Russians are hoarding gold equal to Spain reserves, study shows

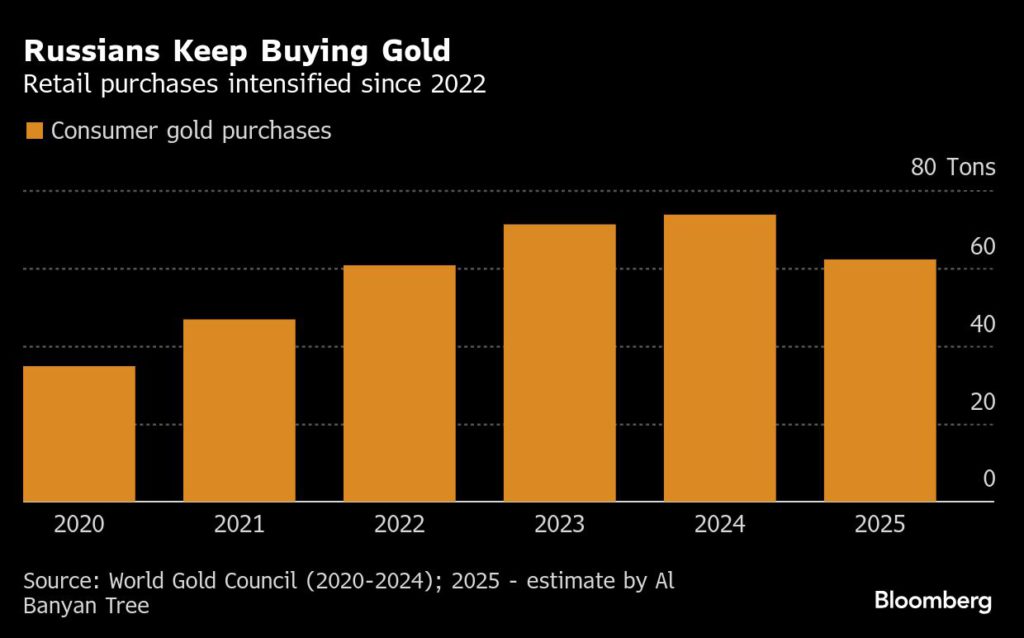

Russian consumers’ gold purchases are set to equal the state reserves of Spain or Austria after the metal has become one of the nation’s most popular savings options during the past four years, according to a study.

Retail purchases of gold in bars, coins, and jewelry are expected to reach 62.2 tons (almost 2 million troy ounces) this year, according to Hong Kong-based Al Banyan Tree Research, a quantitative research startup founded by financial analysts and risk managers with experience in the Russian commodities sector.

Although buying has slowed compared to 2024 as gold prices surged past a record $4,000 per ounce recently, total retail purchases since the Kremlin sent troops into Ukraine in 2022 are projected to total 282 tons, Al Banyan Tree estimates.

The trend highlights how Russians, cut off from traditional saving options such as euros and US dollars, are seeking new ways to preserve their wealth. Gold has emerged as one of their preferred safe havens.

“Individuals have historically preferred to invest in real estate and foreign currency, but after the sanctions-related restrictions, currency became a less convenient way to preserve savings, and since 2022, demand for gold has increased,” Moscow-based BCS Global Markets analyst Dmitry Kazakov said.

Lenders in Russia have mostly phased out deposits in euros and dollars, while cross-border transactions in those currencies have become increasingly difficult. Russians could have moved some of their gold hoard abroad as a way to transfer capital, though the exact amount is impossible to estimate, Kazakov said.

Russia, the world’s second-largest gold producer, mines more than 300 tons of the precious metal a year. Since 2022, however, Russian bullion has been barred from Western markets, and the London Bullion Market Association, which sets global gold trading standards, no longer accepts it.

In response, Russia scrapped its value-added tax on retail gold purchases to boost domestic demand and help sanctioned miners find an alternative to exports.

Without stronger domestic demand, Russian miners would have faced bigger difficulties. The country’s central bank, once the world’s biggest sovereign gold buyer, halted purchases in 2020, and although it opened the door to resuming them in 2022, its gold reserves have remained almost unchanged for years at about 75 million troy ounces.

Domestic sales are also supported by purchases from Russian lenders, who were seen holding 57.6 tons in August 2025, Al Banyan Tree estimates. The firm uses econometric models and AI-driven analytics to interpret complex commodity market data.

Russia this month started physical gold trading on the St. Petersburg Exchange as part of efforts to replace LBMA pricing benchmarks, but so far, only a few bars have been sold. At the same time, gold exports have declined, according to Al Banyan Tree Research.

The shift in domestic demand suggests trade patterns and savings behavior might not fully revert to revert even if sanctions ease. “We doubt that, if sanctions are lifted, everyone will start selling gold,” as the mistrust toward the dollar and euro will persist, Kazakov said.

(By Andrey Biryukov)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments