Silver price hits fresh record as strong ETF inflows sustain rally

Silver touched a fresh record high and capped its second weekly gain as strong inflows to exchange-traded funds added more impetus to a scorching rally.

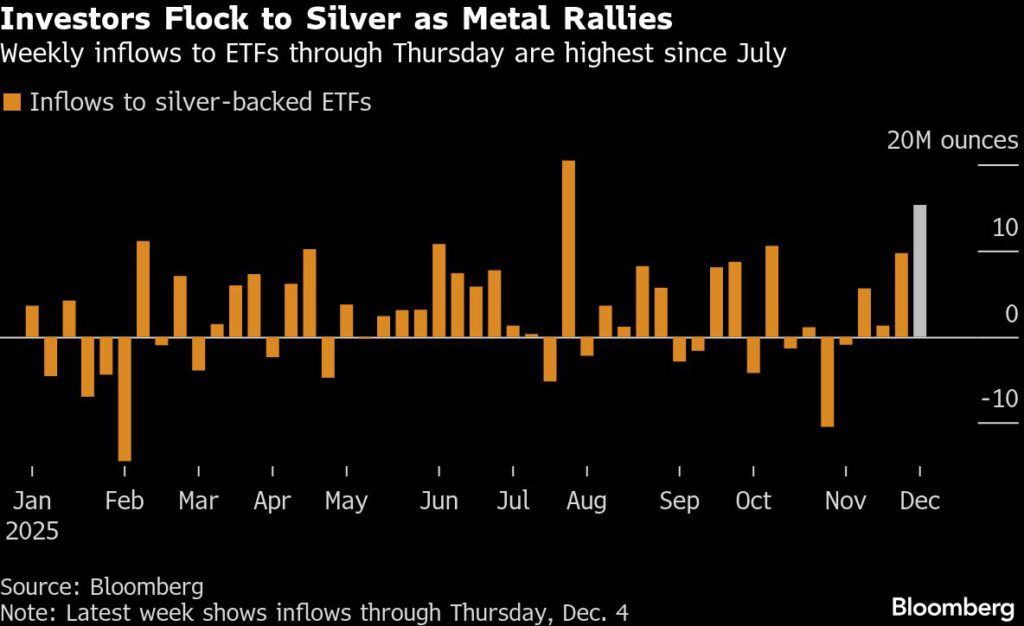

The white metal rose as much as 3.9% on Friday to an all-time high of $59.33 an ounce. Total additions to silver-backed ETFs in the four days through Thursday are already the highest for any full week since July, a strong indicator of investor appetite despite signs silver’s gains may be overdone.

“These flows can quickly amplify price moves and trigger short-term short squeezes,” said Dilin Wu, research strategist at Pepperstone Group Ltd. For much of this week, the metal’s 14-day relative strength index has whipsawed either side of 70 — a threshold above which traders are likely to deem the metal as overbought.

Silver prices have roughly doubled this year, outpacing a 60% rise in gold. The rally accelerated in the last two months, in part thanks to a historic squeeze in London. While that crunch has eased in recent weeks as more metal was shipped to the world’s biggest silver trading hub, other markets are now seeing supply constraints. Chinese inventories are near their lowest in a decade.

“Silver’s outsized rally signals it’s no longer gold’s quiet sidecar,” said Hebe Chen, an analyst at Vantage Markets in Melbourne. “The market is waking up to structural scarcity and fast-rising industrial demand, not just the haven story.”

The metal’s recent surge has also been supported by rising expectations the Federal Reserve will lower interest rates at its meeting next week. Swap contracts indicate a near-certainty the Fed will reduce the cost of borrowing — typically a positive for non-yielding precious metals. These bets withstood the latest US data, which showed the Fed’s preferred inflation gauge in September rose in line with economists’ expectations.

Silver could rise to $62 an ounce in the coming three months “on the back of Fed cuts, robust investment demand, and physical deficit,” Citigroup Inc. analysts including Max Layton wrote in a note.

Not just valued as an investment asset, silver also has many useful real-world properties that make it a component in a range of products, such as circuit boards, solar panels and coatings for medical devices. Global demand for the metal has outpaced output from mines for five consecutive years.

Silver rose 2.1% to $58.35 an ounce as of 4:22 p.m. in New York. It’s up more than 3.3% for the week, following last week’s 13% surge. Gold slipped 0.3% to $4,195.47 an ounce, while platinum and palladium also rose. The Bloomberg Dollar Spot Index inched 0.2% lower.

(By Yvonne Yue Li and Jack Ryan)

More News

Contract worker dies at Rio Tinto mine in Guinea

Last August, a contract worker died in an incident at the same mine.

February 15, 2026 | 09:20 am

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments