Top aluminum buyer seeks $218 million purchase as Trump tariffs roil market

A major aluminum buyer is on the hunt for about 90 million pounds of the metal, an unusual move that threatens to further tighten a market fractured by President Donald Trump’s tariff measures.

Arconic Corp. is looking to buy aluminum in the spot market for the second quarter, according to people familiar with the matter. That’s a shift for the company, which in the past had made a majority of its raw material purchases through annual contracts, said the people, who asked not to be identified discussing private commercial matters.

The amount Arconic is seeking to buy is equivalent to about 10% of US monthly aluminum consumption, potentially adding pressure to an already constrained market. Arconic takes raw aluminum and turns it into sheets, plates and other products for the auto, aerospace, transportation and construction sectors. Arconic didn’t immediately respond to requests for comment by phone and email.

The atypical move to purchase such a large volume on the spot market signals that Arconic is seeking a discount to the premium on US aluminum imports. Trump’s 50% levy on the metal is pushing Arconic, which was part of once-iconic American industrial giant Alcoa Inc. and powered the nation’s strength in building everything from fighter planes to dishwashers, to take steps to hedge against surging costs that are eating into profits and raising prices. Apollo Global Management Inc. bought Pittsburgh-based Arconic in 2023.

Trump’s import duties and uncertainty over the future of his tariffs have disrupted foreign aluminum shipments into the US. At the same time, the levies, which Trump doubled to 50% in June, have made the metal more expensive in the domestic market. If Arconic succeeds in buying 90 million pounds of the metal, American consumers will be squeezed as very little supply is left in the US. Exchange stocks – typically a last resort – have been at zero since October.

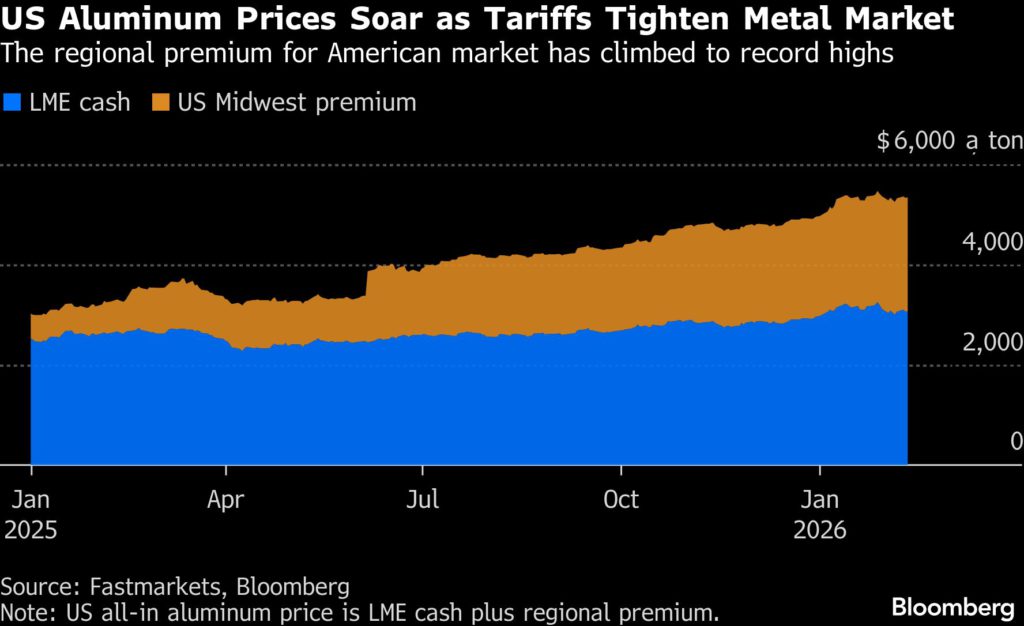

Aluminum prices in the US have been rising faster than global prices for much of this past year because of tariffs. The so-called US Midwest premium — the amount added to global benchmarks to deliver aluminum to that region — climbed to an all-time high of $1.03 a pound on Wednesday, according to data from Fastmarkets. The premium has more than doubled since early June, when the 50% tariff on imports took effect.

Aluminum traded around $3,071 a ton Wednesday on the London Metal Exchange, the biggest global market for metals trading. After adding the Midwest premium, the US price is almost $5,342 a ton. That means the amount Arconic seeks to buy would cost about $218 million, if it can’t get competitive offers from sellers.

Arconic has booked about half of its 2026 tonnage through yearly contracts, and will be in the spot market looking for similar volumes for the third and fourth quarters to fulfill the rest of this year’s feedstock needs, one of the people said.

(By Yvonne Yue Li and Joe Deaux)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments