Serbia will hoard all its gold at home, shunning global hubs

Serbia’s central bank plans to bring all of its roughly $6 billion worth of gold reserves onto its own soil to ensure the security of the hoard in periods of crisis.

That will make Serbia the first eastern European country not to hold any of its bullion in traditional hubs like Switzerland, the UK and the US.

“By returning gold to the country, the National Bank of Serbia sought to increase the availability and security of gold reserves in periods of crisis and uncertainty,” the central bank said in response to questions, adding that the repatriation efforts began in 2021 amid “an environment of increased global uncertainty.”

The pace of global central bank gold accumulation doubled after Russia’s foreign exchange reserves were frozen in 2022, highlighting the political risk of holding dollar and euro-denominated assets. Storing gold bars domestically shields them from this kind of foreign interference.

Serbia bought 17 tons abroad from 2019 through last year, in addition to at least 19 tons from Zijin Mining Group Co.’s local unit. That brought total reserves to 50.5 tons, all stashed in Belgrade except five tons bought in 2024 and still stored in Switzerland, for now. That amount of gold is worth about $6 billion at current spot gold prices.

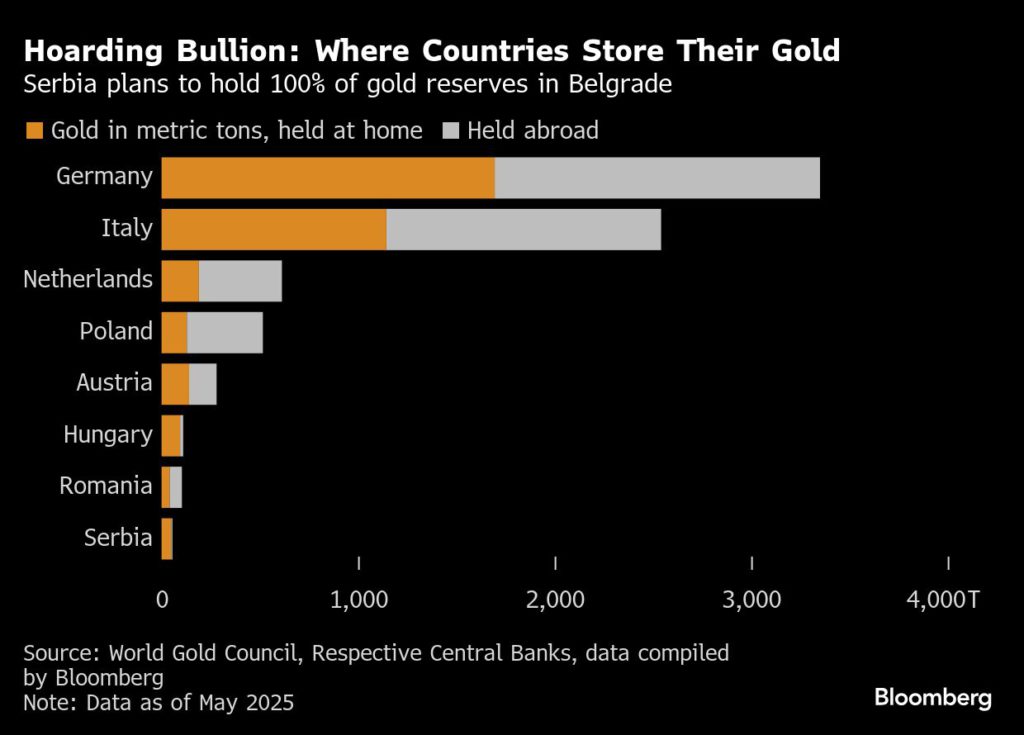

The remaining five tons will be brought home “as soon as possible” Governor Jorgovanka Tabakovic said last week. The region’s share of gold reserves kept domestically ranges from 86% in neighboring Hungary to around 25% in Poland, according to data compiled by Bloomberg.

Serbia weighed the pros and cons before deciding to repatriate, the central bank said, noting that having the gold in market hubs makes it easier to sell or lend.

A significant portion of the world’s gold reserves, worth about $550 billion at current prices, is held in the Bank of England’s vault in London, the global center for precious metals trading.

The Federal Reserve of New York also stores gold for other countries, including Germany and the Netherlands. That became a massive political issue in Germany more than a decade ago, prompting a highly publicized repatriation to increase the share of gold held at home. The metal was held in the US in part due to Germany’s proximity of Soviet forces and the fear of invasion during the Cold War, and remained after the fall of the Berlin Wall.

Similar operations were undertaken by Poland and the Netherlands, and demands for bringing gold bars to domestic depots echoed in Slovakia and Romania.

Storing gold within one’s own borders resonates well with resurging populist parties such as Alternative for Germany, which sees it as necessary insurance against political threats from abroad.

(By Misha Savic and Jack Ryan)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments