Silver retail buying keeps supplies tight as rally gathers pace

From Chinese aunties queuing in Shenzhen markets to out-of-stock Turkish refineries and a Korea Mint offer that sold out within an hour, silver’s dizzying rally is leaving banks and refiners scrambling to meet unprecedented demand from retail investors.

After surging almost 150% last year, the white metal has taken it up a notch in 2026, jumping by around a third in a few weeks as the Trump administration ushers in a new age of imperialism, while renewing attacks on the Federal Reserve. China was an early epicenter of the consumer frenzy for silver coins and bars, but with prices setting records the craze is spreading.

“It’s the highest demand I’ve ever seen,” said Firat Sekerci, the general manager of Public Gold DMCC, a bullion dealer based in Dubai. “Most refineries in Turkey have been out of stock for the smaller bars — 10 ounces, 100 ounces — for the past 10 days.”

Retail investors in Turkey are now prepared to pay as much as $9 an ounce above global benchmark prices in London to get their hands on silver, while premiums are elevated across the Middle East, Sekerci said.

That’s prompting global banks to prioritize shipments to the country and region, resulting in less metal reaching India and leaving demand there unmet, according to two dealers familiar with the matter, who asked not to be named as they are not permitted to speak publicly.

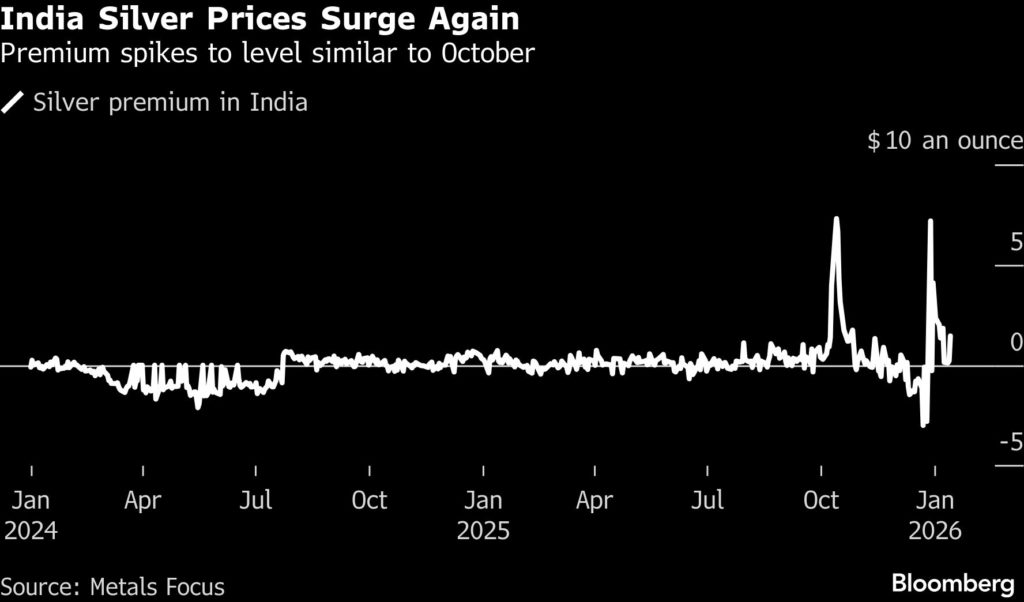

A short squeeze last October showed how local supply constraints can quickly go global, especially for a less-liquid metal like silver. At the time, Indians loading up ahead of the Diwali festival, along with tariff fears that kept supplies locked up in the US, drained liquidity in London and pushed benchmark silver prices to the highest since the 1970s.

Investor demand for silver is now even higher in India than it was in October, with smaller bars and coins in vogue, according to Samit Guha, the CEO and Managing Director of MMTC-PAMP India Pvt., the country’s largest precious metals refiner.

The company’s silver dore imports have more than doubled between October and December from last year, but it’s struggling to keep up with domestic demand and is also getting unusual requests to refine metal for customers in South Korea, the United Arab Emirates, Vietnam and Malaysia, he said. “Whatever we manufacture, we sell. We could supply 25% more coins and bars and the market would absorb it.”

Precious-metals refiners typically produce larger silver bars — of around 1,000 ounces or 15 kilograms — which are the standard delivery sizes for major markets and exchanges. That’s worsening the shortage of coins and smaller bars popular in the retail market.

“It doesn’t make sense for refiners to ramp up production and invest in new lines” to raise kilobar supplies, because they have little visibility on where demand will head next, said Sunil Kashyap, managing director of bullion trader FinMet Pte Ltd., which supplies silver feedstock to refineries.

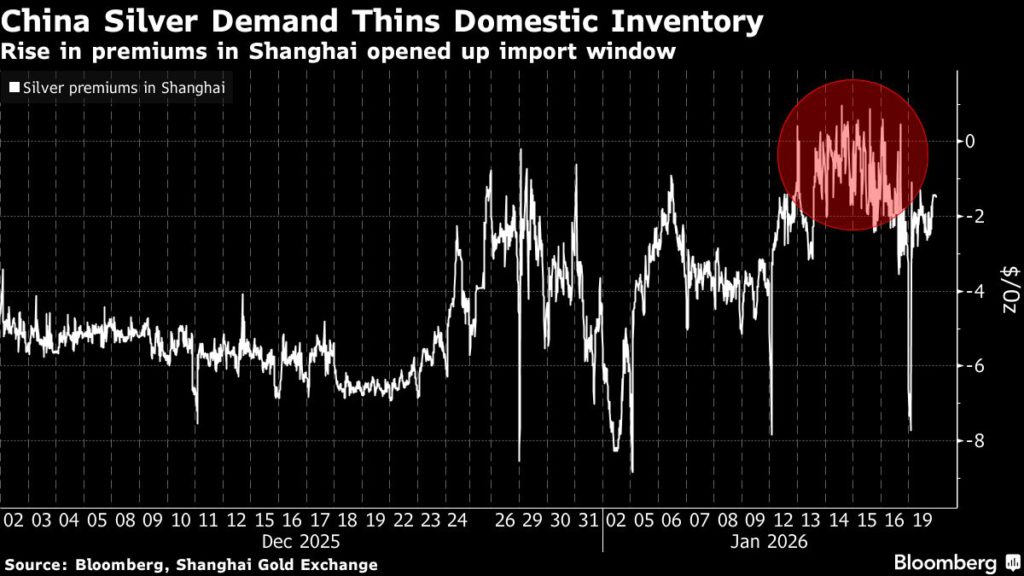

The squeeze in October has also depleted inventories in some locations, leaving the market without much of a buffer. Stockpiles linked to the Shanghai Futures Exchange made a partial recovery in early December, but have now fallen again to where they were after the crunch in October. The surge in demand has led to old bars with varying purities being released back into circulation, according to a manager at a major refinery.

Silver prices in Shanghai spiked above international benchmarks last week, even after accounting for a 13% of value-added tax borne by importers.

“Most retail silver purchases are made fully in cash rather than on margin, so even if prices pull back, many will simply hold on or even use dips to add to positions,” said Zijie Wu, an analyst from Jinrui Futures Co. “So the demand is actually quite resilient on the downside.”

Beyond the big bullion consumers, the insatiable appetite for silver is also spreading. Buyers in South Korea last week snatched up all the 1-kilogram bars in an offer by Korea Mint in less than an hour, while Singaporeans have been queueing for up for 90 minutes to get their hands on the metal.

Misinformation has also contributed to retail buying. Confusion surrounding a Chinese policy update on export licenses issued in October — which was effectively a rollover of existing rules — led some analysts, media outlets and social-media influencers to interpret it as a restriction or outright ban, exacerbating perceptions of scarcity.

“Retail physical demand is keeping prices high,” said Nikos Kavalis, managing director at consultancy Metals Focus. “There’s room for further increase in retail sales and whether this number keeps up will be key to silver’s rally.”

Whether retail buying will eventually cool off if prices keep rising is the big question. With US President Donald Trump tearing up the rules-based international order, and a range of other economic and political risks on the horizon, precious metals offer one of the few relatively safe havens for consumers right now.

Public Gold’s Sekerci doesn’t see any let up in demand. “What else can they invest in?” he said. “The American president is causing problems, the dollar isn’t holding up. Metals are better.”

(By Yihui Xie and Preeti Soni)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments