand, Deputy Finance Minister Aleksey Moiseev said in an interview with RBC in late December.

The Bank of Russia only began drawing on its bullion toward the end of last year, with holdings falling by 0.2 million troy ounces to 74.8 million troy ounces. The decline reflected operations linked to the Finance Ministry’s sales of National Wellbeing Fund assets to finance the budget deficit.

From February 2022 through December 2025, the value of the country’s gold reserves more than doubled, while reserves held in foreign assets and currencies declined by about 14%, Bank of Russia data show. Gold accounted for 43% of total reserves compared with only 21% before the war.

Russia has stopped disclosing detailed information on its foreign currency reserves since the start of the war. As of Jan. 1, foreign currency and other non-gold assets totaled $399 billion, according to the data.

Russia’s Finance Ministry said in 2022 that roughly $300 billion of its overseas sovereign assets had been immobilized abroad.

The fate of those funds is poised to remain a subject of negotiation as talks over a potential peace settlement of the war in Ukraine continue under US leadership. EU countries have debated ways to use frozen Russian assets to provide a loan to Ukraine, but efforts to reach an agreement ultimately failed.

The Bank of Russia in response filed a lawsuit in Moscow seeking 18.2 trillion rubles ($227 billion) from Euroclear. Governor Elvira Nabiullina said the central bank doesn’t intend to drop its claim and is considering legal action in international courts.

Read More: Russians are hoarding gold equal to Spain reserves, study shows

More News

Contract worker dies at Rio Tinto mine in Guinea

Last August, a contract worker died in an incident at the same mine.

February 15, 2026 | 09:20 am

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments