Trump’s rare earth push extends lifeline to green tech

US President Donald Trump has vowed to cut into China’s overwhelming lead in producing critical minerals as part of his national security push, including a new supply chain proclamation on Wednesday. In response, investors are pouring a record amount of money into US startups, providing support to an industry that also plays a key role in the energy transition.

The minerals — a set of 17 metallic elements — are used in products ranging from smartphones and electric vehicles to fighter jets. China controls roughly 60% of the world’s rare earth mining output and more than 90% of the global refining capacity, according to an October report by the International Energy Agency. That leaves industries in the US exposed to potential supply shocks.

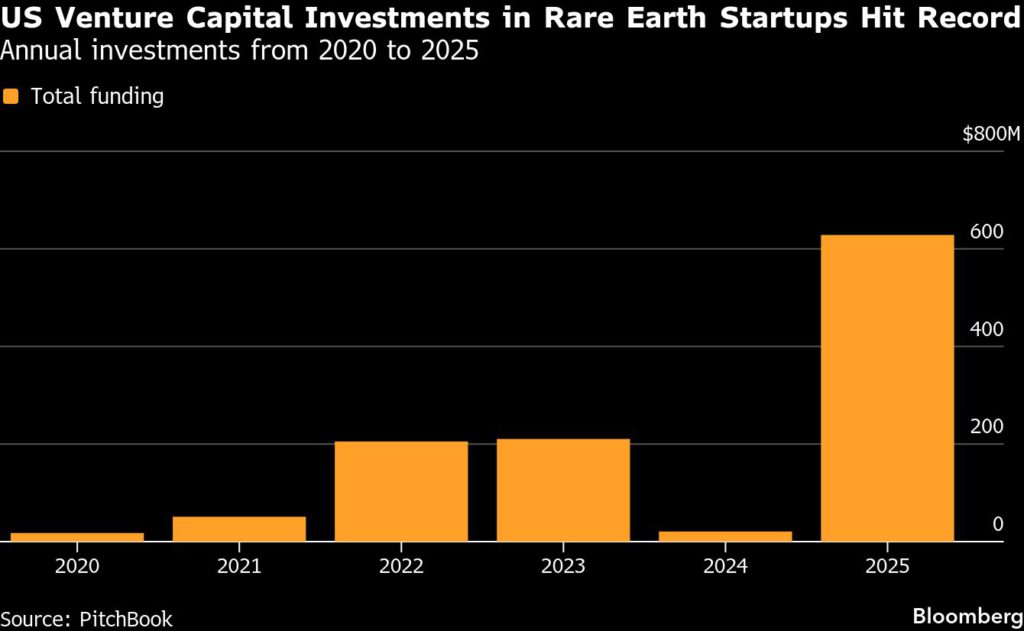

Venture capitalists invested more than $628 million in US startups working on rare earth minerals in 2025, according to PitchBook data, accounting for 90% of all funding globally. That represents a nearly 3,000% jump compared to 2024, and doesn’t account for government deals, including the US Defense Department’s $400 million equity investment in July into MP Materials Corp., a publicly traded rare earth manufacturer.

US companies looking to buy rare earths are also showing increased interest in sourcing the materials at home. Five days after the Pentagon’s investment, Apple Inc. agreed to buy $500 million of rare earth products from MP.

“Rare earths are top of mind right now,” said Zachary Bogue, co-founder and managing partner at DCVC whose firm backed two US-based rare earth startups last year. “There’s geopolitical tensions. The US can no longer rely on China for rare earths and critical minerals.”

The Trump administration has taken steps to support the US rare earths sector for national security purposes, saying it will guarantee minimum prices for producers and coordinating with allies to develop alternative supply chains. That federal support is making investing in rare earth startups a safer bet.

These efforts will also offer a less risky supply of the elements to green tech companies, which are major buyers of the materials. Electric mobility, from vehicles and buses to bikes, accounted for 22% of rare earth permanent magnet demand in the US last year, according to Benchmark Minerals, which tracks rare earth prices and data. The defense sector, meanwhile, accounted for 12%.

“We frame rare earths as a climate issue because it’s fueling so much of the transition, with EVs being the front and center spotlight of it,” said James Lindsay, director of investments at Builders Vision, an investing and philanthropic platform founded by billionaire Lukas Walton. “We generally believe that there’s so much change coming across all industries with climate over the next 20 to 30 years, that looking at anything in these supply chains is important.”

The US’s move to strengthen its domestic rare earth supply chains comes as Beijing has used its industry dominance as leverage, including in April when it introduced export controls on several strategic materials and related products in response to the Trump administration’s tariffs.

Trump’s push to break that chokepoint is lifting rare earths startups. Phoenix Tailings, a startup focused on recycling mining byproducts into rare earth minerals, added $33 million to its Series B in 2025, bringing its funding round total to $76 million.

In October, the company announced it opened its first rare earth refining facility “with zero reliance on Chinese inputs, equipment, or technology” in New Hampshire, with a current capacity of 200 tons per year. Phoenix Tailings is already supplying products to customers, but it declined to provide specific names.

That’s a small fraction of what Benchmark estimates are the nearly 67,000 tons of rare earth oxides mined and refined in the US last year. China, in comparison, produced more than 620,000 tons. Despite its low production, though, Phoenix Tailings said it has been able to produce terbium and dysprosium metals for customers in the defense sector. Both are heavy rare earths that the US has no domestic capacity to produce at scale yet, according to Benchmark.

Still, Bogue of DCVC said recent advances in rare earths mining and processing technologies give him comfort that US startups can catch up to China’s established players. Alta Resource Technologies Inc., a startup that DCVC has invested in, leverages artificial intelligence and advanced biochemistry to aid in mineral separation and is working to scale up its operation to be cost-competitive against Chinese counterparts by 2027, according to Bogue.

For now, though, high costs and slow permitting are challenging rare earth startups’ ability to scale rapidly. With investors flocking to the sector, there is also a risk of overheating. Rajesh Swaminathan, a partner at Khosla Ventures, examined several rare earth magnet startups last year but decided against investing. He said the combination of these startups being at “very early stage” yet having “super high valuation” made him hesitant to place a bet.

Lindsay of Builders Vision, which backs Phoenix Tailings, said he remains hopeful despite the limitations. He pointed to the US oil and gas industry’s transition from relative irrelevance in 2005 to becoming a global leader towards the end of the 2010s. The growth of the oil and gas industry required more capital than what it would likely take to build out a strong US rare earth supply chain, he said, and it shows that “a 15-year cycle has been done before.”

(By Emily Forgash and Coco Liu)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments