Some Japan buyers agree to pay aluminum premium 41% below current level

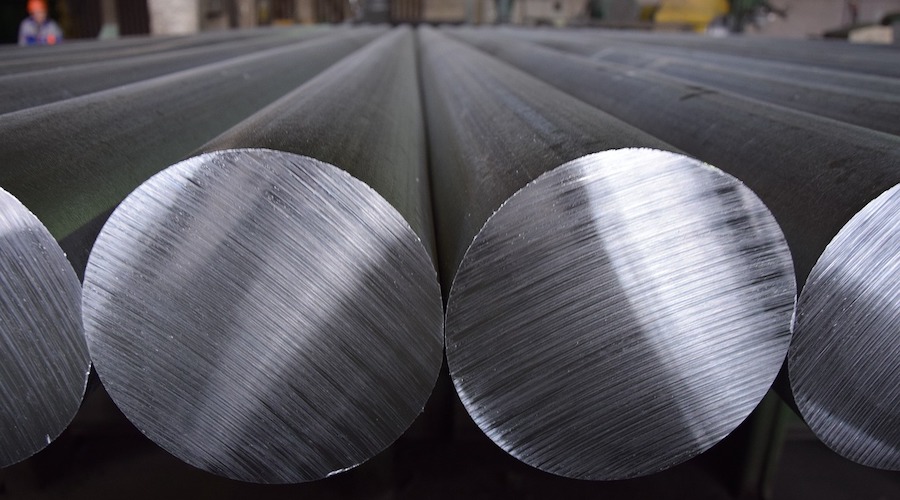

Some Japanese aluminum buyers have agreed to pay a $108-per-metric-ton premium over the benchmark price for July-September shipments, down 41% from the current quarter, amid weak demand and ample supply, four sources involved in the talks said.

The figure is down from the $182 per ton paid in April to June and marks a second consecutive quarterly decline and the lowest since the January-March quarter in 2024. It is also below initial offers of $122 to $145 per ton made by global producers.

Japan is a major Asian importer of the light metal and the premiums for primary metal shipments it agrees to pay each quarter over the benchmark London Metal Exchange (LME) cash price set the benchmark for the region.

“Despite concerns over the impact of US tariffs, the actual effect has been limited so far, and the premium has dropped sharply due to weak supply-demand conditions,” a source at a trading house said.

Aluminum stocks at three major Japanese ports rose to 331,000 tons at the end of May, up 3.3% from the previous month, Marubeni Corp said earlier this month.

“There was no significant change in local demand, but local spot prices have fallen during negotiations, even to the $80 level, forcing producers to abandon their initial offers,” a second source at an end-user said.

The sources declined to be identified due to the sensitivity of the matter.

The quarterly pricing talks began in late May between Japanese buyers and global suppliers, including Rio Tinto and South32.

Some buyers are still in negotiations.

(By Yuka Obayashi; Editing by Tom Hogue)

More News

Contract worker dies at Rio Tinto mine in Guinea

Last August, a contract worker died in an incident at the same mine.

February 15, 2026 | 09:20 am

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments