Silver’s parabolic rally pushes ETF volume near S&P 500 fund

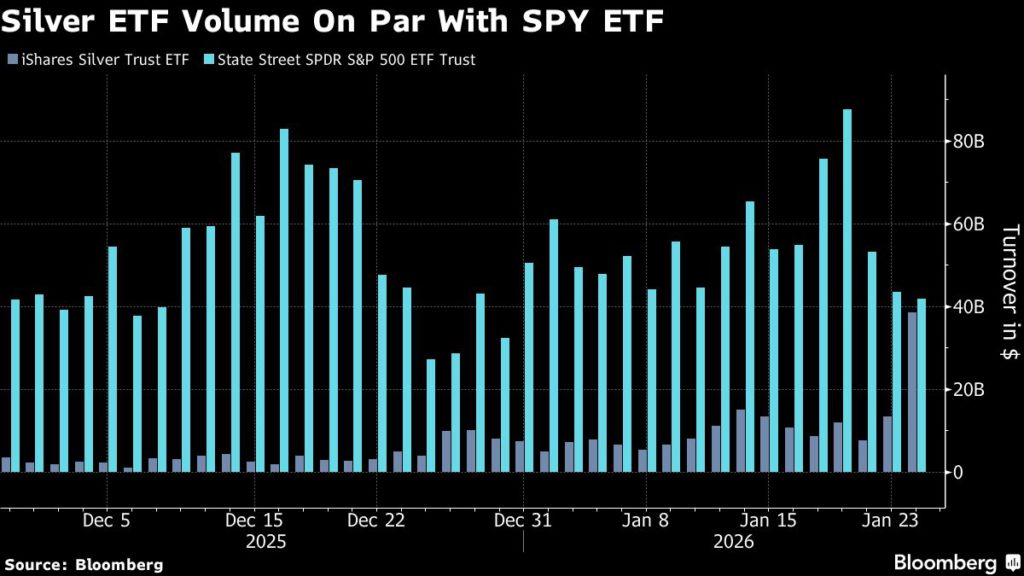

Extreme gains in silver prices are driving massive volumes in the iShares Silver Trust exchange-traded fund, with almost $40 billion in turnover recorded on Monday.

For context, that’s almost on a par with the State Street SPDR S&P 500 ETF, which is one of the world’s biggest. It also exceeds the $23 billion of trading in Nvidia Corp. stock or Tesla Inc.’s $22 billion in turnover.

A few months ago, daily trading in the silver ETF was about $2 billion, before it increased to around $10 billion in late December.

Having more than doubled in 2025, silver has continued its extraordinary rally in January, soaring nearly 60% in what’s poised to be its biggest monthly gain since 1979.

Other commodities and commodity-linked assets are following in its wake. Gold is up 18% this year while the MSCI World Metals & Mining Index has jumped by 19%.

With silver demand swelling in a relatively illiquid market, current price moves and volumes increasingly suggest that pure speculation has largely displaced economic factors as the main driver for the precious metal.

Given these conditions and the flood of money, it’s not inconceivable that the silver trade becomes one of those where momentum collapses under its own weight.

(By Jan-Patrick Barnert)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments