US Commerce Dept gives initial backing to Sibanye’s call for tariffs on Russian palladium

Sibanye-Stillwater’s call for US tariff on Russian palladium imports has received preliminary support from the US Commerce Department, although a final decision is not expected until mid-2026, the miner said on Friday.

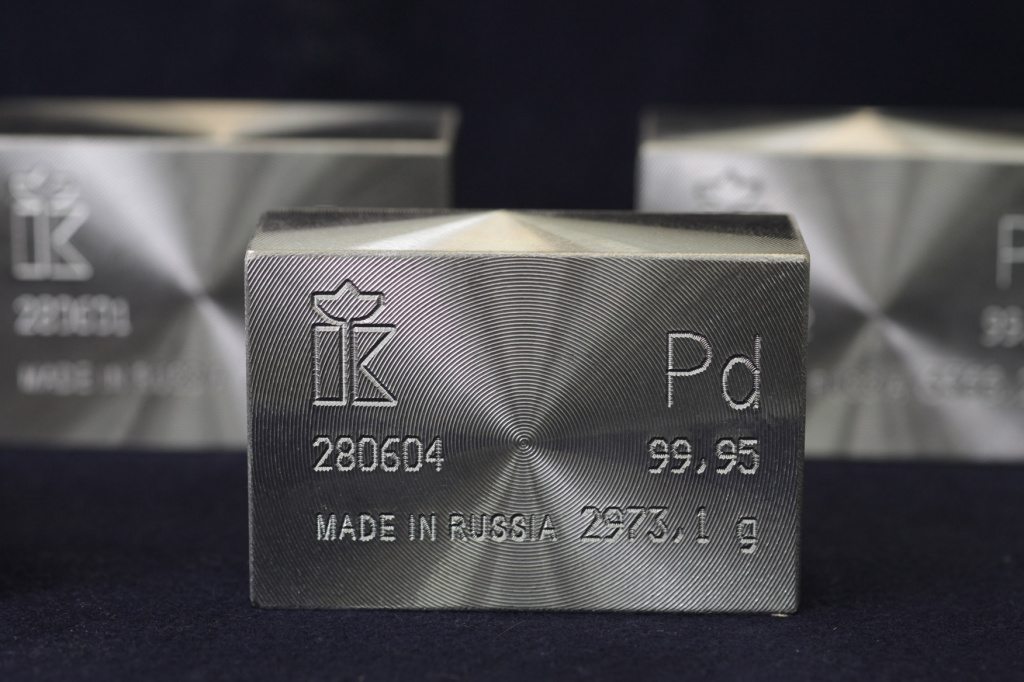

Sibanye-Stillwater, which has production assets in South Africa and the US, asked Washington in July to impose a tariff on Russian palladium imports to support the long-term viability of US supplies.

Trade data indicates that global flows have already begun to reroute since the company filed its petition, with South African producers gaining in the US market, but losing share to Russian palladium in China.

On Tuesday, the US Department of Commerce said the preliminary finding from its investigation was that dumping was taking place, citing a “preliminary weighted-average dumping rate margin” of 132.83% for palladium from Russia.

The final decision, expected in June, will also follow investigations by the US International Trade Commission.

The preliminary finding is encouraging for Sibanye-Stillwater as “Russia’s palladium dumping” has resulted in a material competitive disadvantage to US producers, chief executive Richard Stewart said in a statement.

The Johannesburg-based miner posted a loss of $211 million in the first half of 2025.

Russia’s Nornickel, the world’s largest palladium producer with a 40% share of global mined output, declined to comment.

Highlighting the shift in trade patterns, US palladium imports from South Africa rose 22% to 31 metric tons in January-November 2025, while deliveries from Russia, its second-largest supplier, fell 14% to 23 tons, according to Trade Data Monitor.

For Russia, shipments to China – its second-largest palladium export market after the US – jumped 42% to 22 tons over the same period, while China’s imports from South Africa fell 11% to 6 tons.

Prices for palladium, used to clean exhausts in gasoline vehicles, rose 76% in 2025 amid a wider rally in precious metals.

(By Polina Devitt; Editing by Mark Potter)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments