Silver lease rates plunge as historic market squeeze eases

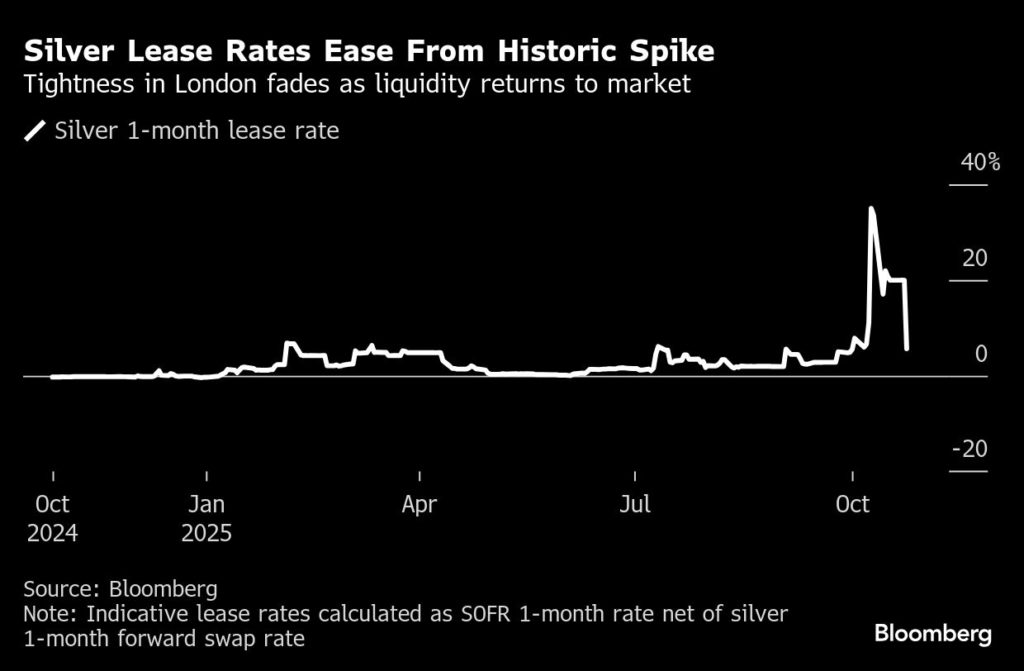

The cost of borrowing silver in London has retreated from a record high, a sign that greater liquidity has returned to the market and brought some relief from a squeeze earlier this month.

Silver lease rates – which represent the annualized cost of borrowing metal in the London market – fell to 5.6% on Monday after surging to an all-time peak of 34.9% on Oct. 9, data compiled by Bloomberg show.

A lack of liquidity in the London silver market sparked a global hunt for the precious metal earlier this month. With benchmark prices in London soaring above those in New York, some traders took the unusual step of booking cargo slots for silver bars on transatlantic flights – a costly option typically reserved for gold – to profit from the different in price.

The historic squeeze has prompted the London Bullion Market Association to consider the weekly publication of silver inventory levels, chief executive officer Ruth Crowell said, adding that the white metal would be prioritized over gold. Inventories of both metals in the London market are currently published monthly. More frequent updates would give the market early warning of future supply tightness.

“The reason for silver is because that has been the recent focus,” Crowell said on Monday at the Global Precious Metals Conference in the Japanese city of Kyoto. “Anytime we involve gold, the Bank of England needs to be involved, which can be a longer process.”

Spot silver prices fell as much as 1.7% on Monday, extending their retreat from an all-time high of $54.4796 an ounce on Oct. 17. The metal was trading at $48.26 an ounce as of 3:13 p.m. Singapore time, down 0.8%.

(By Preeti Soni and Jack Ryan)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments