US backs Serra Verde’s Brazilian rare earth project with $465M funding

Brazilian rare earths producer Serra Verde secured as much as $465 million in funding from the US International Development Finance Corporation as Western nations seek to reduce reliance on China for the key minerals.

The financing is to help cover upgrades to the company’s Pela Ema mine in Brazil’s Goiás state, according to an Aug. 15 document on the website of the DFC. The federal agency was created under US President Donald Trump’s first term to offer financing and guarantees for projects in developing nations with a tie to US foreign policy objectives.

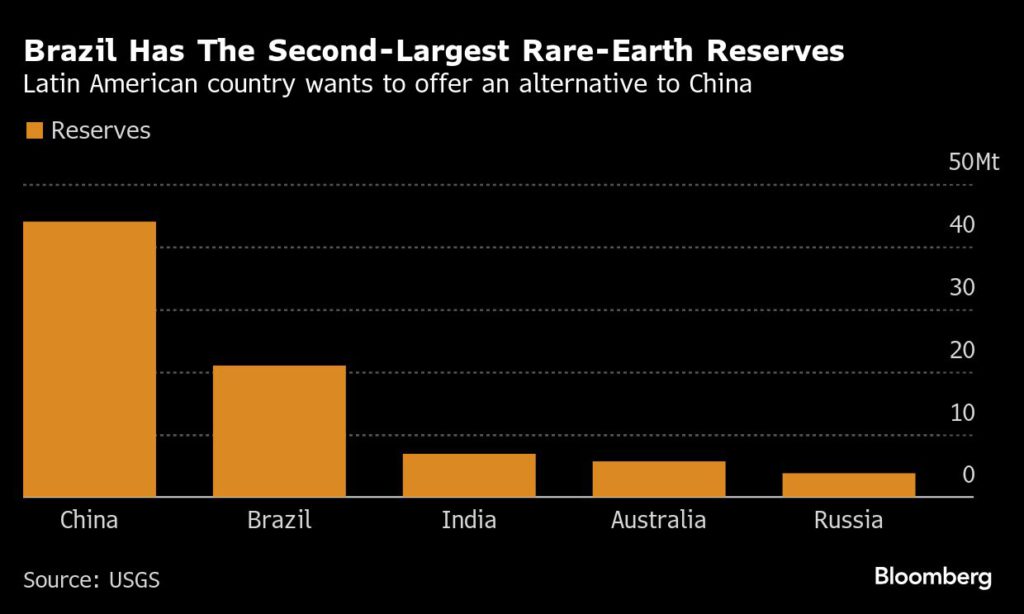

The Trump administration is turning to Brazil — the country with the biggest rare earth reserves outside of China — for its efforts to build alternative supply chains for key elements used in military hardware, electric vehicles and wind turbines.

The Pela Ema deposit contains light and heavy rare earths – mainly neodymium, praseodymium, terbium and dysprosium – that are key to production of magnets used in a wide range of applications. Serra Verde, backed by Denham Capital, Vision Blue Resources and Energy and Minerals Group, is Brazil’s first large-scale rare earths producer.

The DFC said the funding is to finance improvements of the Pela Ema mine as well as operational expenses and refinancing existing shareholder debt. The financing was earlier reported by the Financial Times.

Serra Verde began commercial production at its mine and processing plant in 2024. The firm aims to ramp up output to between 4,800 and 6,500 metric tons of total rare earth oxides by early 2027.

“This project is still undergoing several steps and reviews before closing,” a company spokesman said. “Since these details are not yet finalized, we prefer to wait to comment until the transaction is fully completed and we can provide accurate information.”

In September, Aclara Resources Inc. secured DFC funding for a rare earth project in mid-western Brazil in an arrangement that could be converted into equity in the future.

(By James Attwood and Mariana Durao)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments